Unveiling the Potential of Call Options: A Gateway to Market Gains

In the realm of financial markets, where opportunity and risk intertwine, call options emerge as a powerful tool for savvy investors. These versatile instruments empower traders to harness the potential of rising stock prices and capitalize on market fluctuations. Understanding the intrinsic workings of call options is paramount for unlocking their profit-making potential while mitigating downside risks. This comprehensive guide will navigate you through the complexities of call options, empowering you to make informed decisions and harness the market’s power.

Image: www.loddonobservatory.org

Defining the Essence of Call Options: A Window to Potential Gains

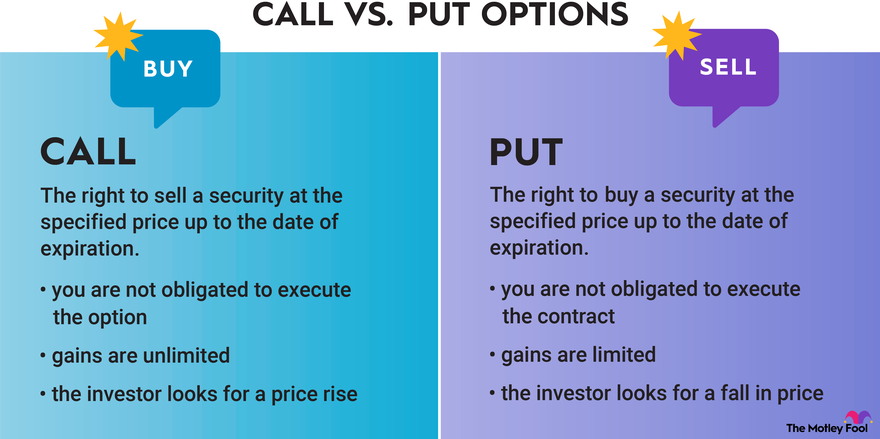

A call option grants the holder the right, but not the obligation, to purchase a specific number of shares of a particular stock at a predetermined price, known as the strike price, on or before a set expiration date. The buyer of a call option is bullish on the stock’s prospects, anticipating its price to rise above the strike price, rendering the option profitable. This anticipation creates a scenario where the potential rewards can outweigh the initial investment. Conversely, the seller of a call option, also known as the option writer, believes the stock price will remain below or rise less than the strike price, making the option worthless.

Exploring the Mechanics of Call Options: Unraveling the Contractual Agreement

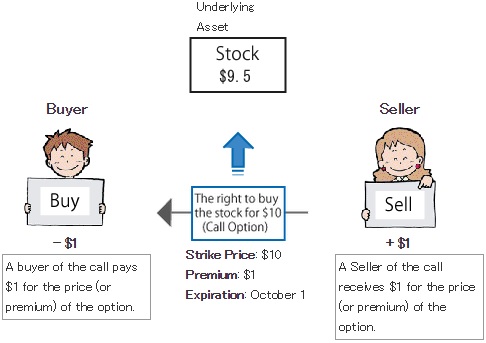

When purchasing a call option, the buyer pays a premium to the seller. This premium represents the price of the right to exercise the option. Should the stock price soar above the strike price, the buyer can exercise the option, obligating the seller to sell the specified number of shares at the predetermined strike price.

The profit potential of a call option is theoretically unlimited, as the stock price has the potential to rise indefinitely. However, the maximum loss is capped at the initial premium paid by the buyer. This limited risk-to-reward ratio makes call options an attractive proposition for traders seeking asymmetric profit potential.

Unveiling the Intrinsic and Time Value of Call Options: A Tale of Two Components

The intrinsic value of a call option is the difference between the stock’s current market price and the strike price. When the stock price is above the strike price, the option holds intrinsic value, reflecting the potential profit if exercised immediately.

However, time also plays a crucial role in the valuation of call options, as the option’s value decays as time passes. This time-sensitive element is known as time value. It compensates the option holder for the remaining period during which the option can be exercised profitably. As the expiration date approaches, the time value dwindles, ultimately reaching zero on the expiration date.

Image: www.fool.com

Navigating the Call Option Market: A Strategic Approach to Success

To maximize the potential of call options, traders must possess a keen understanding of market dynamics and employ strategic trading techniques. Thorough research on the underlying stock, including its historical performance, industry trends, and economic factors, is essential. Additionally, close monitoring of market news, earnings reports, and analyst recommendations can provide valuable insights for making informed trading decisions.

Adequate risk management is paramount in call option trading. Traders must carefully consider their risk tolerance and invest only what they can afford to lose. Proper position sizing, utilizing stop-loss orders, and employing hedging strategies can help mitigate potential losses and preserve capital.

Harnessing Call Options for Profit: A Step-by-Step Guide

-

Identify the target stock: Research and select a stock that exhibits potential for price appreciation.

-

Determine the strike price: Analyze the stock’s current market price and historical volatility to choose an appropriate strike price that aligns with your profit expectations.

-

Calculate the option premium: The option premium is determined by factors like intrinsic value, time to expiration, volatility, and interest rates. Consult option pricing models or online tools for accurate premium calculations.

-

Place the trade: Enter the call option order, specifying the number of contracts, strike price, expiration date, and order type.

-

Monitor the position: Continuously track the stock’s price and option’s performance. Make adjustments as needed, such as adjusting strike prices or closing positions, to optimize profitability and manage risk.

What Is Call In Option Trading

Image: www.option-dojo.com

Conclusion: Unlocking the Potential of Call Options

Call options offer a powerful tool for investors seeking to capitalize on rising stock prices. By understanding the intricacies of these instruments and employing strategic trading techniques, traders can harness the potential of call options to generate substantial returns. However, it is imperative to approach call option trading with a well-rounded understanding of the risks involved and adopt a prudent risk management approach. With meticulous research, informed decision-making, and appropriate risk management, call options can serve as a potent addition to any investment portfolio. So, embrace the world of call options with confidence, reap the rewards, and elevate your path to financial success.