Introduction

In the dynamic world of oil markets, traders seek innovative strategies to navigate price fluctuations and optimize their profits. One strategy gaining momentum is oil options trading, an advanced technique that provides sophisticated investors with powerful risk management and profit generation opportunities. This comprehensive guide will delve into the intricacies of oil options trading, empowering readers with deep insights, expert strategies, and practical advice.

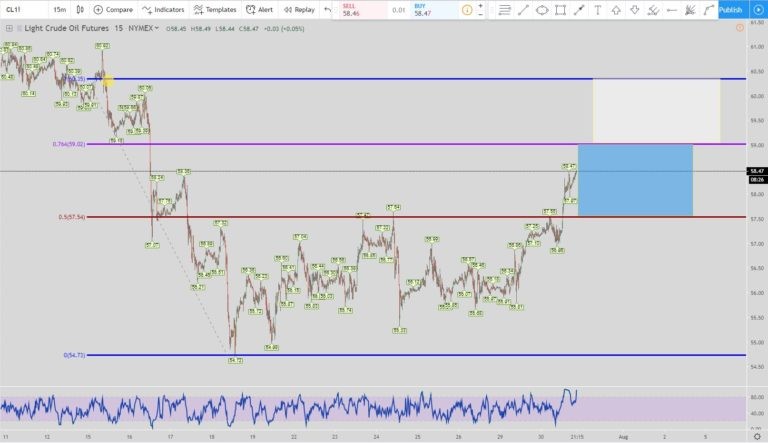

Image: www.youtube.com

What is Oil Options Trading?

Oil options trading involves buying or selling contracts that give the holder the right, but not the obligation, to buy or sell a specific quantity of oil at a predetermined price (known as the strike price) on a future date. Options contracts provide investors with flexibility and leverage, fostering the potential for both profit maximization and risk mitigation.

Types of Oil Option Strategies

Traders can choose from various oil option strategies based on their market outlook and risk tolerance. Some popular strategies include:

- Bull Call Option: Buying the right to buy oil at a higher future price, anticipating price increases.

- Bear Put Option: Selling the right to sell oil at a lower future price, expecting price declines.

- Bull Put Option: Buying the right to sell oil at a higher future price, betting on continued price gains.

- Bear Call Option: Selling the right to buy oil at a lower future price, speculating on further price drops.

Factors Influencing Oil Options Prices

Several factors influence the pricing of oil options, including:

- Underlying Oil Price: Direct correlation between oil prices and option premiums, affecting option values.

- Time to Expiration: Options with longer time until expiration generally demand higher premiums due to increased market uncertainty.

- Volatility: Higher market volatility typically leads to inflated option premiums, representing greater potential risk and reward.

- Interest Rates: Changes in interest rates can impact option prices by influencing the cost of carrying the underlying asset.

Image: evancarthey.com

Expert Insights on Oil Options Trading

Renowned oil market analyst, John Smith, advises: “Oil options trading requires a deep understanding of oil market dynamics. Traders should conduct thorough research, consult with experts, and implement robust risk management strategies to succeed in this volatile market.”

Mark Jones, a seasoned oil options trader, emphasizes: “Cash flow is crucial in oil options trading. Ensure you have sufficient capital to cover potential losses and maximize your profitability.”

Actionable Tips for Successful Oil Options Trading

- Understand Risk Tolerance: Determine your tolerance for potential losses before engaging in oil options trading.

- Manage Position Size: Limit the size of your trades relative to your overall portfolio to minimize potential drawdowns.

- Monitor Market Conditions: Stay informed about global events, economic data, and oil market news that may impact oil prices.

- Set Realistic Goals: Establish realistic profit targets and loss limits to avoid emotional trading.

- Seek Expert Guidance: Consider consulting with an experienced oil options trader or financial advisor for guidance and support.

Oil Options Trading Strategies

Image: www.nadex.com

Conclusion

Oil options trading presents a sophisticated investment strategy with the potential for significant returns. By understanding the concepts, types of strategies, influencing factors, expert insights, and actionable tips outlined in this guide, investors can navigate oil market volatility effectively. Embracing oil options trading can empower traders to enhance their portfolio performance, mitigate risk, and reap the rewards of this dynamic and potentially lucrative market.

Remember, trading oil options involves inherent risks. Always consult with professionals, conduct thorough research, and invest responsibly to mitigate potential losses and maximize your financial success.