Introduction

Image: www.pinterest.com

Embarking on the exhilarating journey of option spread trading requires a roadmap, a beacon of knowledge to illuminate your path. This comprehensive guide unveils proven option spread trading strategies that have stood the test of time, meticulously crafted by seasoned professionals to maximize your potential. Gain invaluable insights, navigate complexities, and uncover the secrets to successful trading with this unparalleled resource at your fingertips.

Deciphering Option Spread Trading: A Gateway to Financial Empowerment

Option spread trading, a sophisticated yet potent strategy, harnesses the transformative power of options to amplify profit potential while meticulously managing risk. This intricate art involves simultaneously buying and selling different options within the same underlying asset, creating a calculated interplay that unlocks opportunities for substantial returns. By delving into the nuances of option spread trading, investors can transcend the limitations of traditional trading, embracing a world of enhanced possibilities.

Navigating the Labyrinth of Option Spread Strategies

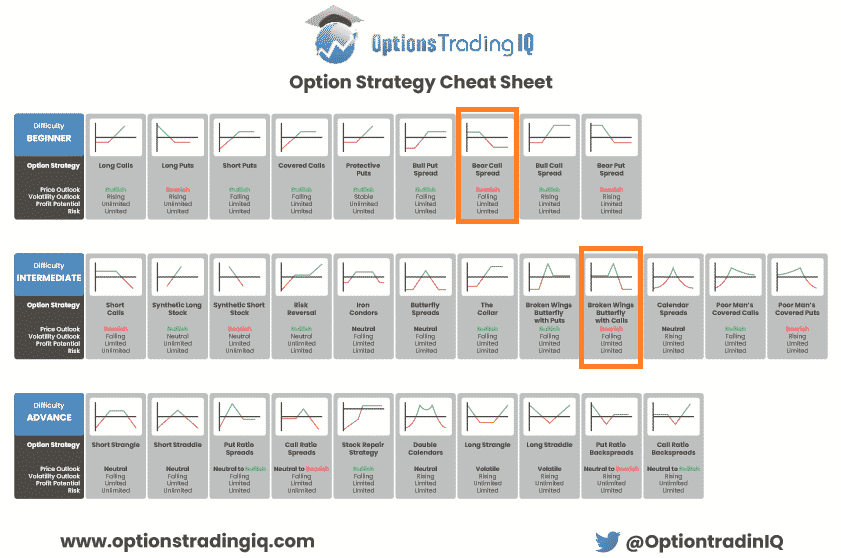

The landscape of option spread trading is a tapestry woven with diverse strategies, each tailored to specific market conditions and risk-reward profiles. Some of the most widely acclaimed and time-tested strategies include:

-

Bull Put Spread: A bullish strategy that anticipates a rise in the underlying asset’s price, involving buying a lower-strike-price put option while simultaneously selling a higher-strike-price put option.

-

Bear Call Spread: A bearish strategy that thrives in falling markets, involving selling a lower-strike-price call option and buying a higher-strike-price call option, capturing potential gains from a decline in asset price.

-

Iron Condor: A neutral strategy that profits from low volatility in the underlying asset, involving selling an at-the-money put spread and an at-the-money call spread with the same expiration date but different strike prices.

-

Butterfly Spread: A bullish or bearish strategy that involves buying one at-the-money option and buying or selling two out-of-the-money options, allowing traders to express directional views while limiting risk.

Expert Insights: Unlocking the Secrets of Option Spread Trading

“Option spread trading is like a symphony, where the interplay of different options creates harmonious melodies of profit.” – Dr. Mark Douglas, Bestselling Author and Trading Psychologist

“Risk management is the cornerstone of successful option spread trading. Carefully calculate potential losses and implement stop orders to safeguard against unforeseen market fluctuations.” – Steve Nison, Technical Analysis Master and Founder of Candlestick Charts

“The key to unlocking the full potential of option spread trading lies in understanding the intricacies of each strategy, its risk-reward profile, and its suitability for specific market conditions.” – Thomas Bulkowski, Renowned Author and Trading Strategist

Conclusion

Option spread trading presents a transformative tool for investors seeking to expand their financial horizons, amplify returns, and navigate market complexities. Armed with the proven strategies outlined in this comprehensive guide and empowered by the wisdom of seasoned experts, you are now poised to embark on a journey of financial enlightenment and success. Embrace the art of option spread trading, unlock its boundless possibilities, and step into a world of limitless investment opportunities.

Image: optionstradingiq.com

Proven Option Spread Trading Strategies Download

Image: tradingtuitions.com