Understanding the World of Options Trading

Amidst the vast landscape of financial markets, options trading stands as a dynamic and intriguing frontier, offering investors the potential to harness both risk and reward. Whether you’re an experienced trader seeking new avenues for profit or a novice eager to delve into the intricacies of financial derivatives, understanding where you can execute options trades is paramount.

Image: club.ino.com

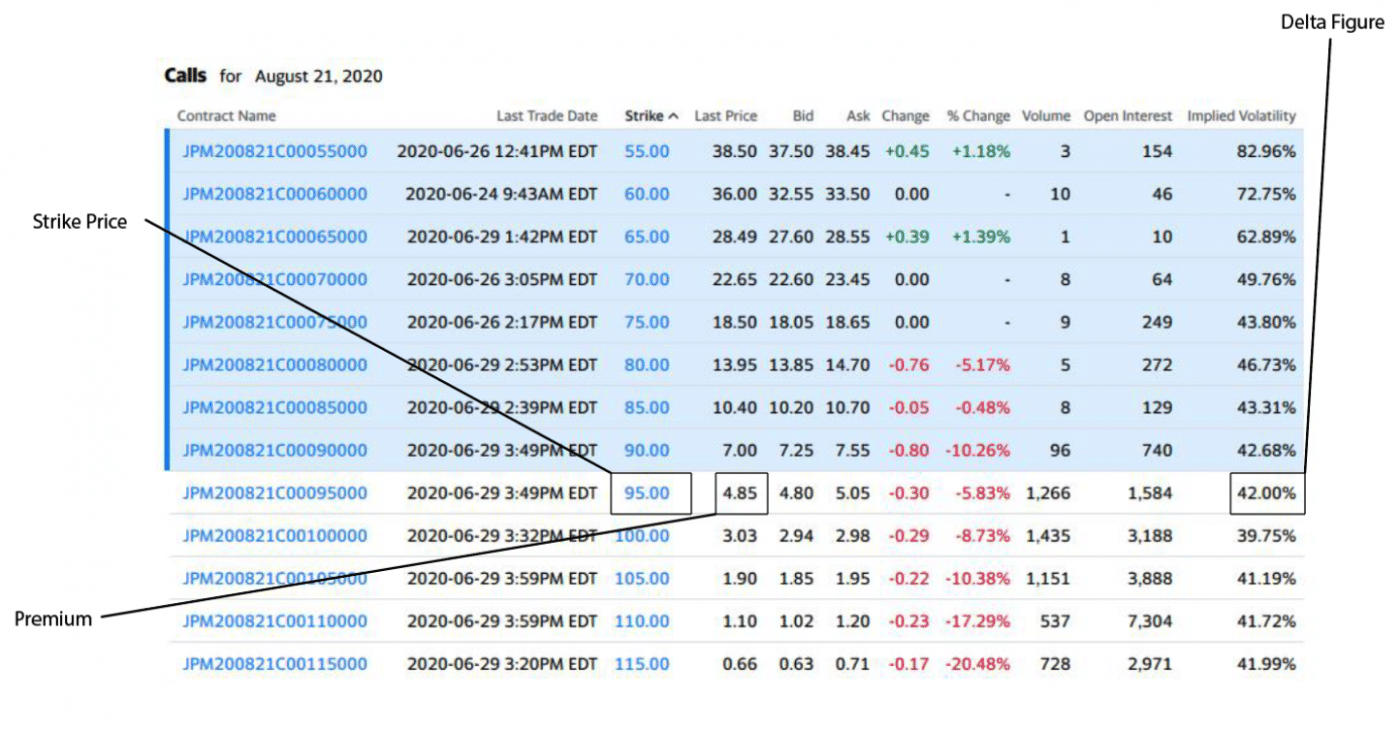

Options, in essence, are financial contracts that grant the buyer the right, not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. This versatility enables traders to navigate market fluctuations, protect their investments, or simply speculate on future price movements.

Online Brokerages: The Virtual Arena

For many aspiring options traders, online brokerages serve as the gateway to this multifaceted market. These platforms provide a user-friendly interface that simplifies the trading process, offering access to a wide range of options contracts and underlying assets.

Prominent players in the online brokerage industry include:

-

TD Ameritrade: Renowned for its advanced trading tools and educational resources, TD Ameritrade caters to both beginner and experienced options traders.

-

Fidelity Investments: With a robust platform and comprehensive research capabilities, Fidelity Investments is a trusted option for discerning investors seeking a well-rounded trading experience.

-

Interactive Brokers: Ideal for high-volume traders and institutional clients, Interactive Brokers offers unparalleled customization options and low trading fees.

-

*ETrade:* Simplistic and intuitive, ETrade is a suitable choice for those seeking a straightforward and user-accessible platform.

-

Tastyworks: Specifically tailored for options trading, Tastyworks boasts a powerful desktop platform and a full suite of options-specific tools.

Traditional Brokerages: The In-Person Experience

While online brokerages have gained significant traction, traditional brokerages continue to offer a personalized touch for investors preferring a more hands-on approach. These brokerages provide access to individual brokers who offer guidance, market analysis, and personalized advice.

Notable traditional brokerages include:

-

Charles Schwab: Known for its impeccable customer service and extensive branch network, Charles Schwab caters to a wide spectrum of investors, including options traders.

-

Merrill Lynch: With a deep-rooted history and a reputation for excellence, Merrill Lynch provides comprehensive wealth management services, encompassing options trading.

-

Wells Fargo Advisors: Offering a comprehensive range of financial products and services, Wells Fargo Advisors serves as a one-stop solution for investors looking to incorporate options trading into their portfolios.

Choosing the Right Platform

Navigating the myriad of options trading platforms can be a daunting task, and the ideal choice depends on a trader’s specific needs and preferences. Factors to consider include:

-

Commissions and fees: Identifying platforms with competitive pricing is crucial, as trading costs can significantly impact profitability.

-

Trading technology: Robust trading platforms with advanced order types and charting capabilities enhance trading efficiency.

-

Education and support: Traders should seek platforms that offer educational resources, webinars, and customer support to facilitate their learning journey.

Image: www.warriortrading.com

Where Can I Do Options Trading

Image: www.olymptradewiki.com

Embarking on Your Options Trading Adventure

Once you have selected a suitable trading platform, the next step is to educate yourself on the intricacies of options trading. This involves understanding option pricing models, risk management strategies, and market analysis techniques. Comprehensive resources such as online courses, books, and webinars can provide the necessary knowledge and enhance your potential for success.

Remember, options trading carries inherent risks and should only be undertaken with a thorough understanding of the involved concepts. Risk tolerance, financial goals, and investment horizon should be carefully considered before venturing into this complex yet potentially rewarding realm.