Introduction

In the fast-paced realm of investing, options trading has emerged as a lucrative strategy for navigating market volatility. However, the associated trading charges can often be a barrier to entry. Enter the world of low-cost options trading, where traders can reap the benefits of this dynamic market without breaking the bank.

Image: diohysba.blogspot.com

Whether you are a seasoned trader or just getting your feet wet, understanding the nuances of options trading and identifying platforms with the lowest charges is crucial. This comprehensive guide will delve into the intricacies of this topic, providing you with the knowledge and insights to make informed decisions and unlock the full potential of options trading.

Low-Cost Options Trading: A Definition

At its core, low-cost options trading refers to a variety of strategies and platforms that allow traders to buy or sell options contracts while minimizing their transaction fees. These fees, typically levied by brokers, can significantly impact profitability, especially for active traders who make frequent trades.

By leveraging platforms that offer competitive pricing and efficient fee structures, traders can reduce their trading expenses and increase their net returns. This paves the way for a more profitable trading experience, allowing traders to focus on their strategies rather than worrying about excessive fees eating into their potential gains.

Factors Influencing Trading Charges

Several factors contribute to the determination of options trading charges, including the following:

- Commission: This is a flat fee charged per trade. Lower commission rates translate to lower overall trading costs.

- Spreads: The difference between the bid and ask prices can also impact trading charges. Tighter spreads mean lower transaction costs.

- Margin interest: For traders who use margin accounts, interest charges may apply. Choosing brokers with competitive interest rates can minimize these costs.

- Clearing fees: Some platforms charge additional fees for clearing trades. Understanding and comparing these fees can help traders identify the most cost-effective options.

Identifying the Lowest Charges

To locate platforms offering the lowest charges for options trading, traders can employ several strategies:

- Compare Brokers: Conduct thorough research to compare commission rates, spreads, margin interest, and clearing fees across different brokers.

- Negotiate Fees: For traders with substantial trading volumes, contacting individual brokers to negotiate lower fees is a viable option.

- Utilize Discount Brokers: Discount brokers typically offer lower commission rates than traditional brokers, making them an attractive option for cost-conscious traders.

Image: demataccountopen.com

Tips for Reducing Trading Costs

Beyond choosing platforms with minimal charges, traders can further reduce their trading costs by implementing the following strategies:

- Trade Less Frequently: While active trading can increase profit potential, it also leads to higher trading costs. By trading less frequently, traders can save on commissions and other fees.

- Use Limit Orders: Placing limit orders instead of market orders allows traders to set a specific price for buying or selling options, potentially reducing the impact of unfavorable spreads.

- Manage Margin Use: Margin trading can amplify returns, but it also increases interest charges. By managing margin use prudently, traders can mitigate these costs.

Frequently Asked Questions

Q: What are the benefits of low-cost options trading?

A: Lower trading costs enhance profitability and allow traders to retain a greater portion of their gains. It also makes options trading more accessible to a wider range of investors.

Q: How can I find the lowest trading charges?

A: By researching different brokers, comparing fees, negotiating with brokers, and utilizing discount brokers, traders can identify platforms offering the most cost-effective options trading services.

Q: Are there strategies to further reduce trading costs?

A: Yes, traders can reduce costs by trading less frequently, using limit orders, managing margin use effectively, and utilizing platforms with low execution fees.

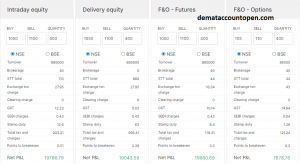

Lowest Charges For Options Trading

Image: www.tradethetechnicals.com

Conclusion

By incorporating these strategies and leveraging the lowest charges for options trading, you can significantly enhance your profitability and maximize your returns. The dynamic nature of options trading demands a comprehensive understanding of fees and charges. Arm yourself with knowledge, implement cost-effective practices, and embrace the opportunities that low-cost options trading presents. Embrace the potential for financial success and unlock the full potential of this exciting investment landscape.

If you found this article informative and engaging, please share it with others who may benefit from its insights. Your feedback and support are highly valued. Let us know if you have any further questions or if you would like to explore additional topics related to options trading. Together, we can navigate the financial markets with knowledge, confidence, and success.