Options trading has always been a tempting avenue for those seeking a piece of the financial markets’ action. The allure of potentially substantial profits in a relatively short time is hard to resist. However, It’s vital to proceed with caution as the risks associated with options trading can be significant.

Image: fipocuqofe.web.fc2.com

Recently I came across a cautionary tale of an acquaintance who ventured into options trading without fully grasping its complexities. The promise of quick returns clouded their judgment, leading to unwise decisions and substantial losses.

The True Nature of Options Trading

Options are financial instruments that provide the buyer with the right – but not the obligation – to buy or sell an underlying asset (such as stocks or bonds) at a predetermined price before a certain date. This flexibility makes them a versatile tool but also introduces significant risk.

The buyer of an option pays a premium to acquire this right, and whether they profit or lose depends on the future performance of the underlying asset. For instance, if you buy a call option (the right to buy an asset at a set price), you stand to gain if the asset’s price rises above the exercise price you agreed to. However, If the price falls, you lose the premium you paid for the option.

Decoding Option Pricing

Understanding the factors influencing option prices is crucial. These include:

- Underlying Asset Price: The most influential factor in option pricing is the current and expected future price of the underlying asset.

- Time to Expiration: As time passes, the value of an option decays due to the decreasing likelihood of the underlying asset reaching the exercise price before expiry.

- Implied Volatility: This refers to the market’s expectations of future price fluctuations in the underlying asset. Higher implied volatility indicates greater uncertainty and accordingly higher option prices.

- Interest Rates: Interest rates influence option pricing in complex ways, depending on the type of option and market conditions.

These factors interact to determine option premiums. Traders must master the art of calculating and interpreting these parameters to make informed trading decisions.

Navigating Options Trading Risks

The potential for substantial profits in options trading comes with the flip side of risk. To mitigate these risks, it’s imperative to adopt a well-informed and disciplined approach:

- Educate Yourself: Thorough knowledge of options trading is paramount. Understanding the concepts, strategies, and market dynamics is crucial.

- Start Small: Begin with a limited capital allocation and gradually increase it as you gain experience and confidence.

- Manage Risk: Employ risk management techniques such as diversification and position sizing to limit potential losses.

- Seek Professional Guidance: Consider consulting with a financial advisor or experienced options trader for guidance.

By adhering to these guidelines, you can minimize the risks associated with options trading and enhance your chances of long-term profitability.

Image: trading-education.com

FAQ on Options Trading

Q: What’s the difference between a call and a put option?

A: A call option gives you the right to buy the underlying asset, while a put option grants you the right to sell it.

Q: Can I lose more than I invested in options trading?

A: Yes, if you purchase an option, you stand to lose the entire premium you paid for it, even if the underlying asset’s price moves in your favor.

Q: How do I know if an option is right for me?

A: Before buying an option, thoroughly consider your risk tolerance, investment goals, and the current market conditions.

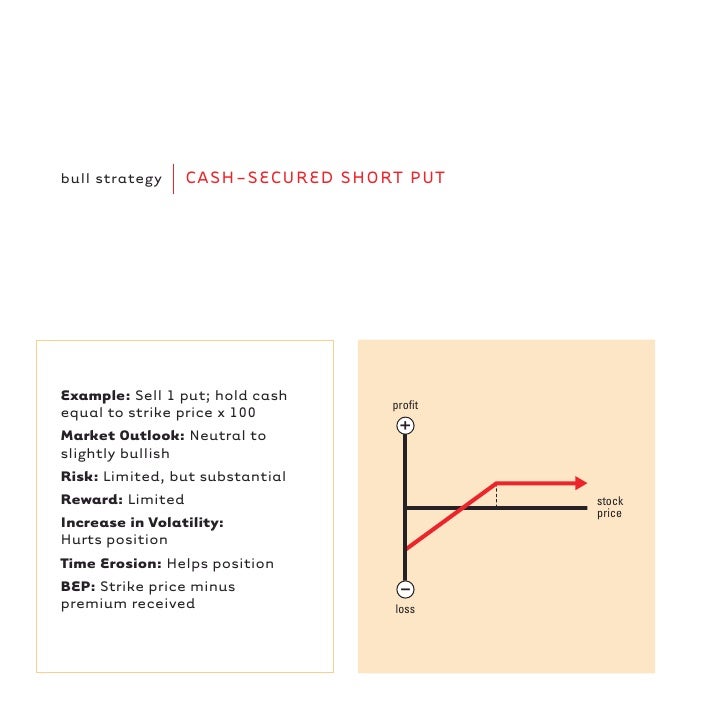

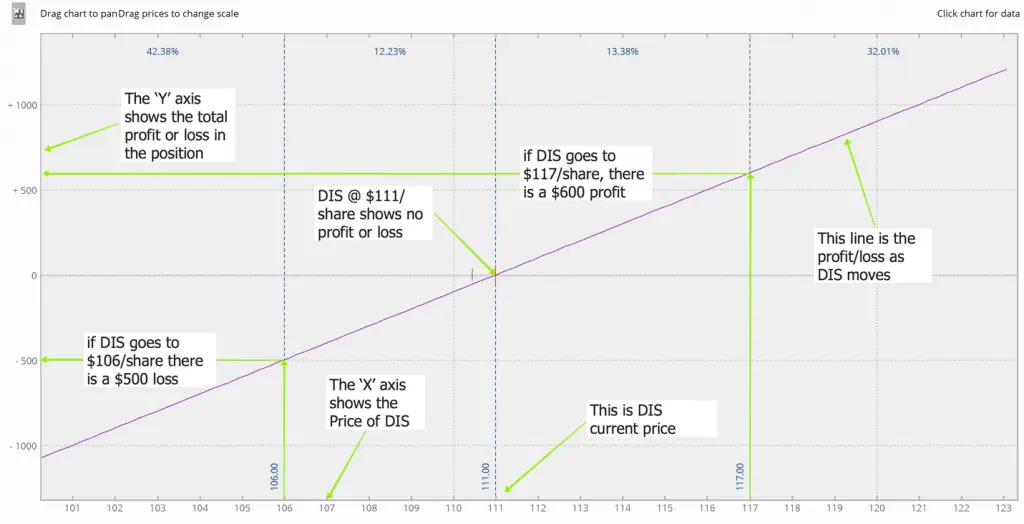

Options Trading High Risk

Image: www.newtraderu.com

Conclusion

Options trading presents both opportunities and risks, and navigating this market cautiously is paramount. By understanding the concept of options, their pricing, and the risks involved, you can better grasp the potential gains and losses. Always remember to approach options trading with a well-informed and disciplined mindset to maximize your chances of success.

Are you intrigued by the high potential returns and risks of options trading? Share your thoughts in the comments below.