Synopsis

Option trading strategies offer a diverse toolkit for investors to navigate financial markets and pursue tailored risk-reward profiles. Among these strategies, the Butterfly Spread emerges as a highly versatile option that allows traders to express market neutrality while maximizing profit potential. This in-depth article delves into the intricacies of the Butterfly Spread, empowering readers with a thorough understanding and practical insights to enhance their option trading strategies.

Origins and Rationale

The Butterfly Spread traces its roots back to the realm of options trading, where it has garnered recognition as an effective strategy to mitigate risk and amplify potential returns. By simultaneously employing multiple call or put options at varying strike prices, the Butterfly Spread creates a bell-shaped profit curve that benefits from both bullish and bearish price movements within a specific range.

Anatomy of the Butterfly Spread

At the core of a Butterfly Spread lies a combination of options. A trader purchases one option at a lower strike price, two options at a middle strike price, and sells one option at a higher strike price. For instance, in a Bullish Butterfly Spread, the trader would buy one call option at strike price 100, two call options at strike price 105, and sell one call option at strike price 110.

The Profit Curve Canvas

The Butterfly Spread’s unique profit curve distinguishes it within the option trading strategies universe. The profit peaks at the middle strike price, offering a maximum reward when the underlying asset settles at that level upon expiration. As the underlying asset price deviates from the middle strike price, the Butterfly Spread’s profit potential diminishes.

Risk-Reward Spectrum

Embracing the Butterfly Spread implies a nuanced equilibrium between risk and reward. This strategy generally exhibits lower risk than outright buying a single call or put option due to its multi-legged structure. The profit potential, on the other hand, is amplified compared to individual option purchases, creating a favorable risk-reward ratio.

Butterfly Spread Constructs

The versatility of the Butterfly Spread extends to its applicability in various market environments. Bullish Butterfly Spreads capitalize on expectations of moderate price appreciation within a range, while Bearish Butterfly Spreads thrive on anticipated price declines.

Execution Precision

Executing a Butterfly Spread demands meticulous attention to detail. The strike prices and the number of options for each leg must align precisely to achieve the desired profit profile. Any deviations can alter the intended risk-reward dynamics, underscoring the importance of calculated execution.

Real-World Case Studies

In the vibrant arena of financial markets, the Butterfly Spread has demonstrated its potency. Case studies of successful Butterfly Spreads abound, where traders have deftly exploited market movements to bolster their portfolios. These examples showcase the practical applications and potential rewards associated with this strategy.

Advanced Applications

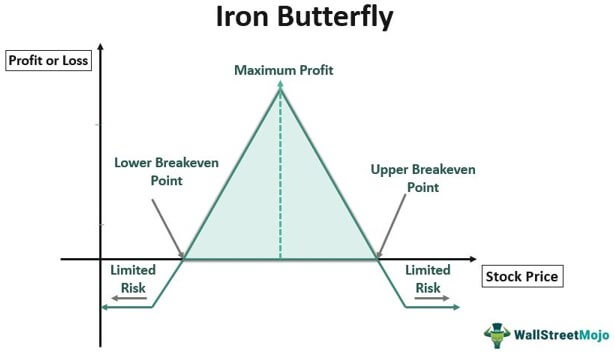

Seasoned option traders often employ advanced variations of the Butterfly Spread to further refine their risk-reward parameters. Diagonal Butterfly Spreads, for example, incorporate varying expiration dates, while Iron Butterfly Spreads involve additional call and put option combinations, enhancing adaptability and profit optimization.

Conclusion

The Butterfly Spread, an ingenious option trading strategy, empowers traders with a nuanced approach to market neutrality and profit enhancement. By harnessing the power of multiple options, the Butterfly Spread provides a balanced risk-reward framework, enabling investors to navigate market dynamics with greater precision. Whether employed in bullish or bearish market conditions, this versatile strategy offers a compelling option for those seeking to elevate their trading prowess.

Image: www.simplertrading.com

Image: www.wallstreetmojo.com

Option Trading Strategies Butterfly Spread

Image: fx1618.com