The labyrinth of financial markets offers a myriad of investment avenues, each with its own set of risks and rewards. Among these, options trading stands out as a potent tool for discerning investors seeking to amplify their gains or hedge their portfolios. Call and put options, the foundational pillars of options trading, empower traders to navigate market volatility and capitalize on both rising and falling asset prices.

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-02_2-6804019b335144f5b3cd32ffae8dae2b.png)

Image: www.investopedia.com

Delving into Call Options: A Call to Profit

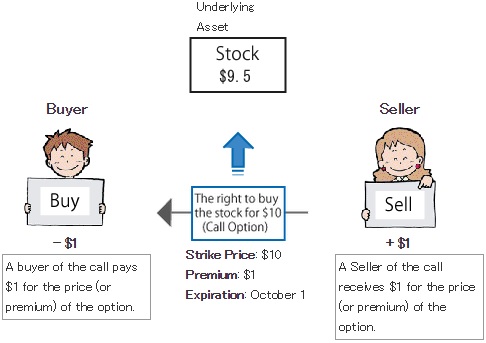

A call option, aptly named, grants the buyer the right, but not the obligation, to purchase a specified asset (underlying) at a predetermined price (strike price) on or before a specified date (expiration date). By acquiring a call option, the buyer anticipates that the underlying asset’s price will ascend, enabling them to exercise their right to purchase it at a lower price than the market dictates.

The intrinsic value of a call option emanates from the difference between the strike price and the current market price of the underlying asset. When the market price surpasses the strike price, the call option gains “in the money” status, signaling the potential for profit. However, should the market price languish below the strike price, the call option remains “out of the money,” rendering it worthless upon expiration.

Unveiling Put Options: A Haven from Declines

Put options, the antithesis of call options, bestow upon the buyer the right, not the obligation, to sell a specified asset at a predetermined price on or before a specified date. The allure of put options lies in their ability to act as a hedge against market downturns. By acquiring a put option, the buyer hedges against potential losses in the underlying asset’s value.

The intrinsic value of a put option stems from the chasm between the strike price and the current market price of the underlying asset. In a declining market, when the market price diminishes below the strike price, the put option assumes “in the money” status, indicating the potential for profit. However, if the market price remains above the strike price, the put option remains “out of the money,” ultimately expiring without value.

Navigating the Nuances of Call and Put Options

The judicious implementation of call and put options demands a thorough understanding of the factors that influence their value. Key considerations include:

- Underlying asset price: The intrinsic value of both call and put options is directly influenced by the market price of the underlying asset.

- Strike price: The predetermined price at which the buyer can purchase (call option) or sell (put option) the underlying asset.

- Time to expiration: The impending expiration date influences the value of options, with options expiring sooner commanding a higher premium.

- Interest rates: Fluctuations in interest rates impact the cost of carry for option traders, directly affecting option premiums.

- Volatility: The market’s expected volatility, gauged by the implied volatility, significantly influences option pricing.

Image: ubawyzo.web.fc2.com

Expert Insights and Prudent Advice

Tapping into the collective wisdom of market pundits and experienced traders can illuminate the complexities of call and put option trading. Here are some invaluable tips:

- Define your objectives: Envision your investment goals and tailor your option strategy accordingly.

- Research thoroughly: Unravel the complexities of the underlying asset, potential risks, and market trends.

- Measure your risk tolerance: Assess your financial capacity to withstand potential losses, shaping your trading strategies around this understanding.

- Manage your emotions: Market volatility can evoke anxiety, but it’s imperative to remain rational and avoid making impulsive decisions.

- Consult with a financial advisor: If the complexities of options trading seem daunting, consider seeking guidance from a qualified professional.

Frequently Asked Questions

Q: What’s the difference between a call and put option?

A: A call option gives you the right to buy, while a put option grants you the right to sell an asset at a specific price on or before a certain date.

Q: When should I buy a call option?

A: When you expect the underlying asset’s price to rise.

Q: What happens if the price of the underlying asset falls when I have a call option?

A: The call option will expire worthless.

Call And Put Option Trading Strategies

Conclusion

Call and put option trading strategies offer a potent arsenal for investors seeking to capitalize on market movements or safeguard against potential losses. By understanding the intricacies of these instruments and embracing prudent trading practices, you can harness the power of options to enhance your financial prowess. Ask yourself, are you ready to navigate the captivating world of call and put options?