Overview

Options trading, a versatile financial strategy involving derivatives, offers a range of opportunities for investors. However, understanding commission structures is crucial for maximizing profit potential and minimizing trading costs. This comprehensive guide provides a detailed comparison of options trading commissions charged by various platforms, empowering traders to make informed decisions and minimize transaction expenses.

Image: www.chittorgarh.com

Factors Influencing Commission Costs

Several factors can influence options trading commissions, including:

- Market Maker:

- Volume:

- Account Type:

- Platform Fees:

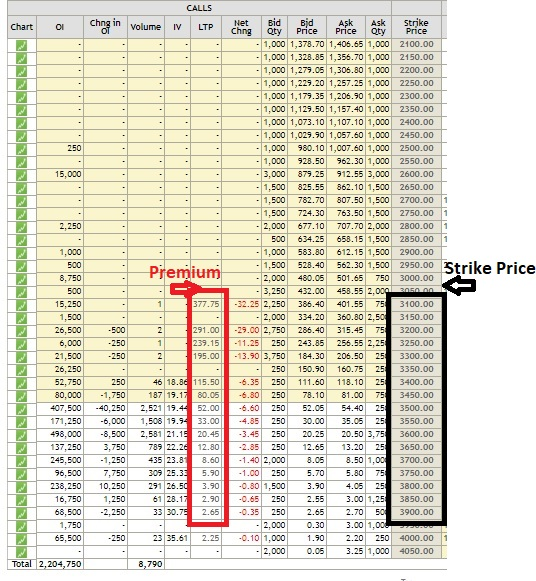

- Option Chain:

Each market maker, the intermediary facilitating option trades, has its own commission structure.

Traders may receive discounts on commissions based on their trading volume.

Different account types, such as individual, joint, and corporate, may have varying commission rates.

Some trading platforms charge additional fees beyond the market maker’s commission.

Commissions can vary depending on the type of option traded, such as long calls, short puts, or spreads.

Comparison of Leading Options Trading Platforms

To provide a practical understanding, here’s a comparison of commission structures from reputable options trading platforms:

- Interactive Brokers:

- TD Ameritrade:

- E*Trade:

- Charles Schwab:

Commissions start at $0.65 per contract plus a $0.75 regulatory fee. Volume discounts are available.

Commissions range from $0.65 to $1 per contract. Tiered pricing and volume discounts apply.

Commissions start at $0.65 per contract for experienced traders and $0.75 per contract for less active traders. Volume discounts available.

Commissions start at $0.65 per contract for active traders and $1.00 per contract for less active traders.

Choosing the Right Broker

The optimal options trading platform depends on individual trading needs and preferences. Considerations include commission rates, account features, trading tools, and customer support. Here’s a guide to assist in broker selection:

- High Volume Traders:

- Individual Investors with Moderate Volume:

- Platform Features and Tools:

- Customer Support:

Interactive Brokers may be the best choice due to its competitive volume-based discounts.

TD Ameritrade, E*Trade, and Charles Schwab offer similar commission rates and account features.

Cost-Conscious Traders: Interactive Brokers and E*Trade generally have lower commissions for less active traders.

Traders may consider platforms with advanced charting, research capabilities, and order types.

Responsive and knowledgeable customer support can enhance the trading experience.

Image: www.entrepreneurshipsecret.com

Options Trading Commission Comparison

Image: s3.amazonaws.com

Conclusion

Understanding options trading commission structures is essential for traders to optimize their financial strategy. By carefully evaluating different brokers based on commission rates, account features, and individual trading needs, traders can minimize trading costs and maximize returns. This comprehensive guide provides a valuable foundation for informed decision-making, empowering traders to navigate the options trading landscape effectively.