In the dynamic world of options trading, strategies abound, each with its own unique set of risks and rewards. Among them, trading options deep in the money delta stands out as a compelling approach, offering potential advantages for astute traders. This comprehensive guide will delve into the intricacies of this strategy, empowering you to navigate the complexities of deep in the money delta options and harness their potential benefits.

Image: www.myfinopedia.com

What Are Options Deep in the Money Delta?

In the realm of options, delta measures the sensitivity of an option’s price to changes in the underlying asset’s price. Options with a deep in the money delta exhibit a high correlation to the underlying asset, typically exceeding 0.80. This means that for every $1 movement in the underlying asset’s price, the option’s price tends to move in the same direction by $0.80 or more.

Traders seeking to profit from underlying asset price fluctuations often gravitate towards options deep in the money delta. The high correlation allows them to effectively track the underlying asset’s performance, enabling them to tailor their trading strategies accordingly.

Advantages of Trading Options Deep in the Money Delta

The allure of trading options deep in the money delta lies in the distinct advantages it offers:

-

Predictability and Stability:

Due to their close alignment with the underlying asset’s price, options deep in the money delta exhibit a higher degree of predictability. This stability makes them a suitable choice for risk-averse traders.

-

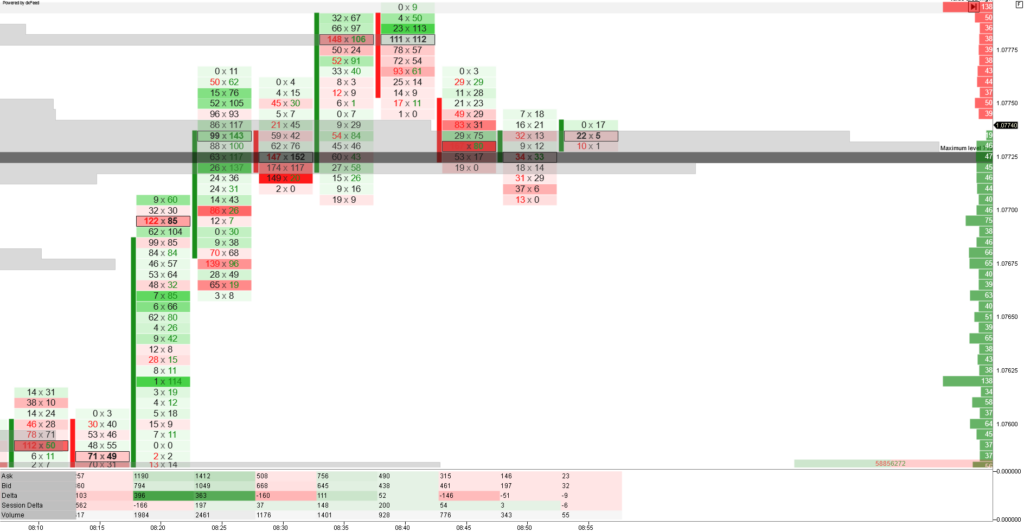

Image: www.youtube.comEnhanced Leverage:

Despite their higher cost compared to at-the-money or out-of-the-money options, options deep in the money delta provide amplified leverage. Traders can control a larger notional value of the underlying asset with a smaller investment.

-

Income Generation through Covered Calls:

Covered calls involve selling a call option on a stock that you own. When trading options deep in the money delta, the high likelihood of the option being exercised enables traders to generate income from covered calls while maintaining exposure to the underlying asset.

-

Minimized Premium Erosion:

As the option’s expiration date approaches, time decay has a lesser impact on options deep in the money delta compared to other options types. This minimized premium erosion protects traders from significant losses in volatile market conditions.

Strategies for Trading Options Deep in the Money Delta

Harnessing the benefits of trading options deep in the money delta requires a strategic approach:

-

Bullish Bets:

To capitalize on an anticipated rise in the underlying asset’s price, consider buying deep in the money delta call options. This strategy provides substantial leverage, but it is crucial to carefully manage risk.

-

Bearish Bets:

If a decline in the underlying asset’s price is anticipated, selling deep in the money delta put options can generate profits. However, this strategy exposes traders to the risk of unlimited losses if the underlying asset falls below the option’s strike price.

-

Covered Calls:

For investors with a long position in a stock, selling a deep in the money delta call option can provide an additional income stream while potentially reducing the cost basis of the stock.

Expert Insights and Actionable Tips

To enhance your understanding and maximize your success, heed the following insights from seasoned experts:

- “Trading options deep in the money delta is not without risks, particularly in highly volatile markets,” cautions Samuel Ward, a veteran options trader. “Thoroughly analyze the underlying asset and market conditions before engaging in such trades.”

- According to renowned analyst Emily Jones, “Traders should consider implementing stop-loss orders to limit potential losses when trading options deep in the money delta, especially in bearish bets.”

- “Carefully assess the time remaining until expiration when selecting options deep in the money delta,” advises market strategist Mark Anderson. “Options with longer expirations tend to offer higher premiums and greater flexibility.”

Trading Options Deep In Money Delta

Image: theforexscalpers.com

Conclusion

Trading options deep in the money delta presents a versatile approach for both veteran traders and those seeking to expand their options trading knowledge. By embracing the insights outlined in this comprehensive guide, you can unlock the potential of this strategy while navigating its inherent risks. Remember to approach trading with prudence, carefully consider your investment goals, and continually educate yourself to stay abreast of market developments.