Embarking on the FTSE Options Trading Journey

The financial realm encompasses a vast array of investment opportunities, each holding unique advantages and complexities. Among these, options trading presents a captivating allure, enabling traders to leverage the dynamics of the stock market to their advantage. For those venturing into the FTSE options arena, a thorough comprehension of trading hours proves essential.

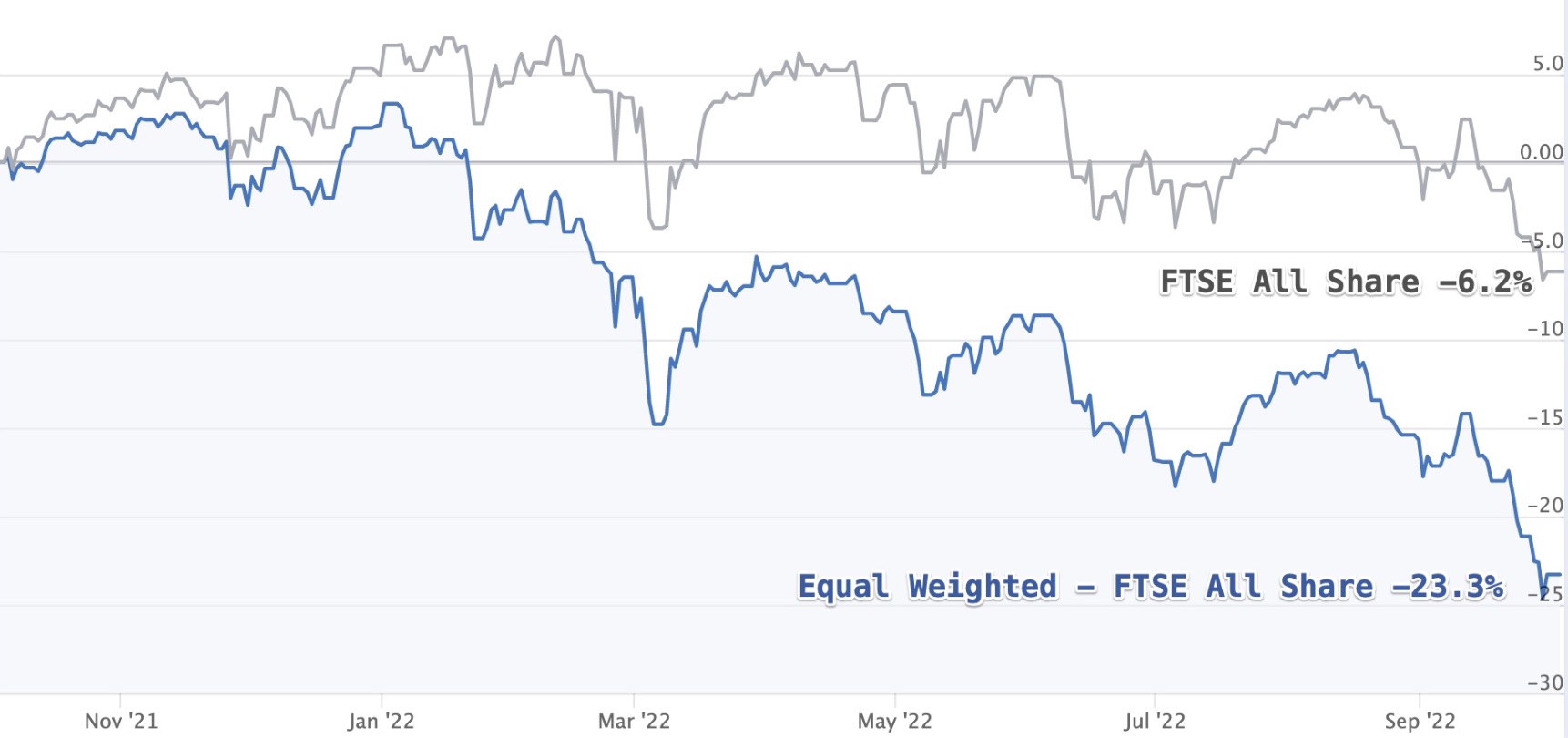

Image: www.stockopedia.com

Navigating FTSE Options Trading Hours

FTSE options, derived from the FTSE 100 Index, offer investors exposure to the performance of the UK’s leading 100 companies. Understanding the trading hours for these derivatives is crucial for executing well-timed strategies. The FTSE options market typically operates during the following hours:

- Opening: 8:00 AM GMT

- Closing: 4:30 PM GMT

These hours align with the regular trading hours of the underlying FTSE 100 Index. However, it’s important to note that extended trading sessions may be available through certain brokers, allowing traders to access the market outside these standard hours.

Understanding the Impact of Trading Hours

The designated trading hours not only establish the permissible timeframe for executing trades but also influence the market dynamics. During the opening hours, the market typically exhibits higher liquidity and trading volume due to increased participation. As the closing hours approach, liquidity may diminish, leading to potentially wider bid-ask spreads and reduced trading activity.

Traders should consider the impact of trading hours when formulating their trading strategies. By aligning their trades with periods of higher liquidity, they can potentially improve execution prices and minimize slippage. Additionally, understanding the closing hours is vital to avoid the risk of open positions being liquidated at unfavorable prices.

Unlocking the Potential of FTSE Options Trading

FTSE options provide traders with an array of possibilities for navigating market movements. These derivatives allow for both bullish and bearish strategies, enabling investors to speculate on the future direction of the FTSE 100 Index. By leveraging options with varying strike prices and expiration dates, traders can tailor their positions to align with their specific market outlook and risk tolerance.

Moreover, FTSE options can serve as a valuable risk management tool. They allow traders to hedge existing positions, protecting against potential losses in the event of adverse market movements. Additionally, options can be employed to generate income through strategies such as covered calls and cash-secured puts.

Image: tradingdiary.incrediblecharts.com

Expert Insights and Trading Tips

Harnessing the expertise of experienced traders can significantly enhance your FTSE options trading endeavors. Here are some valuable tips to consider:

- Monitor Market Trends: Stay abreast of economic data, company announcements, and geopolitical events that may influence the FTSE 100 Index.

- Choose Appropriate Options: Carefully select options that align with your market outlook and risk tolerance. Consider factors such as strike price, expiration date, and implied volatility.

- Manage Risk: Utilize stop-loss orders and position sizing techniques to manage your risk exposure and protect your capital.

- Seek Professional Advice: If necessary, consult with a financial advisor or experienced options trader to gain personalized guidance and insights.

Frequently Asked Questions (FAQs) on FTSE Options Trading

Q: What is the minimum amount required to trade FTSE options?

A: The minimum investment amount varies depending on the broker and the specific option contract.

Q: Are FTSE options available for shorting?

A: Yes, FTSE options can be sold short to profit from a decline in the underlying index.

Q: How do I determine the profitability of FTSE options?

A: The profitability of an options trade is influenced by factors such as the market price of the underlying asset, the option’s strike price, the time remaining until expiration, and the implied volatility.

Ftse Options Trading Hours

Image: www.ig.com

Embracing the FTSE Options Opportunity

FTSE options trading presents a fertile landscape for investors seeking to capitalize on the dynamics of the UK stock market. By navigating trading hours strategically, leveraging the insights of experts, and employing sound risk management practices, traders can harness the potential of these derivatives to pursue their financial objectives.

Embark on your FTSE options trading journey today and unlock the opportunity to forge a path towards financial success.