As the economic landscape shifts and the specter of a recession looms, investors may consider options trading as a potential haven amidst market turmoil. Options provide a unique opportunity to navigate market volatility, but understanding their complexities and potential risks is crucial. In this article, we will delve into the intricacies of options trading during a recession, exploring its mechanisms, strategies, and the emotional challenges that accompany it.

Image: towardsdatascience.com

Options, a type of financial derivative, grant the buyer the right, but not the obligation, to buy (in the case of call options) or sell (in the case of put options) an underlying asset at a specific price (known as the strike price) on or before a certain date (expiration date). This flexibility allows traders to tailor their investments to specific market scenarios and potentially capitalize on fluctuations in asset prices.

During a recessionary period, the market is typically characterized by uncertainty, fear, and increased volatility. Options trading can offer several benefits in such environments:

-

Hedging against Downside Risk: Put options can be used to protect existing investments from potential losses in the event of a market decline. By purchasing put options, investors can lock in the ability to sell a stock at a predetermined price, limiting their exposure to further price erosion.

-

Income Generation: Selling (or writing) options with higher strike prices can generate additional income during periods of market uncertainty. However, it’s important to note that this strategy also carries increased risk.

-

Leverage: Options trading can provide leverage, allowing investors to control a larger number of shares than they could afford to purchase outright. This can amplify potential gains, but it also magnifies potential losses.

Despite these potential benefits, options trading also comes with significant risks:

-

Complexity: Options are sophisticated financial instruments, and understanding their nuances is crucial. Misinterpreting options contracts or executing trades without careful consideration can lead to substantial losses.

-

Volatility Risk: The value of options is heavily influenced by market volatility. During recessionary periods, volatility can spike, leading to rapid fluctuations in option prices, making it difficult to accurately predict outcomes.

-

Time Decay: Option contracts have a predetermined expiration date. As the expiration date approaches, the value of the option decays, which can lead to losses if the price of the underlying asset does not move in the anticipated direction.

To navigate the complexities of options trading during a recession, it’s essential to approach it with both caution and due diligence:

-

Embrace Education: Seek comprehensive education about options trading before venturing into the market. Thoroughly understand the risks and the different strategies available.

-

Start Small: Commence with small trades to gain practical experience and build confidence. Avoid investing more than you can afford to lose.

-

Manage Risk Prudently: Implement strict risk management principles, including setting stop-loss orders and carefully managing leverage.

-

Seek Professional Guidance: If necessary, consult a qualified financial advisor who can provide personalized guidance and help you develop an investment strategy aligned with your risk tolerance and financial goals.

In conclusion, options trading during a recession can be a double-edged sword. While it offers potential opportunities for profit and risk mitigation, it also carries significant risks. Approaching options trading with caution, education, and a disciplined risk management strategy is paramount. By carefully considering the potential benefits and risks, investors can harness the power of options to navigate the turbulent waters of a recession and potentially emerge as victors.

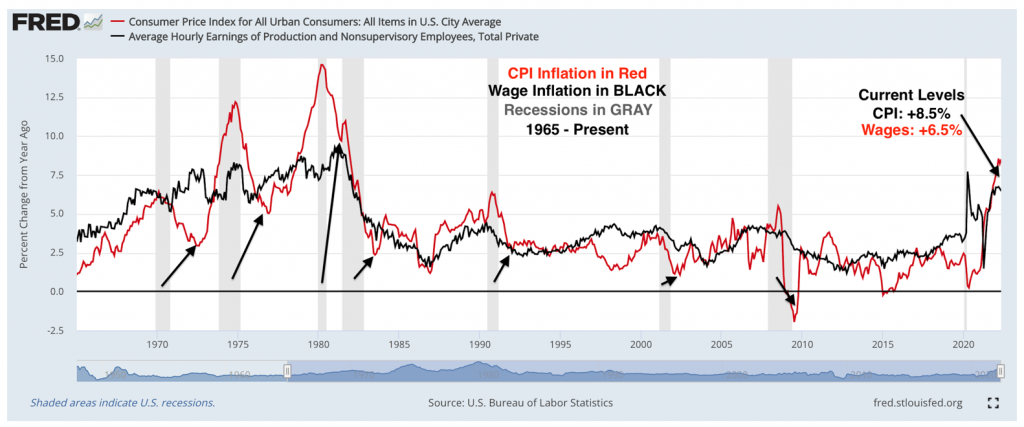

Image: datatrekresearch.com

Options Trading During Recession

Image: capital19.com