Step into the fast-paced world of FTSE 100 options trading, where savvy investors unlock opportunities amidst market volatility. Understanding the intricate dance of trading hours is crucial for maximizing your returns. Join us on an enlightening journey as we delve into the intricacies of the FTSE 100 options trading schedule, empowering you to navigate the complexities with confidence.

Image: www.businessinsider.sg

FTSE 100 Options: A Winning Edge in Market Navigation

The FTSE 100 index, a barometer of the UK’s blue-chip companies, provides a vibrant playground for options traders. Options, versatile instruments that convey the right but not the obligation to buy or sell an underlying asset, offer both profit and risk management tools. Mastering the nuances of FTSE 100 options trading hours will elevate your strategic prowess and set you on the path to financial success.

Navigating the Trading Timeframe: A Journey Through Market Hours

FTSE 100 options trading hours align with the vibrant heartbeat of the London Stock Exchange (LSE). Traders can seize opportunities from 8:00 AM to 4:30 PM, UK time, on weekdays. This extended trading window allows ample time to analyze market trends, adjust strategies, and execute trades.

Market Holidays: Intermissions in the Trading Symphony

As with all financial markets, the FTSE 100 options market observes public holidays. These designated rest periods provide an opportunity to pause and reassess before the market reopens, brimming with fresh momentum. By staying abreast of holiday schedules, traders can avoid any unwelcome surprises that could disrupt their trading plans.

Image: fx-cambodia.blogspot.com

Trading Hours Symphony: A Global Perspective

For global investors, understanding the interplay between FTSE 100 options trading hours and their local time zones is essential. The table below provides a comprehensive overview of trading hours in different regions, ensuring you can align your strategies with the market’s rhythm:

| Region | Trading Hours (Local Time) |

|---|---|

| United Kingdom | 8:00 AM – 4:30 PM |

| United States (Eastern Time) | 3:00 AM – 11:30 AM |

| India (Indian Standard Time) | 12:30 PM – 8:00 PM |

| Australia (Sydney Time) | 10:00 PM – 6:30 AM (Following day) |

Harnessing the Power of After-Hours Trading

While the primary trading hours offer ample opportunities, some platforms extend trading into the after-hours session, creating additional avenues for savvy traders. This extended window, typically from 4:30 PM to 8:00 PM (UK time), enables investors to react to late-breaking news or capitalize on price movements that occur outside regular trading hours.

Know Your Options: Mastering the Nuances

The FTSE 100 options market offers a diverse range of options types, each catering to specific trading strategies. Call options grant the right to buy an underlying asset at a predetermined price (strike price), while put options convey the right to sell. Understanding these fundamental principles will empower you to tailor your trading strategies to suit your risk appetite and profit goals.

Market Holidays: A Time for Reflection and Strategy Refinement

Market holidays are not merely days of respite but also opportunities for traders to reassess their strategies, conduct in-depth research, and prepare for the upcoming trading sessions. By taking advantage of these intermissions, you can emerge from the break with renewed focus and a refined approach, ready to navigate the market’s ever-changing landscape with aplomb.

Time Zone Considerations: Trading Across Borders

Understanding the impact of time zones on FTSE 100 options trading hours is crucial for international investors. By aligning your trading schedule with the market’s operating hours, you can minimize the risk of missed opportunities and ensure timely execution of your trades.

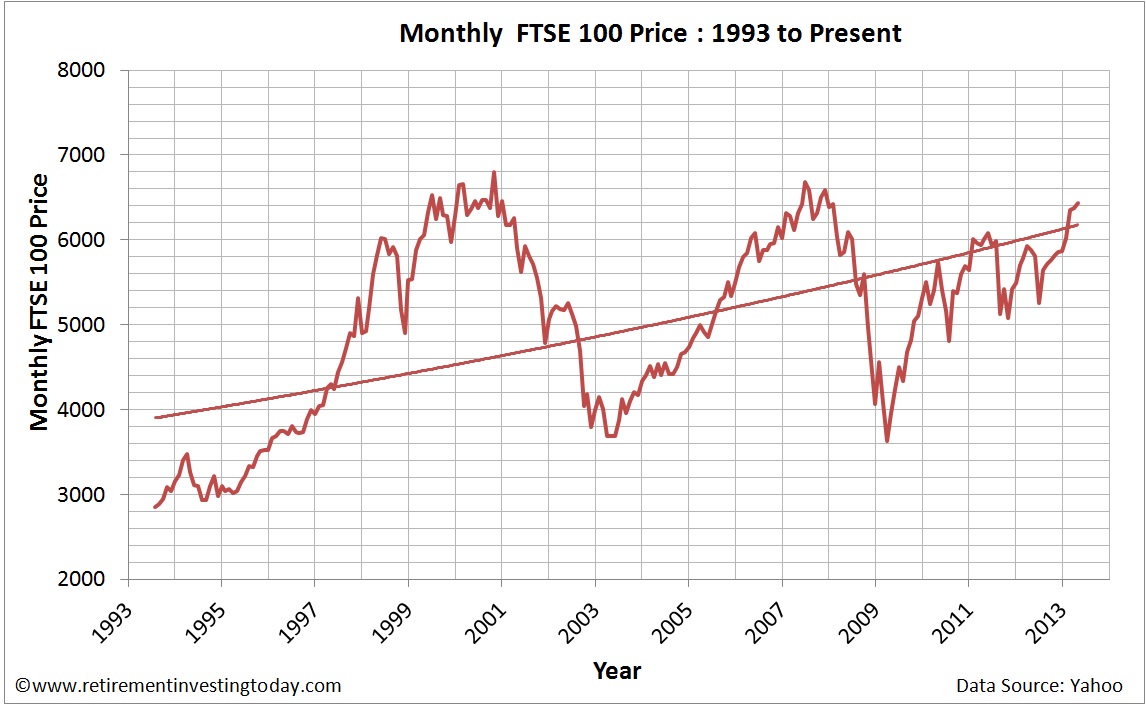

Ftse 100 Options Trading Hours

Image: www.retirementinvestingtoday.com

Conclusion: Embracing Success in the FTSE 100 Options Market

Mastering the intricacies of FTSE 100 options trading hours is a cornerstone of success in this dynamic market. By understanding the market’s rhythm, leveraging after-hours trading opportunities, and navigating time zone differences seamlessly, you can unlock the full potential of this versatile financial instrument. The journey to financial empowerment begins with knowledge, and this comprehensive guide has equipped you with the tools to conquer the FTSE 100 options market with confidence.