Introduction

Are you looking to trade options without breaking the bank? With the proliferation of online brokers, finding the cheapest option trading commissions is crucial for maximizing your profits. This comprehensive article delves into the world of option trading commissions, empowering you to identify the best and most economical options available.

Image: www.projectfinance.com

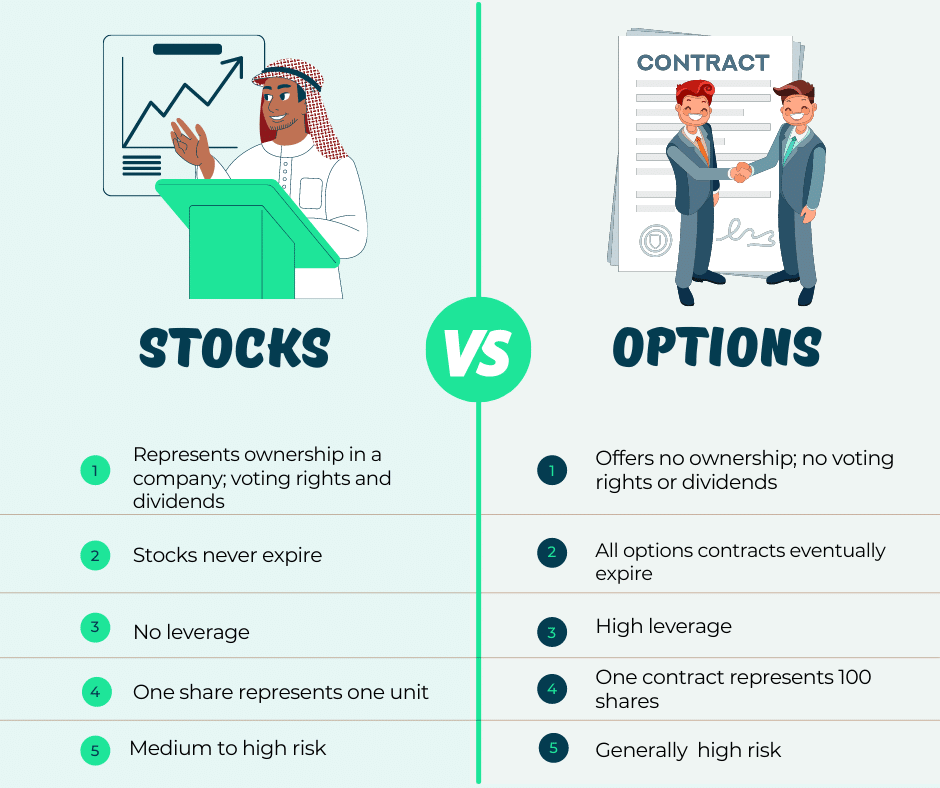

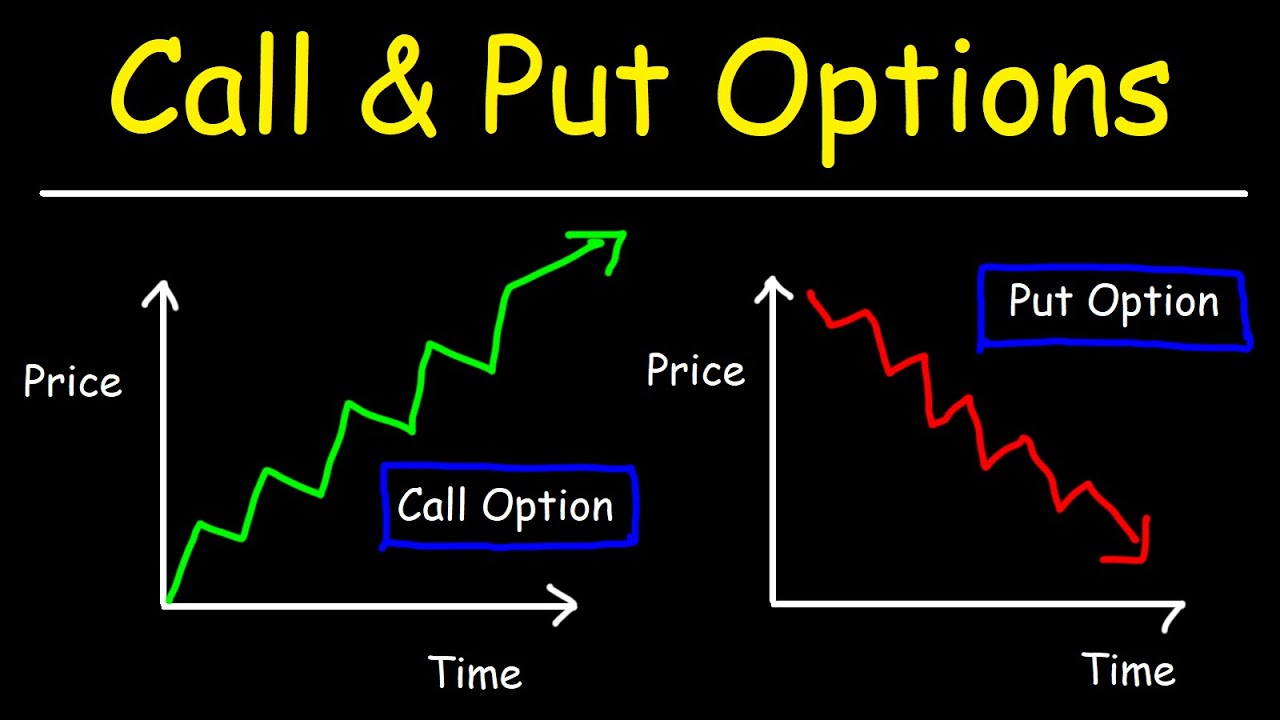

Option trading involves buying contracts that grant you the right to buy or sell a certain asset at a predetermined price within a specific time frame. Commissions play a significant role, as they can eat into your potential returns. Understanding the various commission structures and identifying brokers offering the lowest fees will allow you to optimize your profitability.

Commission Structures

Option trading brokers typically charge one of three commission structures:

- Per-Contract Fees: A flat fee charged for each option contract traded, irrespective of its value.

- Percentage-Based Fees: A percentage of the total value of the option contract traded.

- Tiered-Pricing Structure: Commissions vary based on the number of contracts traded, with higher volume attracting lower fees.

Finding the Best Brokers

To find the best brokers with the cheapest option trading commissions, consider the following factors:

Research and Comparison

Compare commission structures and fees across multiple brokers. Utilize online resources and broker websites to gather up-to-date information.

Image: www.youtube.com

Account Type and Trading Volume

Consider your account type and anticipated trading volume. Some brokers offer lower fees for active traders or those with larger account balances.

Additional Fees

Inquire about other potential fees, such as platform fees, regulatory fees, and clearing fees, as these can add to your trading costs.

Examples of Low-Commission Brokers

Several brokers offer competitive option trading commissions. Here are some examples:

- Robinhood: Zero commissions on all stock, ETF, and options trades.

- Webull: No commissions on up to 50 option contracts per month.

- Fidelity: $0.65 per contract with a minimum of $1 commission per order.

- TD Ameritrade: $0.65 per contract with a minimum of $1 commission per order.

- Interactive Brokers: Commission fees as low as $0.05 per contract for Tiered Pricing customers.

Negotiating Lower Commissions

Consider contacting customer service or account representatives to negotiate lower commissions. Some brokers may be willing to waive or reduce fees for high-volume traders or those who meet certain criteria.

Cheapest Option Trading Commissions

Image: www.youtube.com

Conclusion

Minimizing option trading commissions is essential for maximizing profitability. By researching and comparing different brokers, you can find the best deals that align with your trading needs. Remember to consider not only the commission structure but also the overall reputation and services offered by each broker. Informed decision-making will empower you to trade options effectively while keeping your costs low.

As the financial landscape continues to evolve, be sure to stay updated on the latest trends and developments in option trading commissions. By embracing new opportunities and embracing the power of low-cost trading, you can unlock the potential of the options market.