A Beginner’s Journey into the World of Derivatives

Imagine a world where you can potentially profit from the fluctuations of stock prices without owning the actual stocks. In the realm of options trading, this tantalizing possibility becomes a reality. As a novice in this domain, I embarked on a quest to unravel the enigmatic concepts of call and put options.

Image: pediaa.com

Defining Options and Their Role in Trading

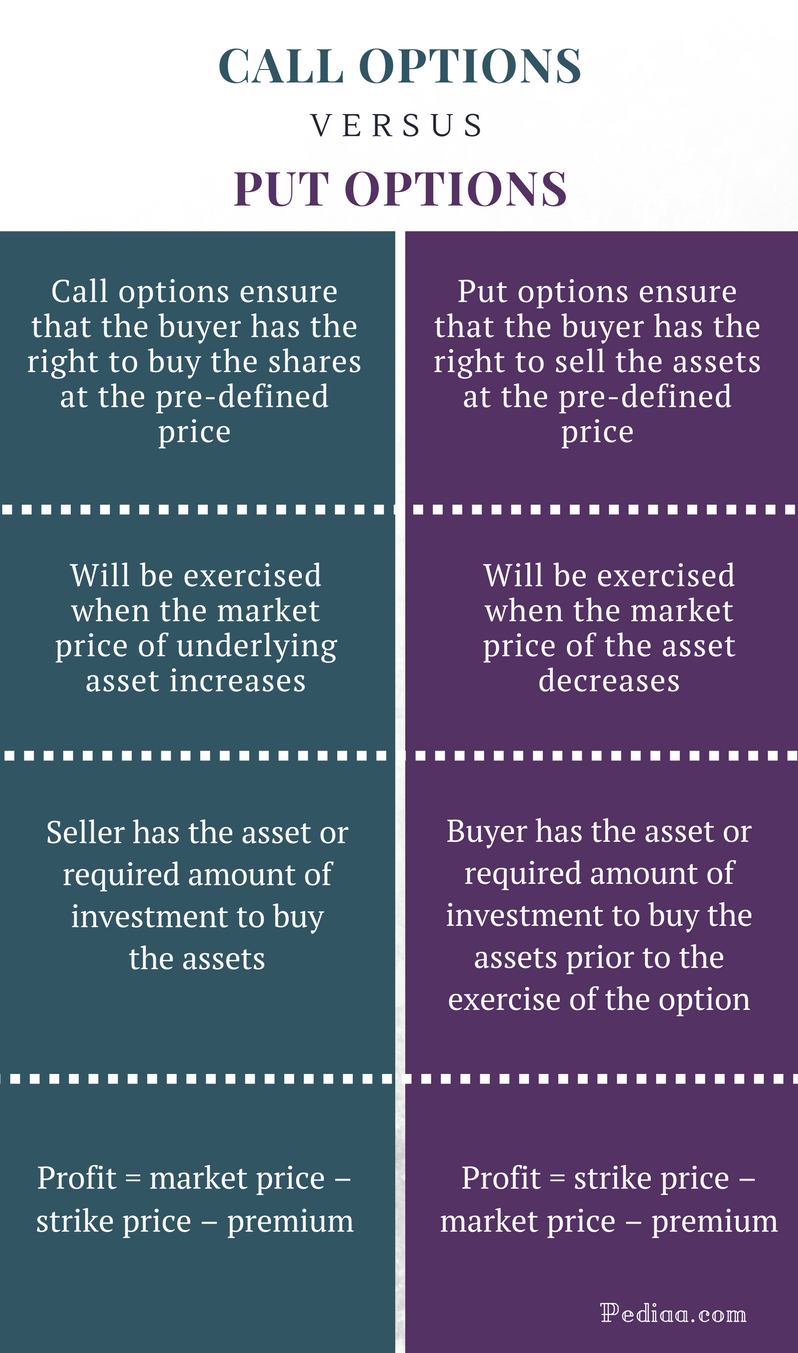

An option, simply put, grants you the right, not the obligation, to buy (call) or sell (put) an underlying asset, such as a stock, at a predefined price (strike price) on or before a specific date (expiration date). This flexibility offers traders a versatile tool for managing risk and enhancing returns.

Call Options: Betting on Stock Price Appreciation

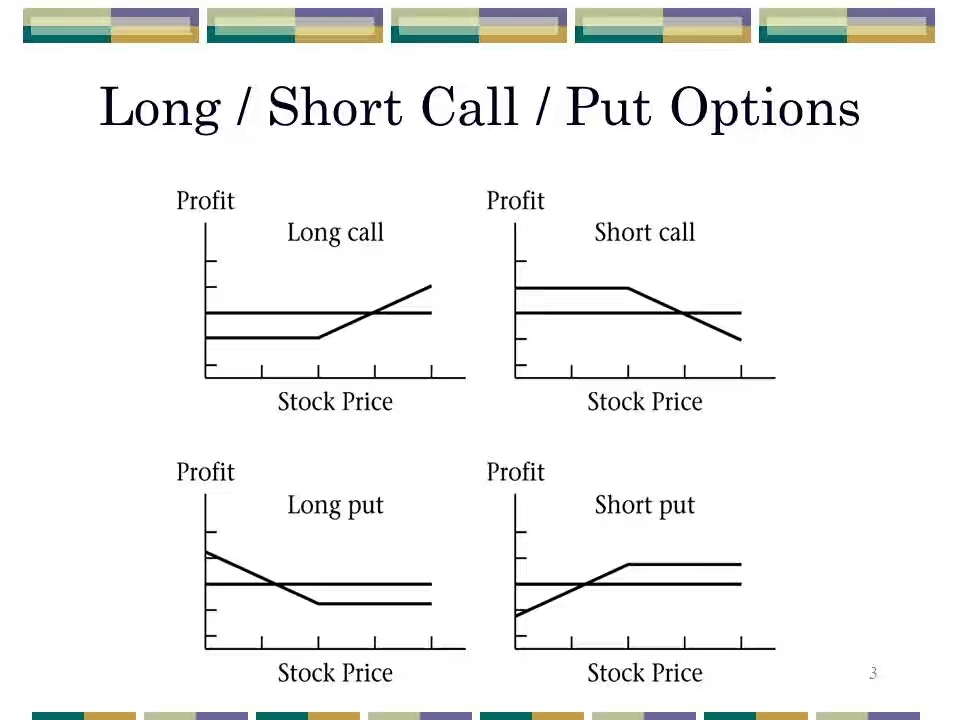

A call option empowers you with the privilege of purchasing a stock at a future date for a predetermined price. When you anticipate a stock’s value to soar, acquiring a call option becomes a shrewd strategy.

As the stock’s price climbs above the strike price, your potential profits multiply. However, if the stock underperforms, the maximum loss is limited to the premium you paid for the option, safeguarding you from catastrophic setbacks.

Put Options: Hedging Against Market Downturns

Conversely, a put option grants you the right to sell a stock at a specified price in the future. This option shines when the market outlook is bearish, and you foresee a stock’s value plummeting.

By exercising your put option, you can sell the stock at a price higher than its current market value, effectively capping your losses. Unlike call options, the disadvantage here is that your potential profits are capped at the difference between the strike price and the stock’s prevailing price when you sell.

Image: www.ispag.org

Navigating the Option Trading Landscape

To harness the full potential of options trading, it is imperative to comprehend the multitude of factors that influence option pricing. Market volatility, time to expiration, risk-free interest rates, and the underlying stock’s price all play a pivotal role.

Delving into forums and social media platforms can provide invaluable insights and help you stay abreast of the latest trends and developments in the ever-evolving world of options trading.

Tips to Uplift Your Options Trading Strategy

Enrich your options trading acumen by adhering to these expert-backed tips:

- Meticulously Research: Conduct thorough due diligence on the underlying stock and the options market to make informed decisions.

- Manage Risk: Employ appropriate risk management techniques, such as stop-loss orders and diversification, to mitigate potential losses.

Delving into the Reasoning Behind Expert Advice

The significance of thorough research cannot be overstated in options trading. By meticulously analyzing the historical performance of the underlying stock, market trends, and option pricing models, you can make educated forecasts and enhance your chances of success.

Risk management is paramount to safeguard your capital and prevent substantial losses. Implementing stop-loss orders helps you exit positions when predetermined thresholds are breached, while diversification enables you to spread your investments across multiple stocks, reducing your exposure to isolated market fluctuations.

Unveiling the Questions that Linger

Q: What are the advantages of options trading compared to traditional stock investing?

A: Options trading offers greater flexibility and risk management capabilities. You can profit from both rising and falling stock prices and tailor your strategies to suit your risk tolerance.

Q: How do I determine the profitability of an options trade?

A: Evaluating option profitability requires considering the option’s premium, strike price, expiration date, underlying stock price, and market volatility. Profitability materializes when the change in the underlying stock’s price exceeds the premium paid for the option.

Q: What are some common beginner mistakes in options trading?

A: Falling into the trap of over-trading, neglecting risk management, and succumbing to emotional trading are common pitfalls that can hinder profitability. Disciplined trading and a solid understanding of options mechanics are crucial for success.

Option Trading Call And Put Meaning

https://youtube.com/watch?v=Mh_8feR85_g

Conclusion: Embracing the Power of Options Trading

Navigating the intricacies of option trading may initially seem daunting, but with patience, dedication, and a thirst for knowledge, you can unlock its potential to bolster your investment strategies.

Understanding the concepts of call and put options, delving into the driving forces behind option pricing, and embracing expert advice will empower you to make informed decisions and increase your chances of reaping the rewards of this versatile trading arena.

Embark on your options trading journey today, and let the power of leverage and flexibility guide you towards financial success. Are you ready to unravel the transformative world of option trading?