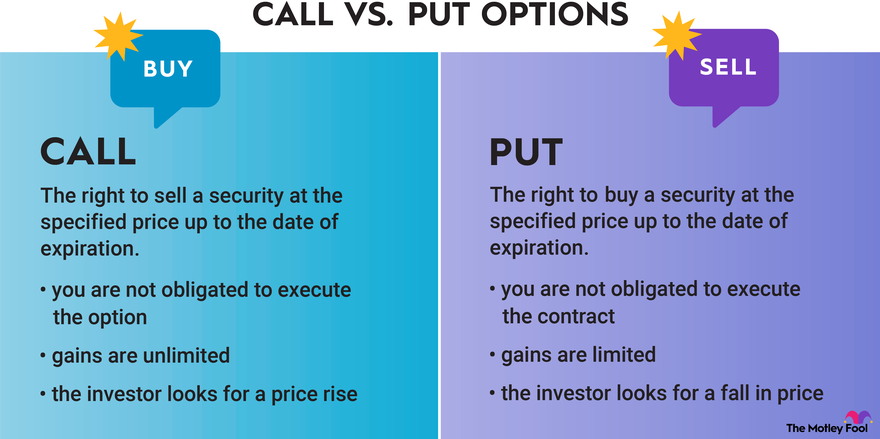

Defining the Call Option

Image: www.pinterest.com

In the vibrant realm of financial markets, options emerge as versatile instruments that bestow upon traders a plethora of opportunities. Among these prized derivatives, call options stand out as a potent weapon in the arsenal of astute investors. A call option grants the buyer the right, but not the obligation, to purchase an underlying asset at a predetermined price, known as the strike price, by a specific date, the expiration date. By leveraging call options, traders can capitalize on the potential appreciation of an asset, augment their returns, or hedge against downside risks.

Unveiling the Call Option Strategy

The allure of call options lies in their ability to magnify the potential returns from an underlying asset’s price increase. When the price of the underlying asset ascends above the strike price, the call option gains intrinsic value, which translates into substantial profits for the option holder. However, if the underlying asset’s price languishes below the strike price, the call option will expire worthless, and the premium paid for acquiring the option will be forfeited. Traders can craft sophisticated strategies by combining multiple call options with different strike prices and expiration dates, customizing their exposure to risk and reward.

Navigating the Call Option Market

To harness the power of call options, it is imperative to understand the intricate dynamics of the options market. The value of an option is determined by an array of factors, including the underlying asset’s price, the time remaining until expiration, the volatility of the underlying asset, and the prevailing interest rates. By meticulously assessing these factors, traders can identify opportune moments to initiate or liquidate call option positions, maximizing their chances of success.

Real-World Applications of Call Options

The versatility of call options extends beyond mere speculation. Traders deploy these financial tools for an array of strategic objectives, including leveraging growth opportunities, hedging portfolios, and generating income through option premiums. For instance, an investor bullish about a particular stock can utilize call options to amplify their potential returns if the stock’s price surges. Conversely, a portfolio manager seeking to protect against market downturns might employ call options as a defensive measure.

Contemporary Trends and Developments

The world of options trading is constantly evolving, driven by technological advancements and changing market dynamics. The rise of electronic trading platforms has facilitated increased liquidity and reduced transaction costs, making call options more accessible to a wider audience. Additionally, the development of exchange-traded funds (ETFs) and other structured products that incorporate call options has broadened the investment landscape, providing investors with innovative ways to access the options market.

Conclusion: Unleashing the Power of Call Options

Call options offer a potent tool for investors seeking to navigate the financial markets with precision and purpose. By comprehending the intricacies of call option trading, traders can harness their inherent potential to enhance returns, mitigate risks, and unlock new investment horizons. Whether embarking on speculative ventures or devising sophisticated hedging strategies, call options remain an indispensable element in the arsenal of savvy investors, empowering them to seize opportunities and weather market turbulence. As the financial landscape continues to evolve, embracing a comprehensive understanding of call options will prove invaluable for those seeking to prosper in the dynamic world of investing.

Image: www.fool.com

Call In Option Trading

Image: www.loddonobservatory.org