Navigating the intricacies of options trading demands a deep understanding of the underlying concepts that shape market dynamics. Beta, a Greek letter representing volatility, plays a pivotal role in quantifying the systematic risk associated with an option. This article delves into the realm of beta, empowering you with the knowledge to make informed decisions in the options market.

Image: www.youtube.com

The Significance of Beta

Beta measures the sensitivity of an option’s price to fluctuations in the underlying asset’s value. It captures the extent to which the option moves in tandem with the market, providing a metric for assessing risk. A high beta signifies a strong correlation, indicating that the option’s price is highly responsive to changes in the underlying asset’s price. Conversely, a low beta suggests a less impactful relationship.

Beta and Systematic Risk

Systematic risk, also known as market risk, is the risk that affects the entire market and cannot be diversified away through strategic investment. Beta serves as a proxy for this inherent risk, as it reflects an option’s exposure to macroeconomic factors, industry dynamics, and overall market sentiment. By understanding beta, investors can gauge the impact of external factors on their options portfolios.

Beta and Greeks

Beta forms part of the Greek letter family, each representing a different aspect of option pricing and risk. Theta, delta, gamma, and vega capture time decay, price sensitivity, curvature, and volatility sensitivity, respectively. Understanding these Greeks collectively provides a comprehensive analysis of an option’s behavior and potential risks.

Image: hozenesipew.web.fc2.com

Beta Applications in Options Strategies

By leveraging beta, options traders can craft tailored strategies to manage risk and enhance returns. For example, investors seeking reduced sensitivity to market volatility may opt for options with lower betas. Beta also helps in selecting appropriate strikes and expiration dates to achieve desired risk-reward profiles.

Tips and Expert Advice

– **Consider individual beta values** when building your options portfolio to diversify risk across different asset classes and industries.

– **Stay informed about market news and trends** that may impact beta values, leading to potential adjustments in your options strategies.

FAQ

Q: How is beta calculated?

A: Beta is determined by comparing the historical price movements of an option to the historical price movements of its underlying asset.

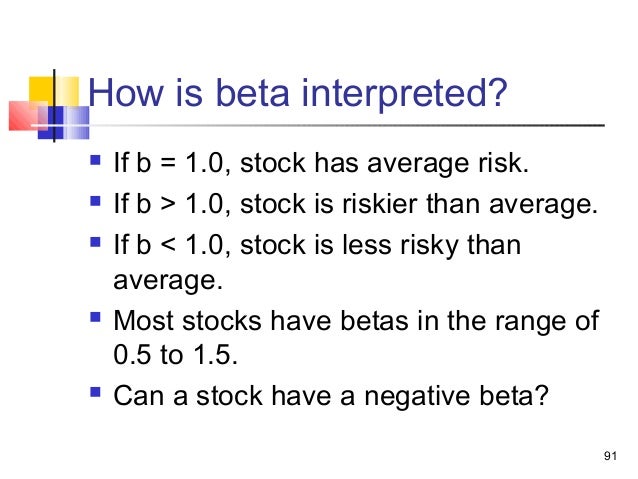

Q: What is a typical beta range?

A: A beta of 1 indicates a high correlation between the option and the underlying asset. A beta of less than 1 indicates a lower correlation, while a beta of more than 1 suggests a higher correlation.

Beta In Options Trading

Image: tradingqna.com

Conclusion

Understanding beta is paramount in options trading, enabling you to quantify an option’s volatility and incorporate risk management strategies into your investment decisions. By acknowledging the impact of beta on option prices, you empower yourself with informed choice-making and enhance your ability to navigate market complexities. Are you ready to delve into the exciting realm of beta in options trading?