Unleashing the Power of Options Trading: Alpha, Beta, and Gamma

Image: www.researchgate.net

Have you ever found yourself longing for strategies beyond traditional stock investing? If so, the world of options trading awaits you – an arena where you can harness advanced tools to multiply your returns and hedge against risks. In this comprehensive guide, we will embark on an illuminating journey into the fascinating realm of options trading, unlocking the concepts of alpha, beta, and gamma.

The Options Trading Arena: A Primer

Options trading is a sophisticated investment technique that allows individuals to profit from price fluctuations while minimizing risk. Essentially, an option grants the buyer the right (but not the obligation) to buy (call option) or sell (put option) a specific asset at a predetermined price on a specific date. This flexibility empowers investors to capitalize on market movements without owning the underlying asset.

Alpha, Beta, and Gamma: The Trio of Metrics

In the options trading landscape, alpha, beta, and gamma emerge as crucial metrics that gauge the performance and risk characteristics of an investment:

-

Alpha (α): Alpha measures the excess return of an investment above a benchmark or index. A positive alpha indicates the strategy’s ability to outperform the market, while a negative alpha suggests underperformance.

-

Beta (β): Beta quantifies the volatility of an investment relative to the broader market. A beta of 1 indicates that the investment moves in tandem with the index, while a beta below 1 (or negative) implies lower volatility.

-

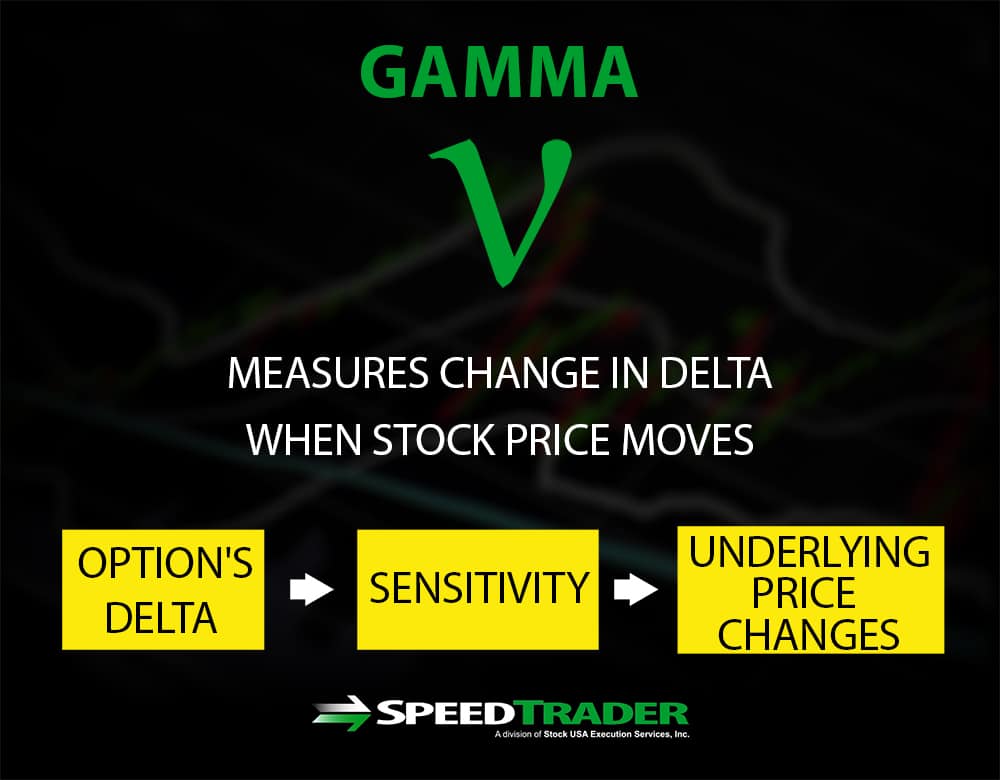

Gamma (γ): Gamma measures the rate of change in delta with respect to the underlying asset price. It indicates the strategy’s sensitivity to price fluctuations. A positive gamma signals increased leverage, amplifying both potential profits and losses.

Unveiling the Secrets of Options

Understanding how alpha, beta, and gamma interplay is essential for successful options trading. Alpha-seeking strategies aim to identify undervalued or overvalued assets and profit from price discrepancies. Beta strategies typically involve buying or selling options with a beta close to 1, enabling investors to track market movements. Gamma strategies exploit the leverage provided by options to magnify returns, but they also come with elevated risks.

Harnessing Options Trading for Your Success

-

Maximize Alpha: Employ fundamental and technical analysis to uncover mispriced options contracts with positive alpha potential.

-

Manage Beta: Diversify your options portfolio by selecting strategies with different betas. This balances market exposure and mitigates overall risk.

-

Utilize Gamma Prudently: Leverage the exponential returns of gamma strategies, but do so with caution. Set clear risk parameters to safeguard your investments.

-

Seek Expert Guidance: Consider collaborating with experienced options traders or financial advisors for personalized guidance and risk management.

-

Continuous Learning: Stay abreast of market trends, innovative strategies, and regulatory changes by pursuing continuous education in options trading.

Empower Yourself with Options Trading

Mastering the concepts of alpha, beta, and gamma equips you with the knowledge and tools to unlock the world of options trading. This empowers you to diversify your investment portfolio, enhance your returns, and effectively manage risk. Remember to approach options trading with a disciplined strategy, risk awareness, and a relentless pursuit of knowledge. Embark on this remarkable journey today and elevate your financial horizons.

Image: speedtrader.com

Options Trading Alpha Beta Gamma

Image: www.alamy.com