Embarking on the Thrilling Journey of Options Trading with a Substantial Stake

Image: www.youtube.com

Options trading, an intricate yet potentially lucrative realm of finance, has captured the attention of countless sophisticated investors seeking to enhance their portfolios. With its inherent flexibility and the potential for significant returns, options trading offers a unique opportunity for reaping rewards. This comprehensive guide will delve into the nuances of options trading, providing a thorough understanding of this dynamic market, its strategies, and how to navigate its potential complexities.

Unveiling the Enigma of Options Trading

Options, fundamentally, are contracts that grant the buyer the right, not the obligation, to buy (in the case of a call option) or sell (in the case of a put option) an underlying asset, such as stocks, bonds, or commodities, at a predetermined price, known as the strike price, on or before a specific date known as the expiration date. This empowers investors with versatility, enabling them to speculate on the future price movements of assets or hedge potential risks.

The allure of options trading lies in the leverage it offers. With a relatively small investment, traders can control a much larger underlying asset. However, it’s imperative to proceed with caution, as the potential for significant returns comes hand-in-hand with the possibility of substantial losses. Understanding the risks involved and adopting a prudent trading strategy is paramount to long-term success.

Exploring the Nuances of Options Trading

Options trading encompasses a wide range of strategies, tailored to specific investment objectives and risk tolerance levels. Some commonly employed techniques include buying and selling naked options, covered options, spread strategies, and iron condors. Each strategy presents unique characteristics, and traders should meticulously assess their suitability before implementation.

Covered options involve selling an option while simultaneously owning the underlying asset. Spread strategies entail buying and selling options with different strike prices or expiration dates, creating a spread with a defined risk-to-reward profile. Iron condors, on the other hand, combine four options with varying strike prices and expiration dates, aiming for limited profits from a stable market.

Image: tradingstrategyguides.com

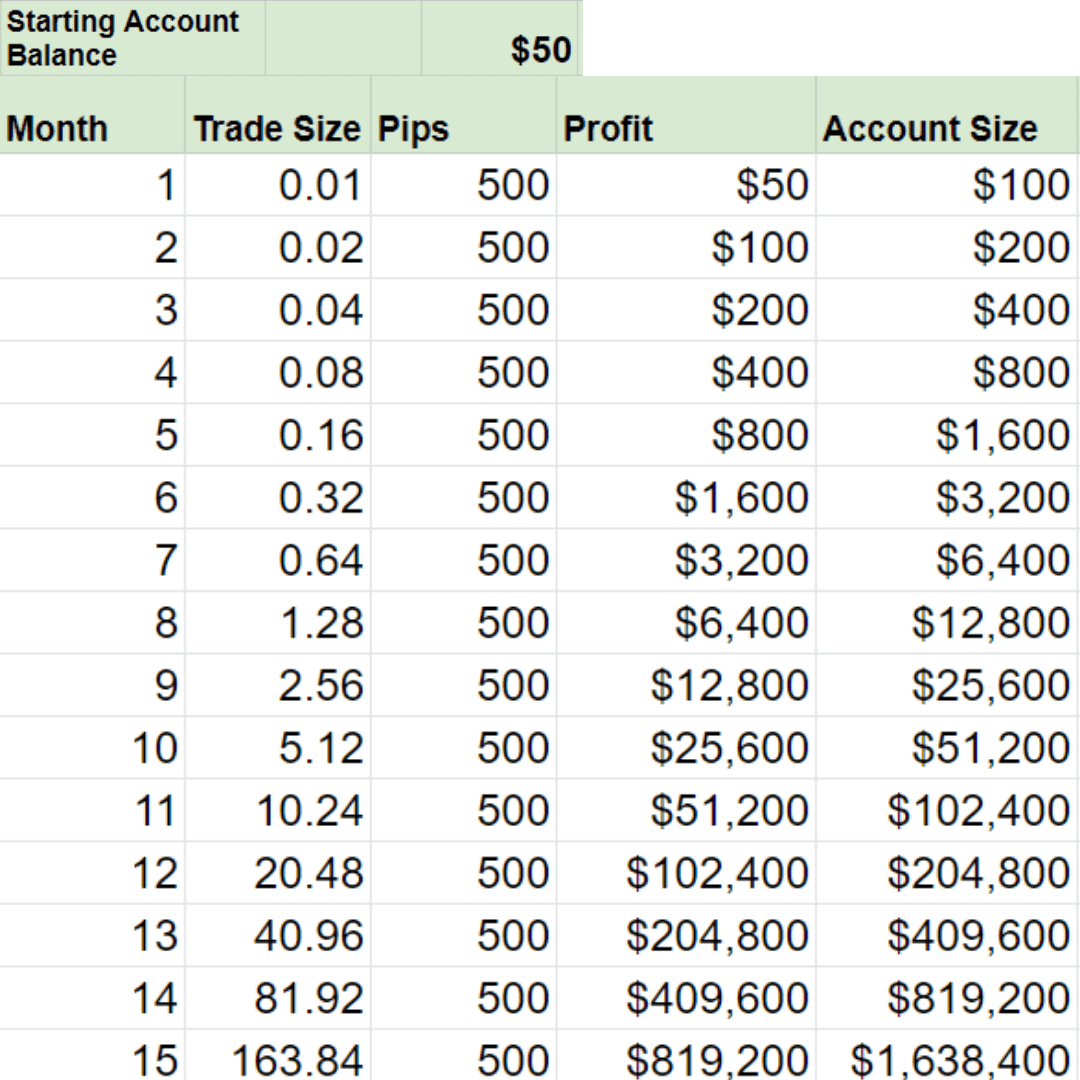

Options Trading 10000

Image: keysgame.pl

Mastering the Art of Options Trading

Successful options trading requires a comprehensive understanding of its dynamics and the ability to make informed decisions. Continuous learning, meticulous research, and prudent risk management are key. Backtesting strategies, utilizing trading simulators, and seeking guidance from experienced traders can significantly enhance one’s proficiency.

Disclaimer: Options trading involves significant risk and is suitable only for sophisticated investors with a high tolerance for risk. It’s essential to consult with a financial professional before engaging in options trading.