Navigating the complex world of option trading requires a deep understanding of various concepts, one of which is the expiry date. Oftentimes, I encounter traders who overlook the significance of expiry dates, leading to costly mistakes. In this comprehensive article, we’ll delve into the intricate details of option trading expiry dates, equipping you with the knowledge and strategies to maximize your trading potential.

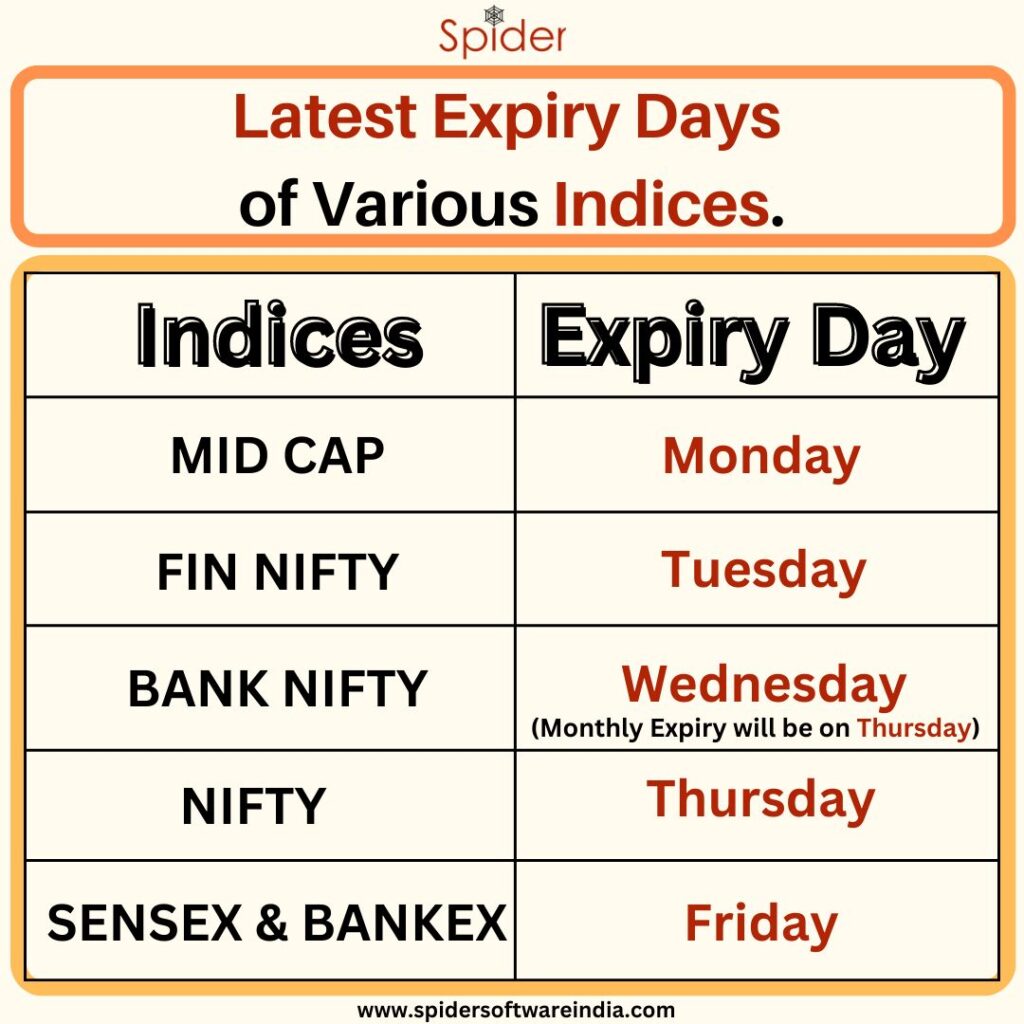

Image: www.spidersoftwareindia.com

Understanding the basics is essential. An option contract, unlike stocks or bonds, has a fixed lifespan. This lifespan is determined by its expiry date, which signifies the last day on which the option can be exercised. Options that are not exercised prior to their expiry date expire worthless, resulting in a total loss of the premium paid for the contract.

When Expiration Matters

The impact of option expiry dates extends beyond mere contract termination. As the expiration date approaches, several factors come into play, each influencing the option’s value and trading strategy.

- Time decay: As the option approaches its expiry date, its value due to time decay reduces. This occurs due to a decrease in the amount of time left to exercise the option, resulting in a decline in its intrinsic value.

- Volatility impact: The option’s value, especially for short-term options, is heavily influenced by the underlying asset’s volatility. As the expiry date looms, the option’s sensitivity to volatility fluctuations magnifies.

- Premium erosion: The time value component of an option’s premium erodes rapidly as the expiration date nears. This implies that the option’s price will decay significantly in the lead-up to expiration.

Strategies for Success

Recognizing the significance of expiry dates enables you to employ strategic approaches to enhance your option trading outcomes. These techniques, if executed with precision, can mitigate risks and maximize gains.

- Match expiry to trading goals: Determine the expiry date that aligns best with your trading strategy and investment horizon. Short-term traders typically opt for shorter-term options, while long-term investors may consider contracts with longer expiries.

- Monitor market volatility: Keep a close watch on the underlying asset’s volatility as the expiration date nears. Adjust your trading strategy accordingly, considering the impact of volatility on option values.

- Sell options before expiry: Consider selling your option contracts prior to their expiry to capture the remaining premium value, especially if the option is unlikely to be exercised. This strategy locks in profits and mitigates the risk of losing the entire investment.

FAQs on Option Trading Expiry Dates

- Q: What happens if I hold an option past its expiry date?

A: The option will expire worthless, and you will lose the entire premium paid for the contract.

- Q: How do I determine the best expiry date for an option contract?

A: Consider your trading goals, market conditions, and the underlying asset’s price and volatility.

- Q: Can I extend an option’s expiry date?

A: Yes, you can roll over your option to a later expiry date by buying a new option with a later expiry while selling the existing option.

Image: www.youtube.com

Option Trading Expiry Date

https://youtube.com/watch?v=UypIt_wa4Qo

Conclusion

Understanding option trading expiry dates is a cornerstone of successful trading. By appreciating the impact of time decay, volatility, and premium erosion, you gain the ability to employ strategies that optimize your trades and minimize risks. Remember, thorough research, sound decision-making, and the willingness to adapt to changing market conditions will empower you to navigate the intricate world of option trading with increased confidence and potential for success.

As you embark on your option trading journey, I encourage you to continue exploring this topic. Delve deeper into the nuances of expiry dates, seek expert advice, and stay informed about the latest market trends. By doing so, you will enhance your knowledge and refine your trading strategies, unlocking the full potential of option trading.