Introduction:

Image: www.aimarrow.com

Imagine a delicate dance performed by a trio of butterflies, their wings fluttering in a captivating harmony. Just as this avian ballet paints the sky with intricate patterns, butterfly options traders orchestrate a symphony of strategies that transform risk and opportunity into a mesmerizing spectacle.

Butterfly options trading is an advanced strategy that empowers investors to navigate the unpredictable markets with precision and finesse. It combines the allure of limited risk with the potential for substantial returns, making it an intriguing choice for seasoned traders seeking to enhance their portfolio.

Understanding Butterfly Wings: The Core Mechanics

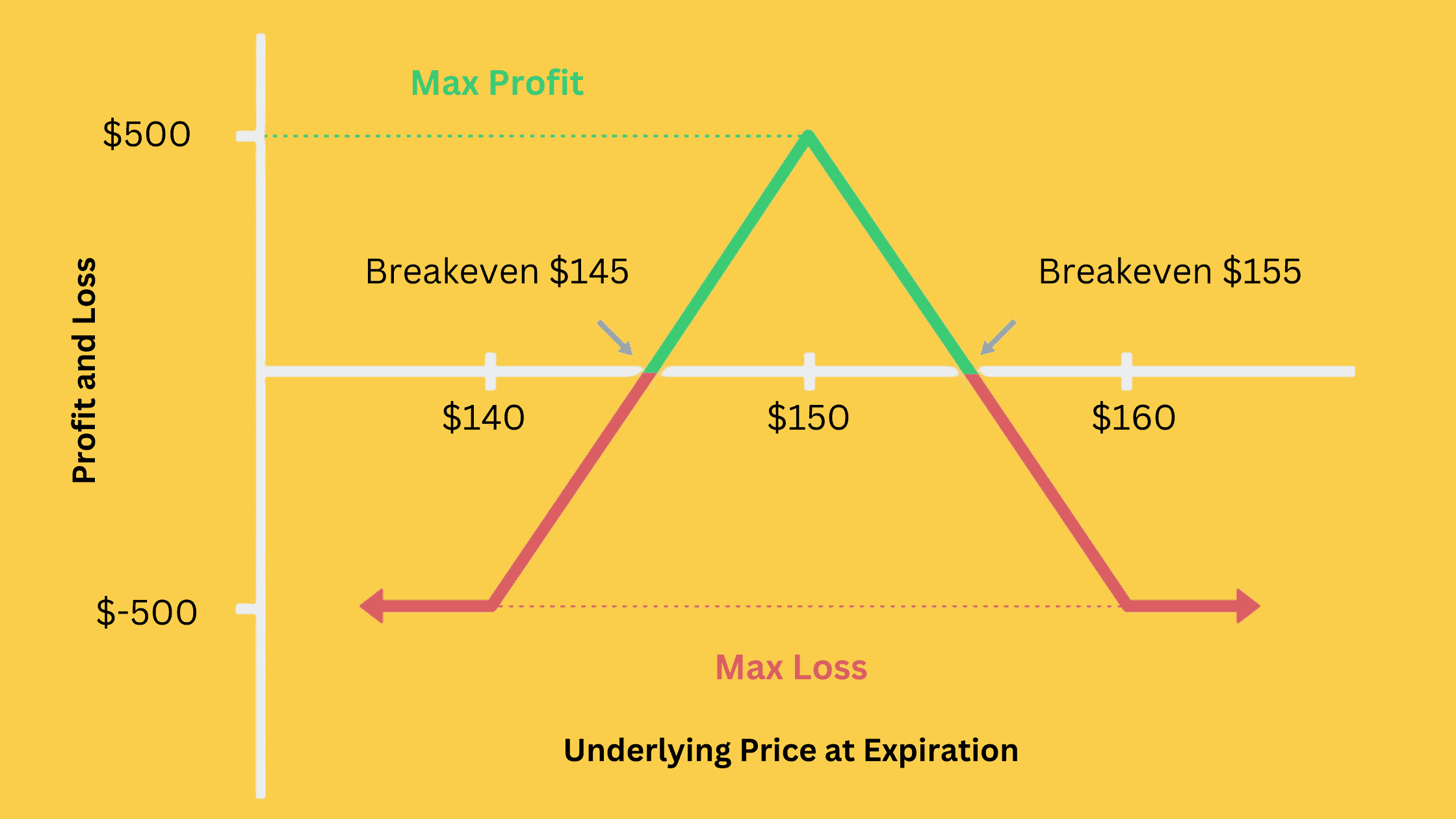

Butterfly options trading takes its name from the unique shape of the trade on a price-time chart. Like the symmetrical butterfly, this strategy consists of three distinct components: the long call, the short call, and the long put.

The long call option grants the buyer the right to acquire an underlying asset at a predetermined price (strike price) on or before a specified date (expiration date). The short call option, on the other hand, obligates the seller to sell the same asset at a slightly higher strike price. The long put option provides the right to sell the asset at a slightly lower strike price.

These three options are meticulously combined to create a balanced position that responds precisely to predictable price movements. Butterfly traders carefully orchestrate the strike prices and expiration dates of each option to lock in a preferred range for the underlying asset’s price.

The Heart of the Strategy: Expectation of Movement

The key to success in butterfly options trading lies in accurately anticipating the price direction of the underlying asset. By understanding market dynamics, traders can posit where the stock, commodity, or other asset will trade relative to the strike prices of their chosen options.

If the asset moves within the desired range, the trader profits from the combination of premiums received and paid. However, if the asset’s price ventures outside the sweet spot, the butterfly’s wings flutter less gracefully, resulting in potential losses.

Spread Your Wings: Emotional Intelligence in Trading

Beyond technical proficiency, emotional intelligence plays a crucial role in butterfly options trading. The inherent risk-seeking nature of this strategy requires traders to maintain a clear head and manage their impulses effectively.

FOMO (fear of missing out) and greed can lead to impulsive decisions, while anxiety can prematurely close a profitable trade. Successful butterfly traders learn to control their emotions, embracing discipline and patience as their guiding stars.

Seeking Expert Guidance: Navigating the Turbulence

Mastering the art of butterfly options trading is a journey best embarked upon with a mentor or education program. Renowned experts in the field offer invaluable insights, helping traders navigate the complexities of this strategy and optimize their approach.

From understanding market patterns to managing risk effectively, these experts can provide the guidance and support necessary to soar above the market’s turbulence.

Orchestrating Success: Keys to Butterfly Harmony

Like any instrument, butterfly options trading requires practice, precision, and a deep understanding of its nuances. Here are five key principles to guide your journey:

-

Thorough Research: Conduct meticulous due diligence before executing any trade.

-

Risk Management: Calculate and manage risk tolerance meticulously.

-

Patience and Discipline: Let the market dictate your actions, adhering to a disciplined trading plan.

-

Continuous Learning: Enhance your skills by studying market trends, patterns, and expert insights.

-

Emotional Control: Embrace emotional intelligence to make sound decisions.

Conclusion:

Butterfly options trading is a sophisticated and potentially rewarding strategy for experienced investors who are willing to embrace risk and manage their emotions with poise. Like the delicate butterfly, this strategy requires precision, balance, and a keen eye for opportunity. By understanding its core mechanics, seeking expert guidance, and cultivating emotional intelligence, traders can transform the unpredictable markets into a canvas for financial artistry.

Image: cannytrading.com

Butterfly Options Trading Strategy

Image: insights.deribit.com