Introduction

In the labyrinthine realm of finance, where fortunes are made and lost, options spread trading emerges as a tantalizing strategy that can unlock boundless opportunities for savvy investors. Whether you’re a seasoned veteran or a novice yearning to venture into the world of options, this comprehensive guide will illuminate the intricacies of spread trading, empowering you to make informed decisions that can lead to financial success.

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-03-762dd3eb350a4e0daffdb7626ffcf6d4.png)

Image: www.investopedia.com

From its inception as a hedging mechanism to its evolution into a versatile tool for both income generation and risk management, options spread trading has left an indelible mark on the investment landscape. By combining the strategic buying and selling of options contracts, investors can harness the power of leverage, enhance their risk-reward profile, and potentially attain substantial returns.

Unveiling the Options Spread Trading Canvas

At the heart of spread trading lies the concept of combining two or more options contracts with identical expiration dates but different strike prices and/or option types to create a customized risk-defined position. This deliberate orchestration opens up a realm of possibilities, enabling investors to tailor their trades to specific market outlooks, manage risk, and pursue strategic investment objectives.

Navigating the Spread Trading Landscape

The world of spread trading encompasses a diverse array of strategies, each with its unique characteristics and risk-reward profile. From the conservative calendar spread, designed to exploit time decay, to the more aggressive bull call spread, which bets on a sustained upward market trajectory, there’s a spread trading strategy suited to every investor’s appetite for risk and return.

Deciphering the Vocabulary of Spread Trading

To fully comprehend the nuances of spread trading, it’s essential to master the lexicon that shapes this dynamic trading arena. Terms like “spread premium,” “long leg,” and “short leg” will become invaluable tools in your quest for investment success.

Armed with this newfound understanding, you’ll be able to dissect complex spread trading strategies with ease, identifying their potential advantages and pitfalls before making any commitments.

![Options Strategies Cheat Sheet [FREE Download] - How to Trade](https://howtotrade.com/wp-content/uploads/2023/02/options-strategy-cheat-sheet-1536x1086.png)

Image: howtotrade.com

Unlocking the Secrets of Successful Spread Trading

As with all endeavors in the pursuit of financial gain, spread trading demands a disciplined and methodical approach. By adhering to proven principles of risk management, conducting thorough market research, and maintaining emotional composure, you can navigate the market’s inevitable ups and downs with greater confidence.

Expert Insights: Navigating the Spread Trading Labyrinth

To further enhance your spread trading prowess, seek guidance from seasoned experts who have navigated the financial markets for years. Their invaluable insights, honed through countless trials and tribulations, can illuminate the path to consistent profitability.

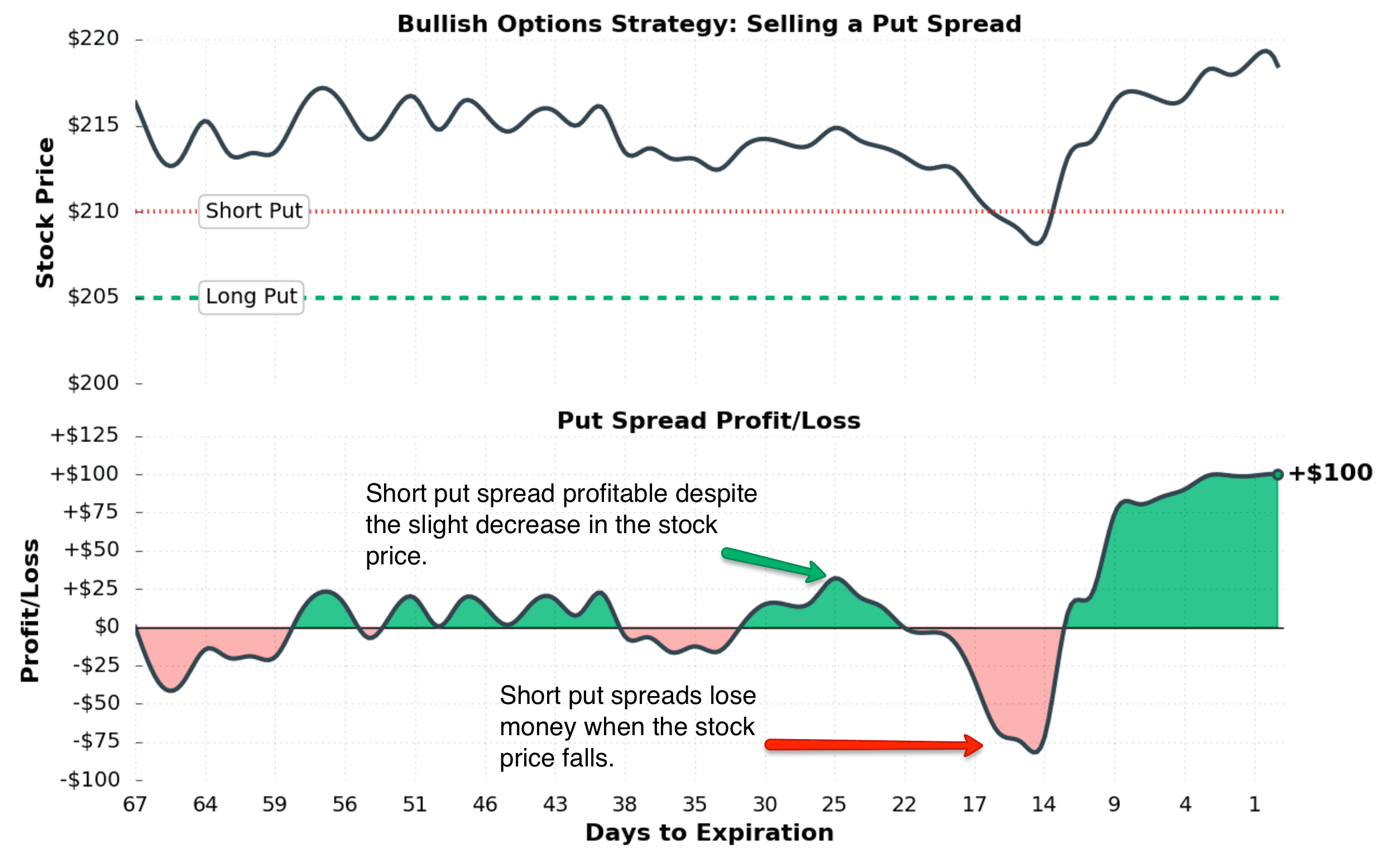

Options Spread Trading Strategies

Image: www.projectoption.com

Embark on Your Spread Trading Odyssey

The world of options spread trading beckons, offering a tantalizing adventure for those willing to embrace its complexities and rewards. With the knowledge and strategies outlined in this comprehensive guide as your compass, you’ll be well-equipped to navigate the ever-evolving financial landscape, potentially unlocking a path to financial freedom and prosperity.