Introduction

In the labyrinthine world of stock trading, options emerge as sophisticated instruments that offer a nuanced approach to investment strategy. Amid this tapestry of financial tools, call options stand out as particularly intriguing vehicles for amplifying potential profits. Understanding what call options entail and how they function is paramount for investors seeking to navigate the intricacies of this dynamic market.

Image: meta-formula.com

This guide delves into the intricacies of call options, meticulously dissecting their definition, mechanism, and role within stock trading. Additionally, we explore the nuances of premium pricing, exercise and assignment processes, and the intricacies of intrinsic and extrinsic value. As we unearth the complexities of call options, readers will gain a comprehensive understanding of this versatile investment instrument.

Demystifying Call Options: Definition and Purpose

At their core, call options confer upon their holders the right, but not the obligation, to acquire a certain number of shares of an underlying stock at a predefined price, known as the strike price. This contract effectively grants the purchaser the privilege of benefiting from a potential increase in the stock’s price.

To illustrate, let’s delve into a scenario. Suppose an investor acquires a call option contract with a strike price of $100 for a particular stock currently trading at $95. This contract grants the holder the option, exercisable at any point before a specified expiration date, to purchase 100 shares at $100 per share. Should the stock’s price soar to $110 before the expiration date, the holder can exercise their right and acquire the shares at the predetermined strike price of $100, netting a profit of $10 per share.

Unveiling Premium Pricing and the Mechanics of Call Options

The price of a call option, commonly referred to as its premium, is influenced by various factors such as the underlying stock’s price, the time remaining until expiration, the volatility of the stock, and the prevailing interest rates. A higher underlying stock price and increased volatility typically command a higher premium. This premium represents the cost the buyer incurs to secure the option contract.

When an investor exercises a call option, they formally request the purchase of the underlying shares at the strike price. It is important to note that exercising is not mandatory, and holders can choose to let the option contract expire worthless if the stock’s price does not rise sufficiently to make exercising profitable.

The Intricacies of Intrinsic and Extrinsic Value

Call options possess two distinct types of value: intrinsic and extrinsic. Intrinsic value represents the profit that can be immediately realized by exercising the option, while extrinsic value reflects the potential for future gains. The intrinsic value of a call option is calculated as the difference between the underlying stock’s price and the strike price. In contrast, extrinsic value encapsulates the premium paid for the option contract and factors in additional elements such as time decay and volatility.

As the expiration date nears, the time value of a call option gradually erodes. This phenomenon is known as time decay. Additionally, lower volatility levels typically result in lower option premiums, as the likelihood of significant price movements diminishes.

Image: sites.psu.edu

Expert Advice and Practical Tips for Navigating Call Options

To enhance your understanding and utilization of call options, consider the following tips:

- Analyze the underlying stock’s fundamentals and historical price movements before purchasing call options.

- Thoroughly research the volatility of the stock and the implied volatility associated with the option contract.

- Determine the appropriate strike price and expiration date based on your investment strategy and risk tolerance.

- Consider utilizing option chains to compare premiums and identify optimal entry points.

- Monitor market conditions and regularly assess the performance of your call option investments.

Remember that investing in options involves inherent risks. Before engaging in option trading, it is crucial to educate yourself thoroughly and proceed with caution.

Frequently Asked Questions about Call Options

To clarify common questions surrounding call options, we present the following Q&A section:

- Q: What is the difference between a call option and a put option?

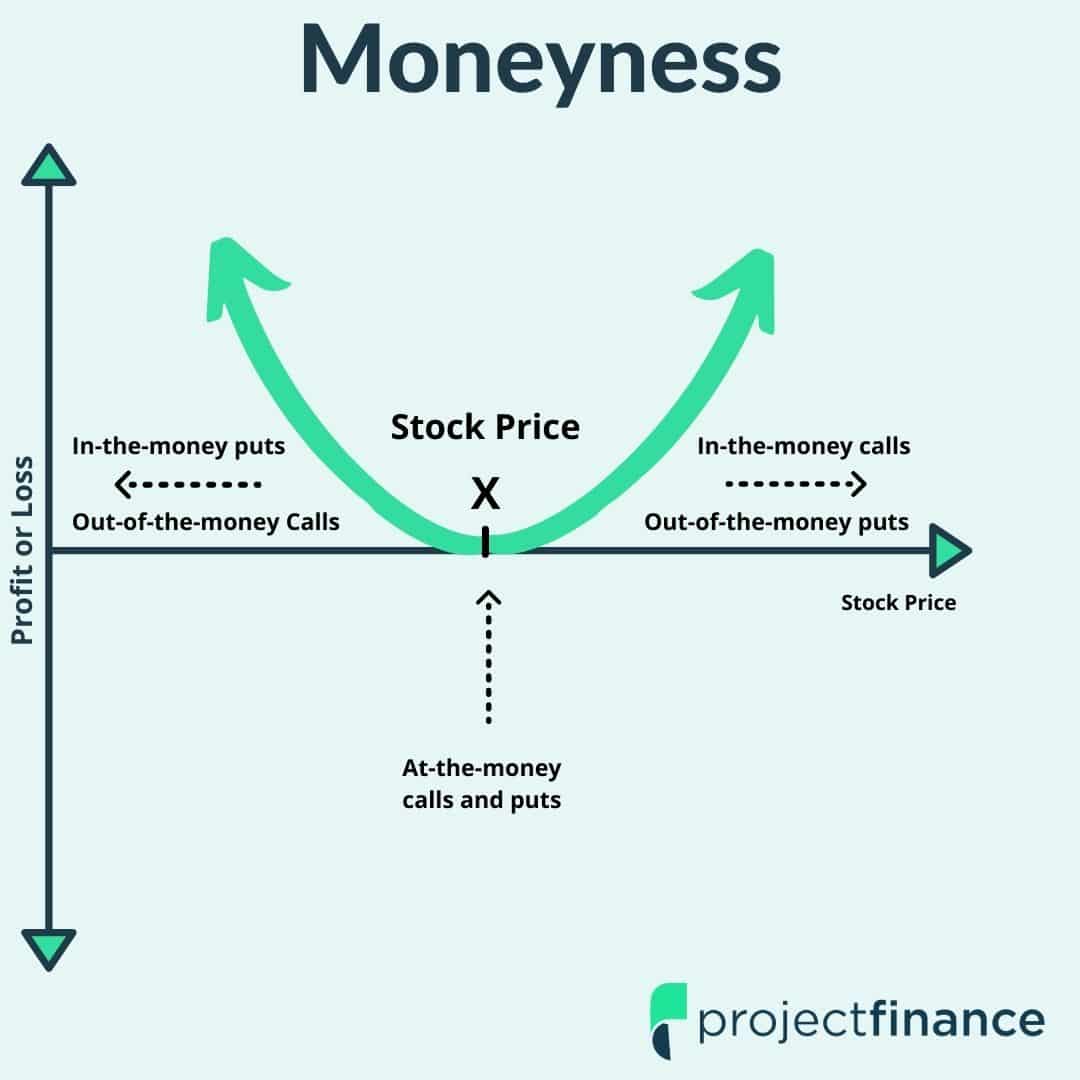

- A: Call options grant the holder the right to buy, while put options provide the right to sell shares of the underlying stock at a specified price.

- Q: When is it advantageous to buy a call option?

- A: Call options are generally purchased when an investor anticipates a rise in the underlying stock’s price.

- Q: What factors determine the premium of a call option?

- A: Premium is influenced by the stock price, volatility, time to expiration, and interest rates.

- Q: What is the difference between exercising and assigning a call option?

- A: Exercising involves the holder requesting the purchase of shares at the strike price. Assigning refers to the brokerage firm’s automatic exercise of an option near its expiration date.

What Is Call Option In Stock Trading

Image: www.projectfinance.com

Conclusion

In conclusion, call options offer investors a versatile tool for speculating on the price movements of underlying stocks. By understanding the mechanisms, pricing, and potential risks associated with call options, investors can harness their benefits and enhance their overall trading strategies. Whether you seek to amplify potential profits or hedge against downside risk, call options provide a powerful instrument for navigating the complexities of the stock market.

Are you intrigued by the world of call options and eager to delve deeper into its intricacies? Join our community of passionate investors and engage in thought-provoking discussions, share insights, and collectively navigate the ever-evolving world of stock trading.