Introduction

Image: alfatoro.com

Options trading offers investors a versatile tool for managing risk, enhancing returns, and even generating income. With its growing popularity, platforms like Webull have emerged as user-friendly gateways to this dynamic world. However, to unlock these opportunities, you must first enable options trading on your Webull account. This comprehensive guide will walk you through the step-by-step process, empowering you to fully harness the potential of options trading.

Step 1: Eligibility Verification

Before delving into options trading, it’s essential to ensure your eligibility. Webull requires users to meet certain criteria to participate in options trading. These include:

- Being a U.S. citizen or resident with a valid Social Security Number

- Having a valid margin account (Webull will automatically create one if you don’t)

- A minimum balance of $2,000 in your account

- Passing the Webull Options Approval Exam

Step 2: Options Approval Exam

To ensure responsible and informed participation, Webull has implemented an Options Approval Exam. This exam tests your understanding of basic options concepts, including contract types, risk management, and trading strategies.

- Preparation: Webull provides study materials and practice questions to prepare for the exam.

- Exam Details: The exam consists of 25 multiple-choice questions with a passing score of 70%. You have three attempts to pass.

- Consequences of Failure: If you fail the exam, you will need to wait 30 days before retaking it.

Step 3: Enable Options Trading

Once you have passed the exam, follow these steps to enable options trading on Webull:

- Log in to your Webull account.

- Click on “More” in the bottom right corner.

- Select “Trading Permissions.”

- Toggle on “Options Trading” and confirm your selection.

We recommend reviewing and understanding Webull’s Options Trading Agreement before proceeding further.

Step 4: Understand Options Trading Concepts

Before placing your first options trade, it’s crucial to gain a solid foundation in options trading concepts. This knowledge will empower you to make informed decisions and navigate the unique complexities of this market:

- Option Types: Call options represent the right to buy, while put options confer the right to sell the underlying asset.

- Option Premiums: The price you pay to acquire an option. It reflects the market’s expectations of the underlying asset’s future value.

- Expiration Dates: Every option has an expiration date, which determines the time frame in which the option can be exercised.

- Strike Prices: This refers to the specified price at which the underlying asset can be bought (in the case of call options) or sold (put options).

- Leverage: Options offer leverage, which can amplify both potential profits and losses. This aspect requires careful consideration.

Step 5: Develop a Trading Strategy

Developing a trading strategy is vital to guide your decision-making and risk management in options trading. Here are some common options trading strategies:

- Covered Calls: Selling call options against your existing shares.

- Cash-Secured Puts: Selling put options while holding cash to cover potential purchases.

- Bull Call Spreads: Involving the simultaneous purchase of a higher strike call option and sale of a lower strike call option.

- Bear Put Spreads: Combining the sale of a higher strike put option with the purchase of a lower strike put option.

Step 6: Place Your First Trade

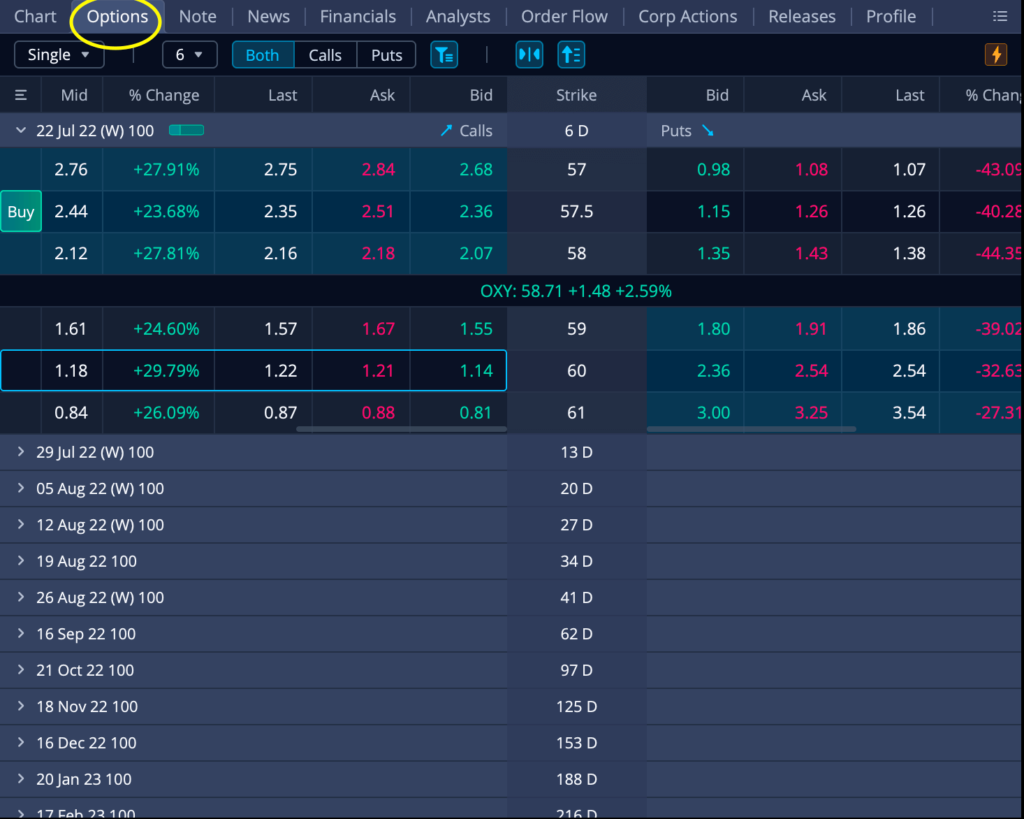

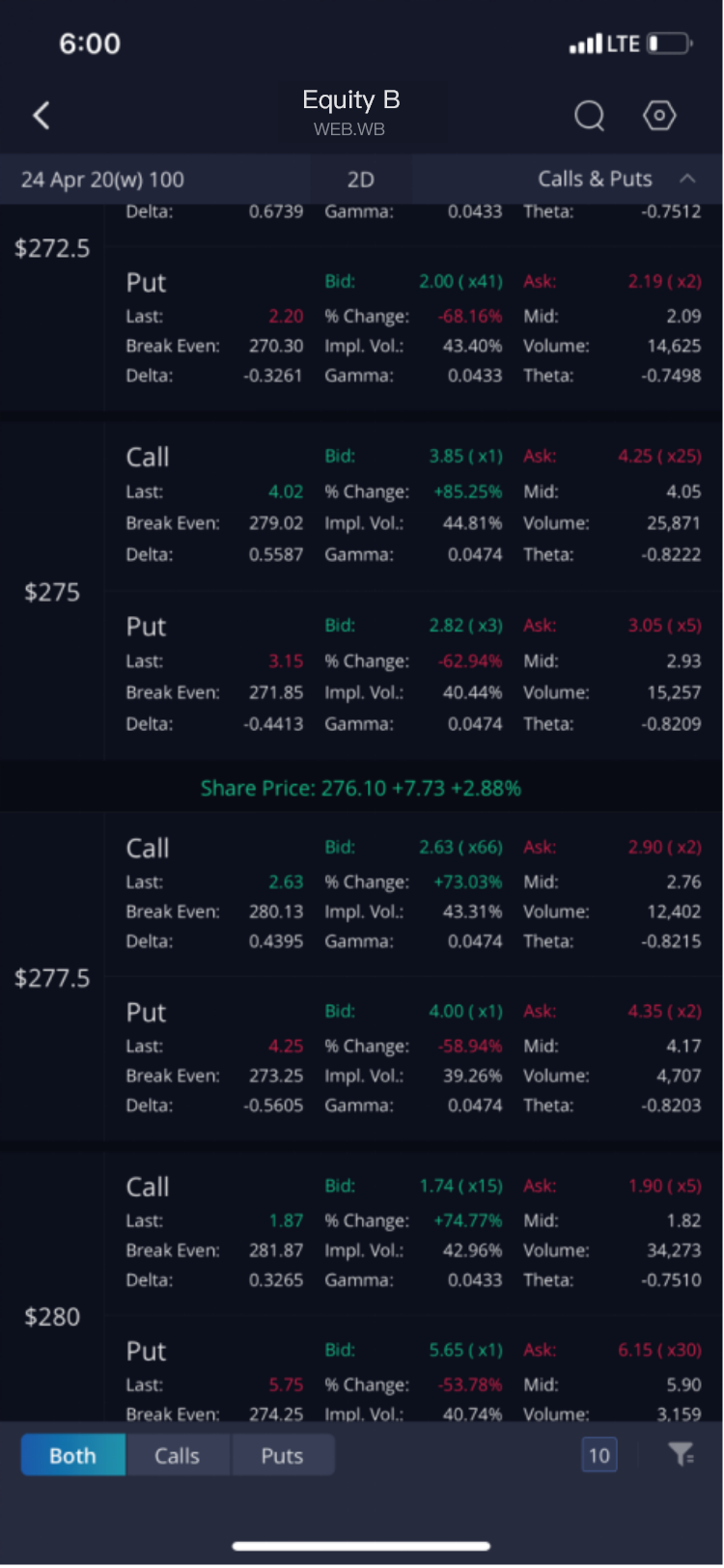

Once you have selected an appropriate strategy, it’s time to place your first options trade. Follow these steps:

- Enter the symbol of the underlying asset you want to trade options on.

- Select the desired option contract (call or put).

- Enter the strike price and expiration date.

- Choose the number of contracts you wish to trade.

- Preview and confirm your order.

Step 7: Manage Your Options Positions

Once your options trade is executed, it’s crucial to monitor and manage your position:

- Risk Management: Implement appropriate risk management strategies, such as stop-loss or stop-limit orders.

- Adjustment of Position: You can adjust your position by closing the trade, rolling it over to a different expiration date, or entering into an additional contract.

- Market Monitoring: Stay abreast of market news and events that could impact your options trades.

Conclusion

Turning on options trading on Webull opens the door to a world of opportunities and enhanced portfolio management strategies. By following the steps outlined in this guide, you can empower yourself with the knowledge and tools to confidently navigate this complex market. Remember to approach options trading with a well-informed and prudent approach to maximize its potential benefits.

Image: www.youtube.com

How To Turn On Options Trading Webull

Image: www.webull.com