Have you ever felt like you’re missing out on the intricate world of options trading? Perhaps you’ve heard whispers of a hidden layer of information that empowers seasoned traders, but you’re unsure where to begin. That’s where the concept of Level 2 options trading comes into play.

Image: www.youtube.com

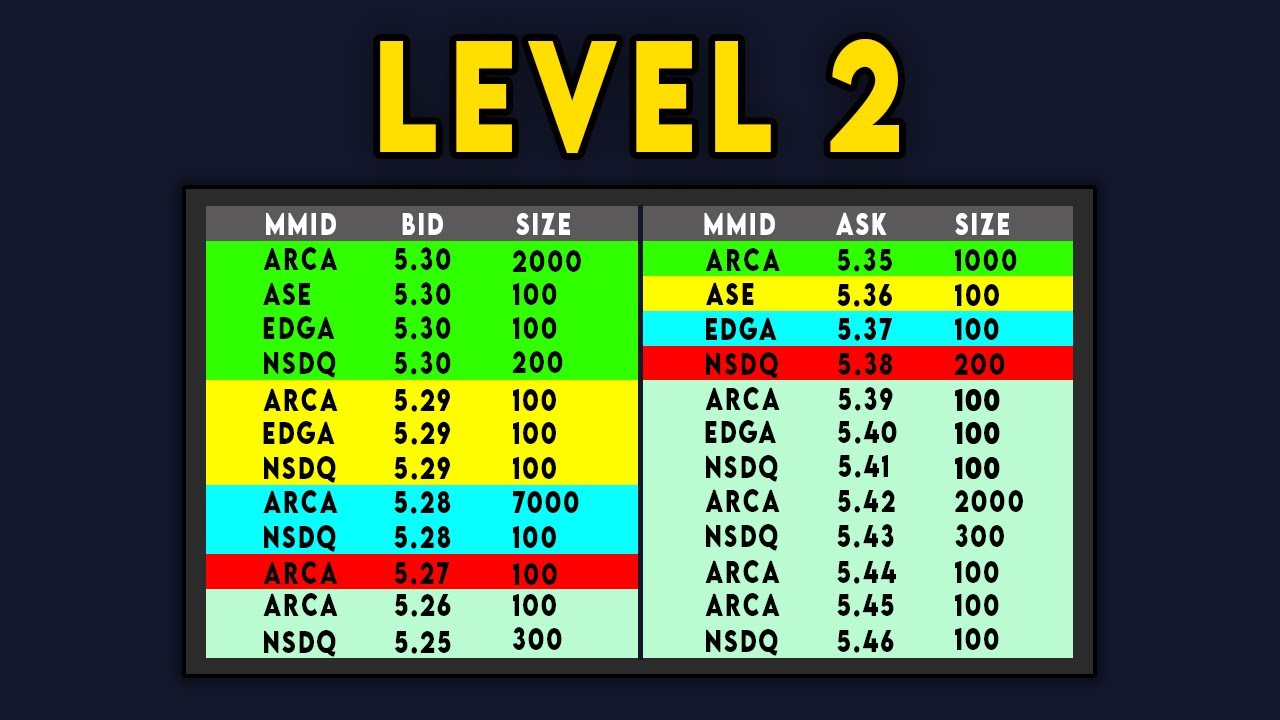

Level 2 options trading goes beyond the basic display of bid and ask prices you see in traditional trading platforms. It unlocks a powerful world of real-time order book data, providing traders with a deeper understanding of market activity and an edge in executing profitable trades. This article will guide you through the intricacies of Level 2 options trading, explaining its benefits, how to use it effectively, and the strategies that can be employed to leverage this powerful tool.

What is Level 2 Options Trading?

Imagine a bustling marketplace, filled with buyers and sellers actively negotiating prices. Level 2 options trading is like having a front-row seat to this dynamic scene. It provides a detailed view of the order book, revealing the exact price and quantity of all pending orders—both buy (bid) and sell (ask). This information goes beyond the simple best bid and ask prices displayed on basic platforms.

Why Use Level 2 Options?

Understanding Level 2 data gives options traders a crucial advantage. Consider these benefits:

- Market Depth: Level 2 allows you to gauge the strength of a potential move. A deep order book, with many buy and sell orders at various price levels, indicates underlying strength and potentially sustained momentum.

- Order Flow Analysis: Observing order flow reveals the intentions of market participants. Large buy orders appearing near the bid price hint at potential price increases, while significant sell orders near the ask price may signal a potential downward move.

- Improving Entry and Exit Points: Level 2 data assists in identifying optimal entry and exit points. By watching the order book, you can anticipate price movements and execute trades when the market is most favorable.

- Enhanced Risk Management: Understanding the order book allows for better risk management. You can see the potential support or resistance levels based on pending orders and adjust your risk positions accordingly.

Understanding Level 2 Data

Level 2 data is presented in a tabular format, listing each order with its price, quantity, and type (buy or sell). For example, a buy order at $100 for 100 contracts would indicate a willingness to purchase 100 contracts at $100 per contract. Understanding this structure is essential to decode the information displayed.

Image: www.youtube.com

Key Concepts for Level 2 Options Trading

To effectively navigate Level 2 options trading, you need to grasp a few core concepts:

1. Bid and Ask Prices

These represent the highest price buyers are willing to pay (bid) and the lowest price sellers are willing to sell (ask). The difference between these two is known as the bid-ask spread, which reflects the cost of trading.

2. Limit Orders

These orders specify a maximum price for buying (limit buy) or a minimum price for selling (limit sell). If the market price reaches your limit order, the trade will be executed.

3. Market Orders

These orders are filled immediately at the best available price. This ensures execution but may not be at the desired price, especially if the market is volatile.

4. Order Book Depth

This refers to the number and quantity of orders at each price level. A deep order book indicates strong liquidity and potential for sustained price movement.

Reading the Level 2 Order Book

Now that you understand some key concepts, let’s delve into reading the Level 2 order book. Here’s a breakdown of the information you’ll encounter:

- Price Level: Each row represents a specific price level, with prices ranging from the best bid to the best ask.

- Bid Orders: These are buy orders at specific price levels. A larger number of bid orders indicates strong buying pressure.

- Ask Orders: These are sell orders at specific price levels. A larger number of ask orders suggests strong selling pressure.

- Quantity: The number of contracts offered for buying or selling at each price level. A higher quantity indicates larger potential trades and potential for greater price movements.

Level 2 Trading Strategies

Understanding Level 2 data empowers traders to employ distinct strategies. Here are a few examples:

1. Order Book Sniper Strategy

This strategy involves placing limit orders just ahead of a significant surge in orders. For example, if you see a large buy order pop up just below the best bid, you can place a limit buy order at a slightly higher price. This allows you to capitalize on the anticipated price surge.

2. Momentum Trading with Level 2

Level 2 data can enhance momentum trading strategies. By identifying large buy or sell orders entering the market, traders can anticipate price movements and execute trades accordingly.

3. Volatility Scalping

Level 2 data enables traders to quickly identify price fluctuations and profit from small price differences. By monitoring order flow and identifying buying or selling pressure, traders can enter and exit trades quickly, generating profits from volatility.

Level 2 Options Trading Tips

Here are essential tips to keep in mind when using Level 2 options data:

- Practice Makes Perfect: Familiarize yourself with trading platforms, the order book structure, and the indicators that showcase market activity.

- Don’t Over-Trade: Level 2 data can be overwhelming. Stick to a few strategies and focus on executing them effectively.

- Be Patient: Level 2 data is dynamic. Don’t rush into trades based solely on initial order book changes. Observe patterns and confirmations before acting.

- Use Stop-Loss Orders: As with any options trading strategy, risk management is paramount. Set stop-loss orders to protect against significant losses.

- Stay Informed: Keep up with market news, economic data, and industry trends to make informed trading decisions.

Level 2 Options Trading

Conclusion

Level 2 options trading unlocks a world of opportunities for those seeking an edge in the market. By deciphering the intricacies of the order book and learning to interpret its signals, traders can gain significant insights into market activity and make better-informed decisions. Remember, trading strategies are constantly evolving, and patience, discipline, and continuous learning are essential for success in the exciting field of options trading.