The realm of finance offers a multitude of avenues for investors seeking to navigate the complexities of the financial markets. Among these, options trading stands out as a potentially lucrative, yet nuanced strategy. Plus500, a renowned online trading platform, has emerged as a formidable player in the options trading arena, providing traders with an accessible and intuitive platform to explore this dynamic market. In this comprehensive guide, we delve into the intricacies of Plus500 options trading, empowering traders with the knowledge and insights to harness its full potential.

Image: cryptomojo.com

Understanding the Essence of Options Trading

Options trading revolves around financial instruments known as options contracts. These contracts confer the buyer with the right, but not the obligation, to buy or sell an underlying asset at a predetermined price and date. This unique feature distinguishes options trading from传统的股票交易, where traders are bound to complete the purchase or sale once a transaction is initiated.

Options contracts are classified into two primary types: calls and puts. Call options grant the holder the right to purchase an asset at the specified price on or before the expiration date. Conversely, puts options provide the right to sell an asset at the predetermined price.

The versatility of options trading lies in its applicability to a wide range of underlying assets, including stocks, indices, commodities, and currencies. This flexibility allows traders to speculate on future price movements across diverse market segments.

Plus500: A Gateway to Options Trading Accessibility

Plus500 has established itself as a prominent force in the options trading landscape. Its user-friendly interface and comprehensive suite of features cater to traders of all experience levels. The platform offers a diverse selection of underlying assets, ensuring that traders can find suitable opportunities to match their investment strategies.

One of the key advantages of Plus500 options trading is its accessibility. Traders can initiate positions with a relatively low minimum investment, making it a viable option for both experienced and novice investors. Additionally, the platform provides real-time market data and advanced charting tools, empowering traders with the necessary information to make informed decisions.

Exploring the Mechanics of Plus500 Options Trading

To engage in Plus500 options trading, traders must first open an account and fund it. Once the account is established, traders can browse the available underlying assets and select the ones that align with their investment goals.

The next step involves selecting the type of option contract (call or put), the expiration date, and the strike price. The strike price represents the predetermined price at which the trader can buy or sell the underlying asset.

Each options contract has a premium associated with it. This premium represents the cost of acquiring the right to buy or sell the underlying asset. Traders must carefully consider the premium in relation to the potential profit or loss they anticipate.

Once all parameters are set, traders can execute their trades. Plus500 provides various order types, such as market orders (executed immediately at the current market price) and limit orders (executed only when the market price reaches a specified level).

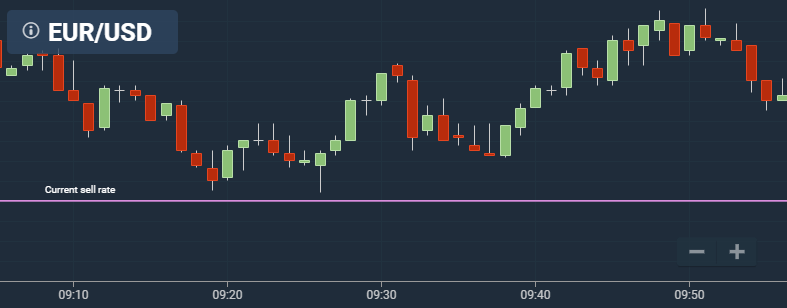

Image: www.trustedbrokers.co.uk

Pricing Options and Risk Management Strategies

Options pricing is determined by a complex interplay of factors, including the underlying asset’s price, the time to expiration, the strike price, and the implied volatility. Traders must possess a solid understanding of these factors to make informed pricing decisions.

Risk management is paramount in options trading. Options contracts can carry substantial risks, and traders should employ appropriate strategies to mitigate potential losses. Stop-loss orders and position sizing are valuable tools for managing risk and preserving capital.

The Allure of Plus500 Options Trading

The appeal of Plus500 options trading lies in its potential for both profit-making and risk mitigation. By leveraging the flexibility of options contracts, traders can tailor their strategies to capitalize on market movements while managing downside risk.

Plus500 options trading also offers the advantages of relatively low barriers to entry and a comprehensive trading platform. Traders can experiment with different strategies and refine their skills without risking significant capital.

Plus 500 Options Trading

https://youtube.com/watch?v=5nvvr2CjVWg

Conclusion: Embracing the World of Plus500 Options Trading

Options trading presents a compelling opportunity for savvy investors and traders seeking to enhance their financial portfolios. Plus500 has emerged as a leading provider of options trading services, offering an accessible and feature-rich platform to explore this dynamic market. By mastering the intricacies of options contracts and leveraging the advantages of Plus500, traders can unlock the full potential of options trading and navigate the financial markets with increased confidence and potential profitability.