Navigate the Complex World of Derivative Trading with Confidence

Intrigued by the allure of derivative trading but overwhelmed by its complexities? In this comprehensive guide, we delve into the intricacies of one of its most versatile strategies: the butterfly option trading strategy. Whether you’re a seasoned investor seeking to refine your skills or a novice eager to venture into this dynamic realm, this article will equip you with the knowledge to navigate the butterfly option trading strategy with confidence.

Image: tipstotradebtc.com

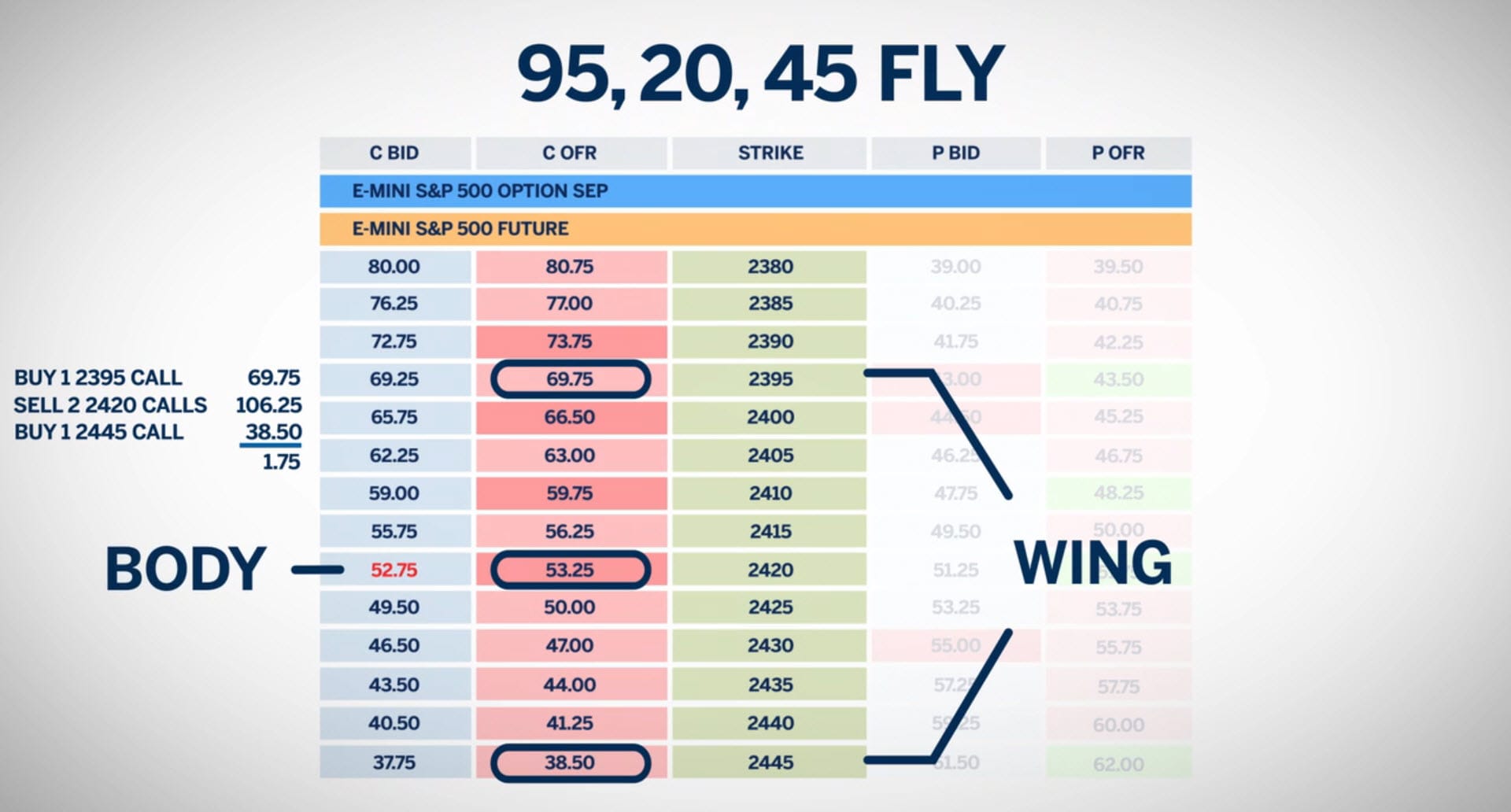

A Delicate Dance of Premiums: Understanding the Butterfly’s Anatomy

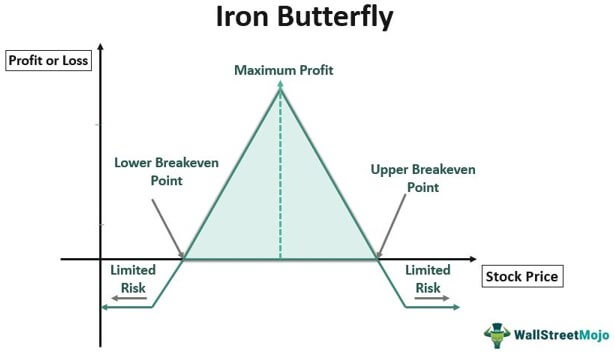

At its core, a butterfly option trading strategy involves the simultaneous purchase of one call option and one put option, both at the same strike price, and the sale of two call options or two put options at strike prices above and below the middle strike price. This complex arrangement creates a profit profile resembling a butterfly’s spread wings, with gains predominantly concentrated within a specific price range.

The Pragmatic Purpose of Butterfly Spreads: A Calculated Margin of Comfort

The butterfly option trading strategy is particularly appealing to traders seeking to take advantage of a stock’s expected movement within a defined range. It allows traders to profit from a stock’s fluctuation within a predetermined boundary, while limiting potential losses if the stock’s movement deviates significantly from their prediction.

Positively Positioned: A Bird’s-Eye View of Butterfly Option Trading Strategies

There are two primary flavors of butterfly option trading strategies: the long butterfly spread and the short butterfly spread.

- Long Butterfly Spread: Designed to capitalize on a predicted moderate rise in the underlying stock’s price, while providing a buffer against significant declines.

- Short Butterfly Spread: Aims to profit from a moderate decline in the underlying stock’s price, while limiting potential losses if the stock’s price rises unexpectedly.

Image: www.wallstreetmojo.com

Fine-Tuning Your Butterfly: Factors Influencing Strike Price Selection

The choice of strike prices is crucial in butterfly option trading strategies. By carefully considering the underlying stock’s volatility, potential price movements, and the desired profit range, traders can optimize their strategy’s success.

Profit and Pain Points: Charting the Butterfly’s Trajectory

The butterfly option trading strategy’s profit and loss profile is a delicate balance. Profits are typically maximized when the underlying stock’s price settles within the predetermined range at the expiration date. Conversely, losses can amplify if the stock’s price moves significantly beyond the defined boundaries.

Evolution of the Butterfly: Risk Management and Strategy Refinement

Like all financial instruments, butterfly option trading strategies carry inherent risks. To mitigate these risks, traders must carefully manage their positions, constantly monitoring market movements and adjusting their strategies as needed.

What Is A Butterfly Option Trading Strategy

Image: www.finideas.com

Conclusion: Soaring with the Butterfly and Beyond

The butterfly option trading strategy, with its nuanced approach and refined risk-reward profile, offers a powerful tool for seasoned traders. By understanding the strategy’s intricacies and navigating its complexities, traders can enhance their portfolio’s growth potential and soar higher in the competitive financial landscape.