Unveiling the Significance for Informed Decision-Making

In the dynamic realm of options trading, understanding Beta weighting is essential for accurate risk assessment and informed trading strategies. Beta, a measure of market sensitivity, reveals how an option’s price fluctuates in response to changes in the underlying asset’s price. Comprehending the role of Beta weighting empowers traders to make strategic decisions, manage risk effectively, and maximize their profit potential.

Image: climateimpact.edhec.edu

Decoding Beta Weighting: A Comprehensive Overview

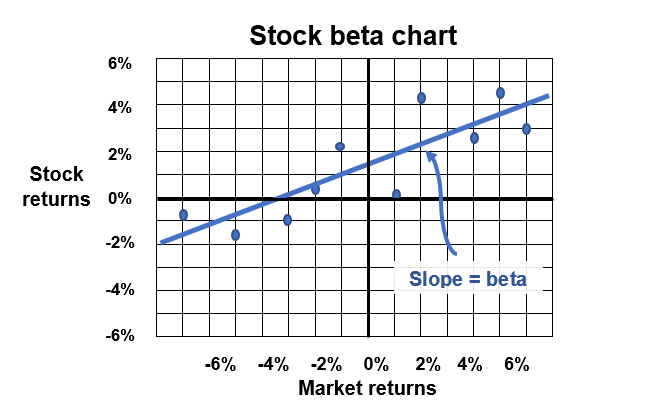

Beta weighting gauges the relationship between an option’s price and the price of the underlying asset. It represents the percentage change in an option’s price for a 1% change in the underlying asset’s price. For example, an option with a Beta of 0.8 will experience an 0.8% change in its price for a 1% change in the underlying asset’s price. Positive Beta indicates that the option moves in the same direction as the underlying asset, while negative Beta signals that the option moves in the opposite direction.

Beta and Option Classification

Beta plays a crucial role in classifying options as either bullish or bearish. A positive Beta denotes bullish options, which gain value when the underlying asset’s price increases. Conversely, a negative Beta indicates bearish options, which profit from a decline in the underlying asset’s price.

Beta as a Risk Indicator

Beta is a reliable indicator of risk in options trading. Options with higher Beta carry more risk, as their prices are more volatile and sensitive to underlying asset price fluctuations. Traders should carefully consider Beta when selecting options, as it provides insights into the potential magnitude of both profits and losses.

Image: www.linkedin.com

Applications of Beta Weighting in Options Trading

Beta weighting finds practical applications in various aspects of options trading:

- Risk Management: Beta assists in evaluating the risk associated with option positions, enabling traders to make informed decisions regarding position sizing and hedging strategies.

- Option Selection: By considering Beta, traders can select options that align with their risk tolerance and trading objectives, optimizing their chances of successful trades.

- Historical Analysis: Beta analysis of historical market data helps traders identify trends and patterns in the relationship between option prices and underlying asset prices. This analysis provides valuable insights for predicting future price movements.

- Trading Strategies: Beta serves as a basis for developing customized trading strategies, such as bullish or bearish spreads, that leverage the relationship between options and their underlying assets.

What Does Beta Weighting Mean In Option Trading

Image: seekingalpha.com

Conclusion: Empowering Informed Options Trading

Beta weighting holds immense significance in option trading, providing traders with a critical tool for assessing risk, classifying options, and developing effective trading strategies. Understanding the implications of Beta enables traders to make informed decisions, maximize their profit potential, and navigate the complexities of options trading with confidence. In today’s dynamic financial landscape, mastering Beta weighting is indispensable for successful options trading endeavors.