Introduction

Imagine the thrill of making a fortune from buying and selling stocks. But what if there was a way to multiply your potential returns with less risk? Welcome to the world of stock options trading. In this comprehensive guide, we’ll reveal all the essentials you need to embark on your journey as a successful options trader.

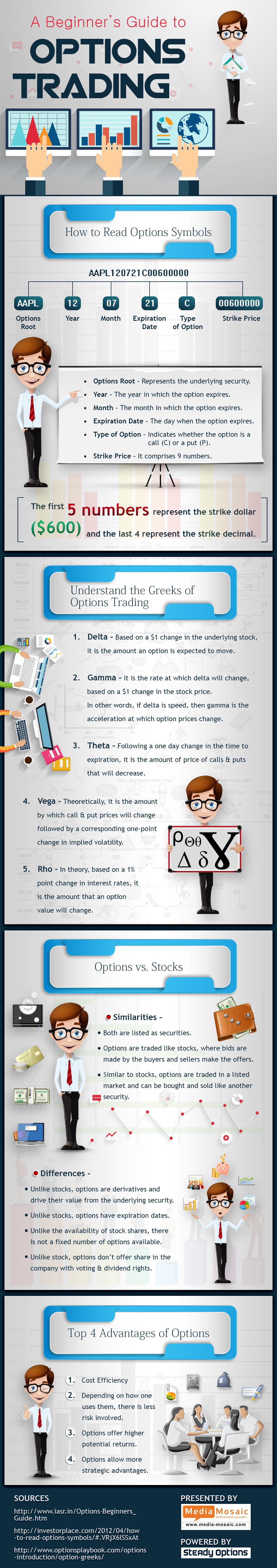

Image: steadyoptions.com

Understanding Stock Options

Stock options are contracts that give you the right, but not the obligation, to buy (call option) or sell (put option) a certain number of shares in a specified stock at a set price (strike price) on or before a specified date (expiration date). By understanding this concept, you’re laying the foundation for your trading success.

Types of Stock Options

Call Options

Call options allow you to buy a stock at a future date at a predetermined price. If the stock price rises above the strike price before the expiration date, you can exercise your option and purchase the shares, potentially profiting from the price difference.

Image: www.youtube.com

Put Options

Put options give you the right to sell a stock at a future date at a predetermined price. If the stock price falls below the strike price before the expiration date, you can exercise your option and sell the shares, benefiting from the price decline.

Benefits of Options Trading

- Leverage: Options offer the potential for amplified returns compared to investing directly in stocks.

- Limited Risk: Unlike investing in stocks, where losses can be unlimited, options carry a predefined maximum loss determined by the premium paid.

- Flexibility: Options provide traders with the versatility to bet on both rising and falling stock prices, as well as speculating on volatility.

How to Get Started

To commence your options trading journey, it’s crucial to:

- Choose a Broker: Select a reputable broker that offers options trading services tailored for beginners.

- Open an Account: Set up a trading account and fund it with sufficient capital for your trading.

- Educate Yourself: Take courses, read books, and delve into online resources to master options trading fundamentals.

Tips for Success

Enhancing your chances of success as an options trader requires:

- Understand Risk: Always remember that options offer leveraged returns, which means both gains and losses can be amplified.

- Manage Capital Wisely: Only risk capital you are prepared to lose, and diversify your investments.

Expert Advice

Seasoned options traders often emphasize the importance of:

- Trend Analysis: Study market patterns and historical data to identify potential trading opportunities.

- Implied Volatility: Evaluate the market’s estimate of future price volatility to assess options premiums.

FAQ

Q: What are the key differences between call and put options?

A: Call options give you the right to buy, while put options grant you the right to sell a stock at a specified price in the future.

Q: How much money do I need to trade options?

A: Your capital requirements vary depending on your trading strategy and risk tolerance. However, it’s recommended to start with a modest amount.

Stock Options Trading Course For Beginners

Image: wavemetricindia.blogspot.com

Conclusion

The world of stock options trading offers a compelling opportunity for both novice and experienced investors. By comprehending the fundamentals, you can unlock the potential for amplified returns. Remember to proceed with caution, manage risk prudently, and never stop educating yourself. Embark on this thrilling journey, and let your options trading knowledge lead you to financial success.

Are you intrigued by the possibilities of stock options trading? Don’t wait, take the first step towards unlocking your financial potential today!