Unleashing the Power of Options with Charles Schwab

Welcome to the world of options trading with Charles Schwab, a leading brokerage firm renowned for its innovative trading platforms and comprehensive financial services. If you’re ready to venture into the dynamic realm of options, this detailed guide will equip you with the knowledge and insights to navigate the market confidently.

Image: www.youtube.com

Charles Schwab Options Trading Platform

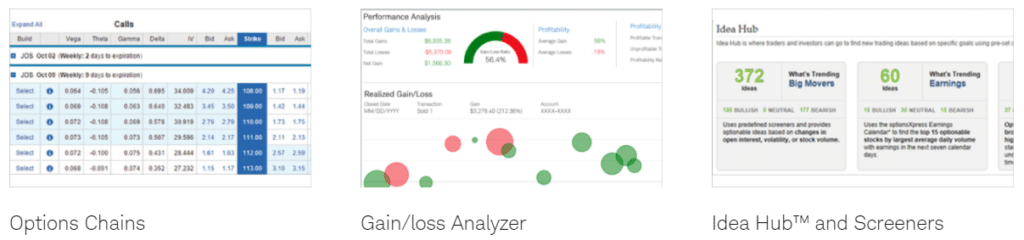

At the heart of Schwab’s options trading experience lies its state-of-the-art platform, designed to cater to both novice and seasoned traders. The user-friendly interface provides real-time market data, customizable charts, and advanced trading tools. Whether you prefer to trade online, on mobile, or through the desktop application, Schwab’s platform offers a seamless and intuitive experience.

One noteworthy feature is Schwab’s Options Strategy Lab, which enables you to research and analyze complex options strategies before executing trades. The robust options chain display and option chains comparison tool further enhance your decision-making process. Additionally, the platform provides access to educational resources, including webinars, tutorials, and FAQs, empowering you to stay informed and refine your trading skills.

Trading Options with Schwab: Understanding the Market

Before delving into options trading, it’s crucial to comprehend the basics of this multifaceted market. Options, unlike stocks, don’t represent ownership of an underlying asset; instead, they confer the right to buy (call options) or sell (put options) an asset at a specific price (strike price) on or before a particular date (expiration date). This flexibility allows traders to speculate on the future price movements of assets while employing various strategies for profit potential.

Schwab’s Margin Account for Options Trading

To engage in options trading with Charles Schwab, a margin account is essential. This account type allows you to borrow funds from Schwab to increase your trading power and potentially amplify returns. However, it’s vital to exercise caution when utilizing margin, as losses can exceed your initial investment. Therefore, it’s imperative to thoroughly understand the risks involved and manage your trading activities responsibly.

Image: www.schwab.com

Tips and Expert Advice for Options Trading Success

To enhance your options trading journey, consider implementing these expert tips:

- Educate yourself: Equipping yourself with a solid understanding of options trading fundamentals, strategies, and market dynamics is paramount.

- Practice disciplined risk management: Implementing sound risk management strategies, such as stop-loss orders and position sizing, is crucial to mitigating potential losses and preserving your capital.

- Utilize professional analysis tools: Leveraging sophisticated charting and analysis tools can provide valuable insights and enhance your decision-making process.

- Monitor market trends: Staying informed about economic and market news, as well as industry-specific developments, is essential for adapting to changing market conditions.

- Consider seeking professional guidance: Working with an experienced financial advisor or broker can provide tailored advice and support tailored to your individual needs and investment goals.

FAQs on Charles Schwab Options Trading Account

- Q: What are the eligibility criteria for opening an options trading account with Charles Schwab?

A: To qualify, you must be at least 18 years of age, a U.S. citizen or resident, and have a valid Social Security number or Taxpayer Identification Number (TIN). - Q: What types of options can I trade with Schwab?

A: Schwab offers a wide range of options contracts, including single-leg options (call and put options), multi-leg options strategies (spreads, straddles, and strangles), as well as index options, ETF options, and currency options. - Q: What are the fees associated with options trading with Schwab?

A: Schwab charges competitive fees for options trades, with per-contract fees varying based on the type of option and the exchange where the trade is executed. You can find the detailed fee schedule on Schwab’s website. - Q: Is there a minimum account balance requirement for options trading with Schwab?

A: While there is no minimum account balance requirement, Schwab recommends maintaining a sufficient balance to cover potential losses and margin calls. - Q: What are the risks involved in options trading?

A: Options trading involves significant risks, including the potential for substantial losses that may exceed your initial investment. It’s crucial to thoroughly understand the risks involved and trade responsibly.

Charles Schwab Options Trading Account

Image: tradingplatforms.com

Conclusion

Embarking on options trading with Charles Schwab can empower you with the tools and resources to navigate the market with confidence. By leveraging Schwab’s advanced platform, educational materials, and expert support, you can gain a deeper understanding of options trading and refine your strategies. Remember, it’s crucial to approach options trading with a disciplined and informed mindset, acknowledging the inherent risks. With careful planning and diligent execution, you can unlock the potential returns that options trading offers.

Are you intrigued by the possibilities of options trading or seeking to elevate your trading skills? Connect with Charles Schwab today to explore tailored solutions that align with your financial goals.