Embark on a Journey of Precision, Potential, and Emotional Aptitude

In the enigmatic world of options trading, the butterfly strategy, akin to the butterfly’s mesmerizing dance, offers a graceful balancing act between risk and reward. As you glide through this article, we’ll delve into the depths of this elegant technique, unraveling its intricate layers and equipping you with the knowledge to navigate this captivating realm.

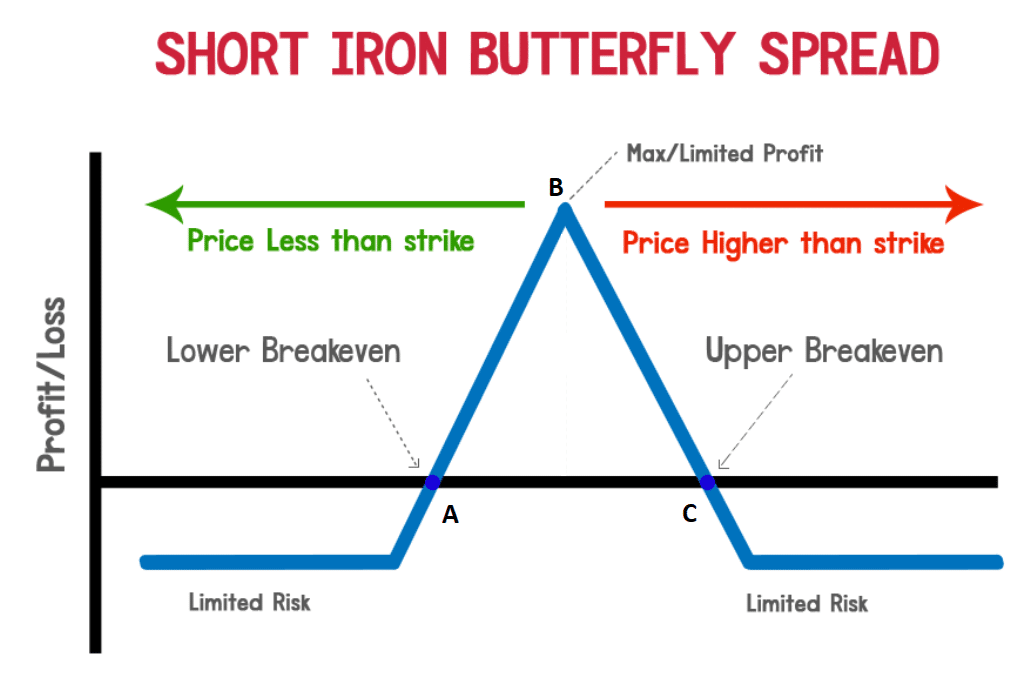

Image: marketxls.com

Unveiling the Butterfly’s Anatomy

At its core, the butterfly strategy is an advanced options trading tactic that employs three options contracts to capture specific price movements within a defined time frame. Like a skilled surgeon, it requires precision and a keen understanding of market dynamics to execute successfully.

Picture a scenario where an underlying stock is hovering around $100, and you anticipate a narrow price fluctuation within the next three months. The butterfly strategy empowers you to construct a trading position composed of the following options:

-

One buy option (call or put) at a strike price slightly above (for call) or below (for put) the stock’s current price ($102 for a call or $98 for a put)

-

Two sell options (call or put) at strike prices further from the stock’s current price (e.g., buy $102 call, sell $104 call and $96 put)

This calculated arrangement creates a “profit zone” within a specific price range. If the underlying stock’s price remains within this zone, the trader will reap the rewards of their strategic positioning.

The Psychology of the Butterfly

Executing a successful butterfly strategy hinges not only on technical proficiency but also on emotional intelligence. It’s a journey that demands patience, discipline, and an unwavering belief in one’s strategy.

The emotional toll of options trading can be profound. Fear and greed are constant companions, whispering their siren songs in your ear. The key to mastering this emotional rollercoaster lies in recognizing and managing these impulses, ensuring they do not cloud your judgment.

Trading with a Butterfly’s Intuition

Expert traders approach the butterfly strategy with the same grace and finesse as a seasoned dancer. They rely on keen market observation, calculated risk-taking, and a deep understanding of the factors that influence stock price movements.

Seasoned experts in the field of options trading advocate for a thorough analysis of market trends, volatility patterns, and potential catalysts before executing a butterfly strategy. By diligently studying market behavior, traders can refine their intuitions and make informed decisions that increase their chances of success.

Image: www.pinterest.com

Harnessing the Butterfly’s Potential

The butterfly strategy offers a unique advantage in the options trading arena:

-

Limited risk: Compared to other options strategies, the butterfly strategy carries a lower risk profile, as it involves selling two options while only purchasing one

-

Profit potential: The potential for profit with a well-executed butterfly strategy can be significant, particularly when market movements align with your predictions

-

Flexible positioning: The butterfly strategy can be tailored to your specific risk tolerance and profit objectives, allowing you to fine-tune your trading approach

A Butterfly’s Cautious Grace

Despite its allure, the butterfly strategy is not without its caveats. It demands a comprehensive understanding of options trading dynamics and market intricacies. Newcomers to options trading are advised to approach this strategy with caution and consider seeking guidance from experienced traders or financial advisors.

Moreover, market conditions are subject to change, and even the most meticulously crafted butterfly strategy can encounter unforeseen challenges. Volatility, liquidity, and time decay are factors that can significantly impact the outcome of your trades.

Options Trading Strategies Butterfly

Image: www.youtube.com

Conclusion

The butterfly strategy offers a compelling blend of risk and reward in the realm of options trading. By embracing the finesse and precision of this technique, traders can potentially reap significant profits while mitigating their exposure to risk.

However, it’s crucial to remember that options trading is a complex endeavor, and the butterfly strategy is not a magic wand that guarantees success. Knowledge, discipline, and emotional resilience are vital ingredients in this intricate dance.

As you navigate the ever-evolving markets, may the butterfly’s graceful flight inspire you to achieve your trading aspirations. Remember, with knowledge, patience, and a touch of audacity, you too can soar to new heights of trading success.