In the captivating realm of financial markets, where fortunes are made and lost, options trading stands as a tantalizing beacon of opportunity. Among the myriad options strategies that dance upon the trading floor, the butterfly option emerges with ethereal elegance and harmonic precision.

Image: www.themeetinghouse.net

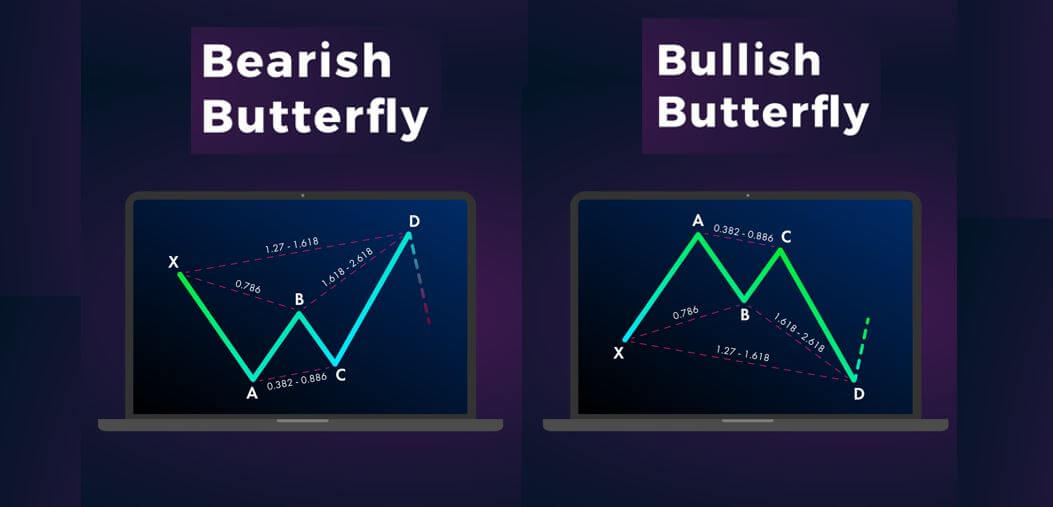

Butterfly options, like their namesake in the natural world, consist of three components: two long options at different strike prices and a short option in the middle. This intriguing arrangement, like a carefully choreographed ballet, seeks to capture the sweet spot of price movement within a defined range.

Unveiling the Enigmatic Butterfly

Once upon a time, in the annals of options trading, a brilliant mind conceived of the butterfly option. Its genesis originates from the realization that a price breakout is not always a clear-cut binary event. Instead, markets often dance within a predetermined range, fluttering between defined boundaries. The butterfly option, with its dual long and single short positions, adeptly exploits this price oscillation.

Anatomy of a Butterfly

To construct a butterfly option, one must first establish the desired price range. Then, they purchase two long options at strike prices above and below the anticipated trading range’s midpoint. Simultaneously, a short option is sold at the midpoint strike price. This delicate balance between long and short positions allows the butterfly to profit from price movements within the defined range.

Profiting from Price Harmony

The butterfly’s profitability hinges on its ability to harmonize with the underlying stock’s price fluctuations. If the stock price remains within the anticipated range, the outer long options appreciate while the short option decays. This convergence creates a sweet symphony of profits.

Conversely, if the stock price ventures far beyond the defined range, the butterfly’s wings may flutter into the red. The outer long options may lose value while the short option may increase in value, disrupting the delicate equilibrium.

Image: optionstradingiq.com

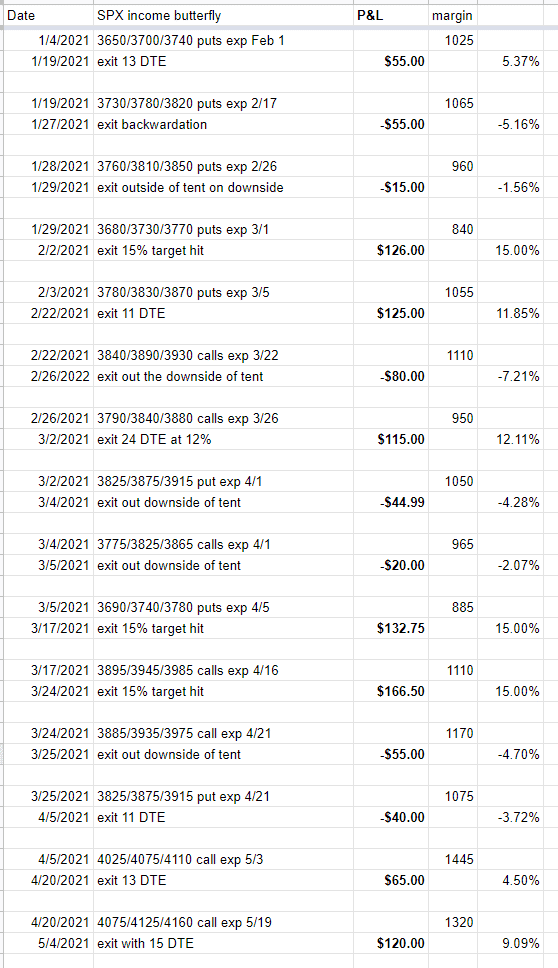

The Butterfly’s Dance in Practice

Let us paint a vivid canvas of a butterfly option in action. Imagine the stock XYZ trading at $100. An astute trader senses that the stock’s price is likely to hover between $95 and $105 over the next trading session. They thus construct a butterfly option as follows:

- Buy 1 XYZ $95 Call at a premium of $3

- Sell 1 XYZ $100 Call at a premium of $2

- Buy 1 XYZ $105 Call at a premium of $1.5

If XYZ’s price remains within the $95-$105 range, the trader’s butterfly will dance to the tune of profitability. However, if the price swings wildly outside these boundaries, the butterfly may stumble, resulting in financial losses.

Unleashing the Butterfly’s Potential

Butterfly options, like a virtuoso’s instrument, can produce enchanting melodies of profit when played with finesse. Expert insights and actionable tips can guide traders in harnessing the butterfly’s potential:

-

Identify Trading Range: The key to butterfly success lies in accurately predicting the stock’s trading range. Study historical price data, consider market sentiment, and utilize technical analysis to establish precise boundaries.

-

Select Strike Prices: Choose strike prices that align with the predicted trading range, ensuring sufficient space for price movement. Avoid overly wide or narrow ranges to maximize profitability.

-

Manage Risk: Never venture beyond your risk tolerance. The butterfly option carries inherent risk, making it crucial to understand the potential for losses and plan accordingly.

Trading Butterfly Options

Embracing the Butterfly’s Symphony

In the grand symphony of financial markets, butterfly options offer a captivating blend of elegance and profit potential. By understanding their intricate dance and armed with expert insights, traders can unleash the butterfly’s harmonic melodies to orchestrate their financial endeavors. Remember, the market is an ever-shifting landscape, and careful navigation is key to unlocking the butterfly’s true power. So, spread your wings, embrace the possibilities, and let the butterfly’s symphony guide your trading journey towards financial success.