In the bustling world of finance, options trading stands out as a unique and sophisticated investment strategy. Imagine entering a realm where you have the power to leverage potential opportunities and mitigate risks with precision. This blog post will take you on a journey into the fascinating world of option trading, providing you with a comprehensive understanding of its inner workings and empowering you to make informed decisions.

Image: www.pinterest.jp

What is Option Trading?

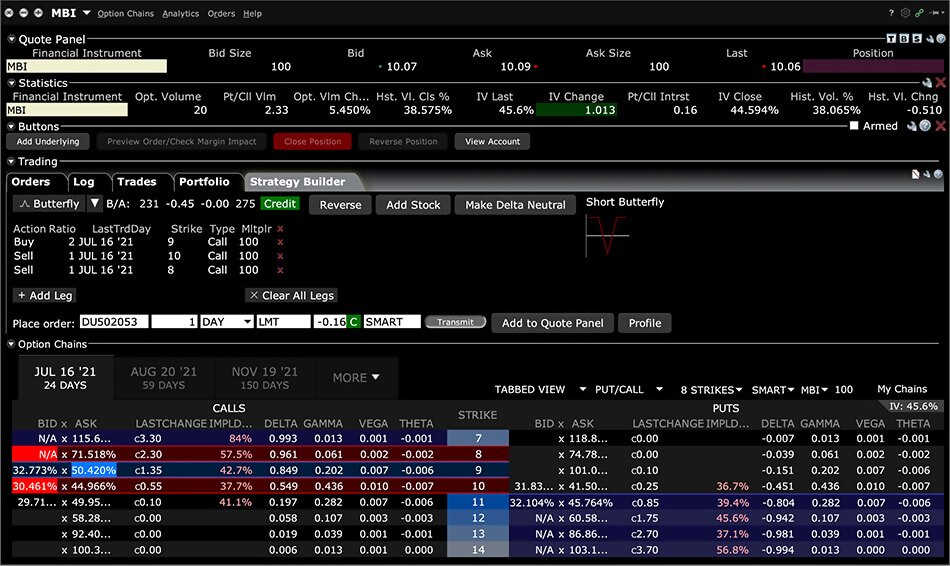

Option trading involves contracts that grant you the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset, such as a stock, index, or commodity, at a specified price on or before a certain date. These contracts act as financial tools that can be used for various purposes, including hedging against price fluctuations, speculating on market movements, and enhancing income.

Understanding Key Concepts

Before delving into the specifics of option trading, we must first grasp some fundamental concepts. Firstly, every option contract has an expiration date, which signifies the final day on which you can exercise your right to buy or sell the underlying asset. Options are also characterized by their strike price, which refers to the specified price at which the contract can be executed.

Types of Options

Options come in two primary forms: call options and put options. Call options provide the right to purchase an asset at a future date, while put options grant the right to sell. Both types can be traded in the market as standardized contracts or customized to meet specific investment objectives.

Image: www.interactivebrokers.com

Understanding Option Premiums

When you purchase an option contract, you pay a premium. This premium represents the price of the contract and is influenced by various factors such as the underlying asset’s price, the time until expiration, and market volatility. The higher the premium, the greater the potential profit or loss.

Leveraging Options Strategies

The beauty of option trading lies in its versatility. It enables investors to employ a wide range of strategies to capitalize on market movements and manage risk. Here are some popular strategies: Buying and selling calls or puts, covered calls and protective puts, and straddles and strangles.

Tips and Expert Advice

To navigate the complexities of option trading successfully, consider the following tips and advice from experienced traders:

- Educate yourself thoroughly: Understand the concepts and mechanics of option trading before investing.

- Manage risk prudently: Always assess your risk tolerance and allocate funds wisely.

- Start with small trades: Begin with smaller trades to develop your skills and confidence.

- Monitor market trends: Stay updated on market news and economic indicators.

- Consider using options for hedging: Protect your existing investments against potential losses.

Frequently Asked Questions

To address common queries, here’s a brief FAQ section:

- Q: Is option trading suitable for beginners?

A: While options trading offers opportunities, it’s recommended for experienced investors due to its complexity and potential risks.

- Q: What are the key factors that affect option pricing?

A: Underlying asset price, time until expiration, and volatility are primary factors influencing option premiums.

- Q: What’s the difference between American and European options?

A: American options can be exercised at any time before expiration, whereas European options can only be exercised at expiration.

How The Option Trading Works

Conclusion

Mastering option trading requires a keen understanding of market dynamics, risk management, and strategic execution. By embracing the insights provided in this comprehensive guide, you can unlock the potential of this fascinating investment avenue. Remember, as with any financial instrument, due diligence and prudent decision-making are paramount to achieve success.

Are you eager to explore the world of option trading further? If so, immerse yourself in the vast array of resources available, engage with experienced traders, and embark on your journey toward informed option trading.