Are you interested in options trading? Do you find those mind-boggling commissions a bit disheartening? If so, you’re definitely not alone. Options commissions can be a significant expense, especially if you’re an active trader. That’s why it’s important to compare options trading commissions before you open an account with any broker.

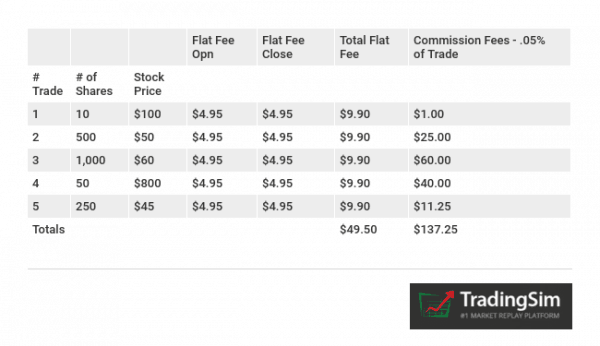

Image: www.tradingsim.com

In this article, we’ll break down the different types of options trading commissions and help you find the best deal for your needs. We’ll also provide some tips on how to reduce your options trading costs.

Types of Options Trading Commissions

There are three main types of options trading commissions:

-

Per-contract commissions: This is the most common type of commission. It’s a flat fee per contract that you buy or sell, regardless of the size of the contract.

-

Percentage commissions: These commissions are based on the value of the contract. The higher the value of the contract, the higher the commission will be.

-

Tiered commissions: These commissions are based on the number of contracts you trade in a given month. The more contracts you trade, the lower your commission rate will be.

Which Type of Commission is Right for You?

The best type of commission for you will depend on your trading volume and the size of your contracts. If you’re an active trader who trades large contracts, then tiered commissions may be your best option. However, if you’re a new trader or you only trade small contracts, then per-contract commissions are probably your best choice.

How to Reduce Your Options Trading Costs

There are a few things you can do to reduce your options trading costs:

-

Open an account with a discount broker. Discount brokers offer lower commissions than full-service brokers.

-

Negotiate with your broker. If you’re a loyal customer, you may be able to negotiate a lower commission rate with your broker.

-

Trade fewer contracts. The fewer contracts you trade, the lower your commissions will be.

-

Use a commission-free broker. Some brokers offer commission-free options trading. However, these brokers typically have other fees, so it’s important to compare all of your costs before opening an account.

Image: www.youtube.com

Options Trading Commissions Comparison

Conclusion

Options trading commissions can be a significant expense, but there are steps you can take to reduce your costs. By comparing options trading commissions, negotiating with your broker, and trading fewer contracts, you can save money on your options trades.

We hope this article has provided you with the information you need to make an informed decision about options trading commissions. If you have any further questions, please don’t hesitate to contact us.