Introduction

In the realm of financial markets, options trading stands out as a sophisticated strategy capable of unlocking substantial returns. India, a rapidly expanding economic powerhouse, offers a thriving options market brimming with opportunities. However, navigating the intricacies of option trading requires a well-crafted strategy. This article delves into the fundamentals of option trading, empowering aspiring investors in India with the knowledge and strategies to capitalize on this dynamic market.

Image: equityblues.com

Decoding Option Basics

An option is a financial contract that grants the buyer the right, but not the obligation, to buy (in the case of a call option) or sell (put option) an underlying asset at a predetermined price (strike price) on a specific date (expiration date). Options provide flexibility, allowing investors to speculate on price movements or hedge against potential losses.

Types of Options

Call Option: Grants the buyer the right to buy the underlying asset at the strike price on or before the expiration date, allowing them to profit from a potential price increase.

Put Option: Grants the buyer the right to sell the underlying asset at the strike price on or before the expiration date, enabling them to profit from a potential price decline.

Key Factors in Option Pricing

The value of an option is influenced by several factors:

- Underlying asset price

- Strike price

- Time to expiration

- Interest rates

Image: www.pinterest.com

Option Trading Strategies

A plethora of option trading strategies cater to diverse investment goals:

Bullish Strategies: Designed to profit from rising asset prices (e.g., Bull Call Spread, Covered Call).

Bearish Strategies: Designed to profit from falling asset prices (e.g., Bear Put Spread, Cash-Secured Put).

Neutral Strategies: Designed to generate returns from market volatility (e.g., Iron Condor, Strangle).

Risk Management

Understanding and managing risk is paramount in option trading. Strategies such as stop-loss orders, position sizing, and hedging are essential for mitigating potential losses.

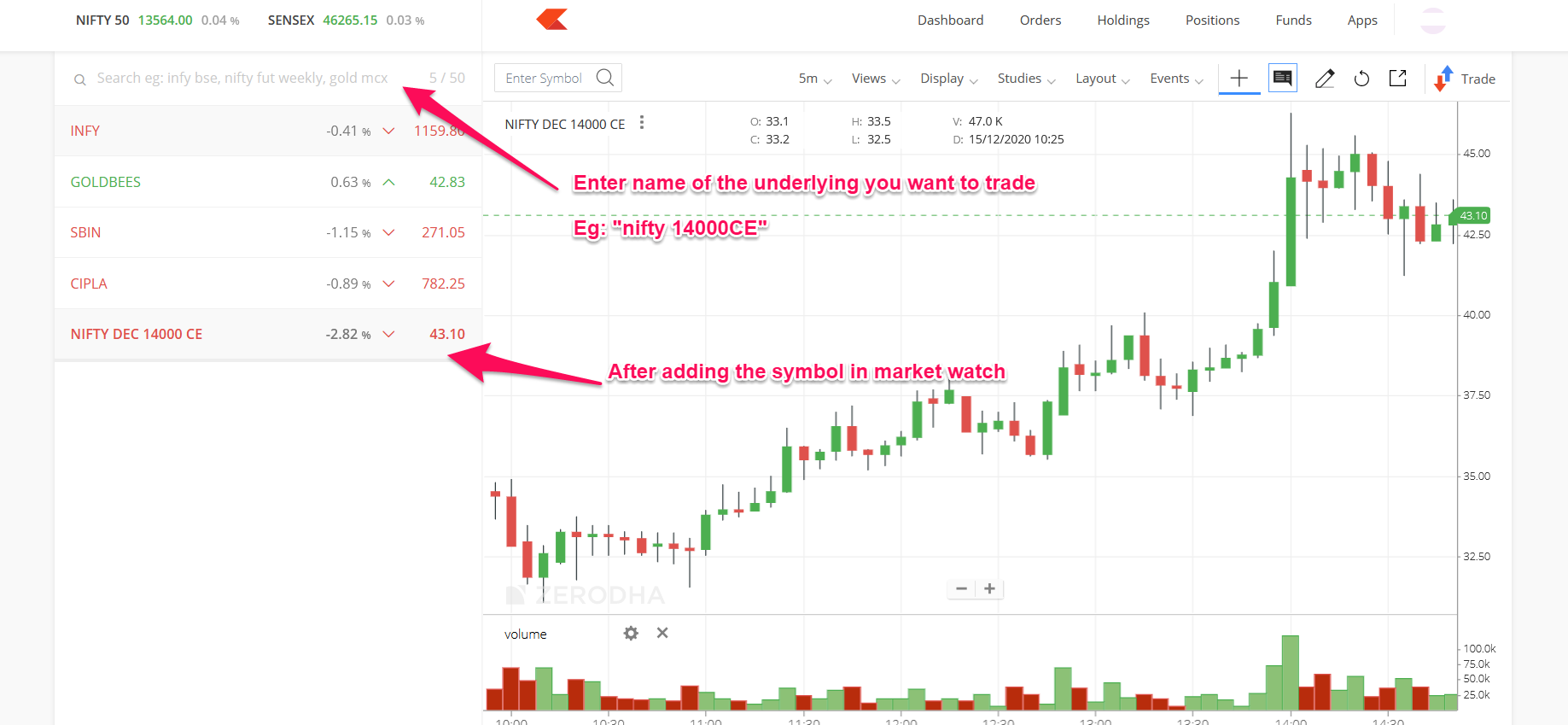

Option Trading Strategy India

Image: www.investopedia.com

Conclusion

Option trading in India offers immense potential for enhanced returns. By equipping themselves with the knowledge outlined in this article, investors can navigate the nuances of the options market and develop effective strategies. Remember, thorough research, prudent risk management, and a disciplined approach can help you reap the rewards of option trading in India.