Navigating the Complex World of Options Trading

Options trading can be a lucrative way to maximize your investments, but it’s essential to understand the intricacies of the market and the potential risks involved. One of the key factors that can impact your profitability is the fees and charges associated with trading options. In this comprehensive guide, we delve into the world of option trading charges, exploring the different types of fees, how they can vary, and how to find the lowest charges available.

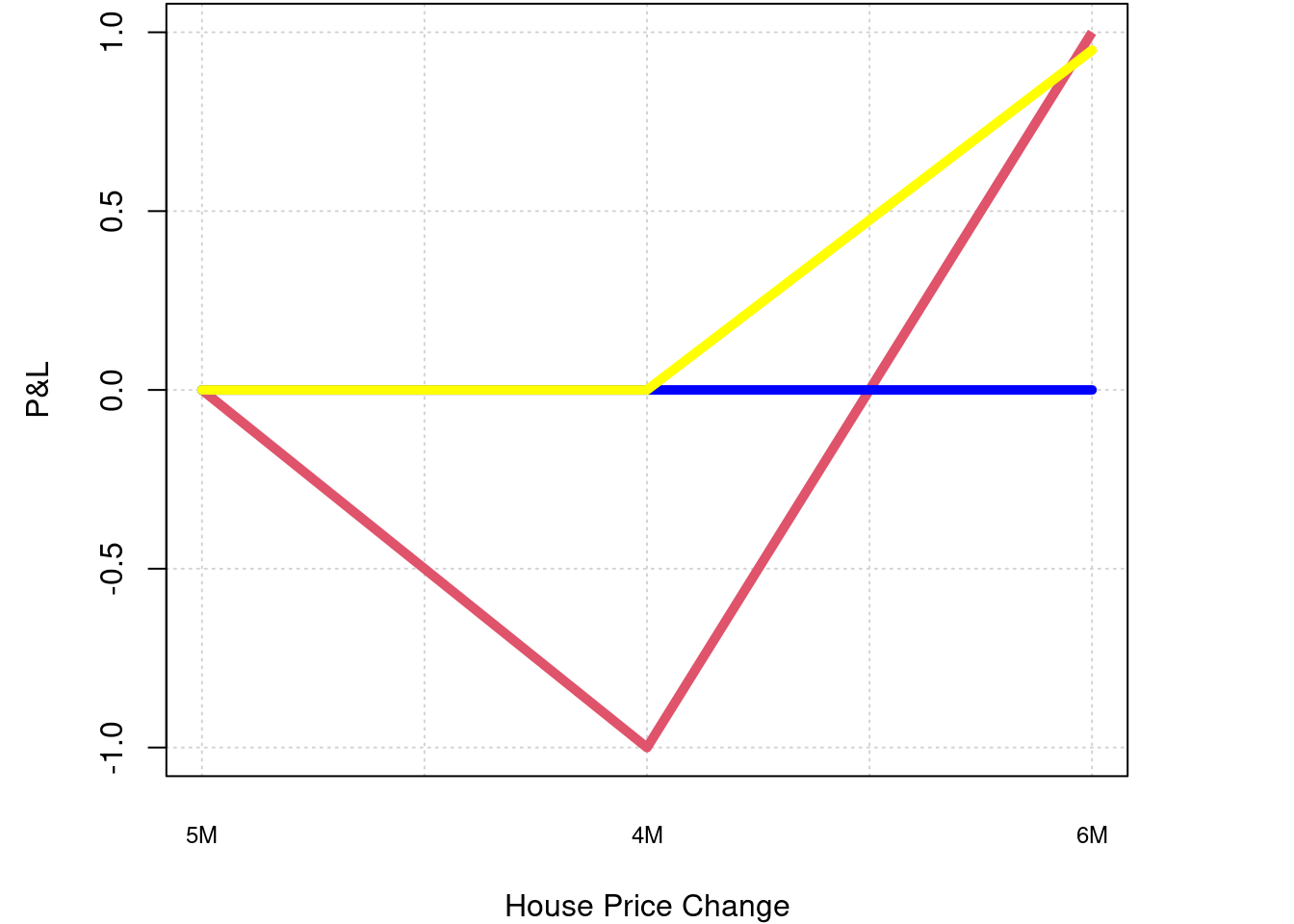

Image: bookdown.org

Types of Option Trading Charges

-

Commissions: These fees are charged by the broker for executing your trades and are typically based on the number of contracts traded or the contract value.

-

Exchange Fees: Regulated markets, such as the CBOE and CME, charge fees for trading options on their platforms. These fees are typically a flat rate per contract.

-

Option Premium: When you buy an option, you pay a premium to acquire the right to buy or sell the underlying asset at a specific price and date. This premium represents the cost of opening the contract.

Factors Affecting Option Trading Charges

-

Brokerage Firm:

Different brokers have their own fee structures, so it’s crucial to compare fees before selecting a broker. Some brokers may offer discounted rates for high-volume traders or those who trade specific types of options.

-

Image: www.angelone.inAccount Type:

The type of account you have can also affect the fees you pay. Active trader accounts may have lower fees than standard brokerage accounts.

-

Trading Platform:

Some trading platforms charge additional fees for real-time data, advanced charting, or order management tools.

-

Contract Type and Size:

The complexity and size of the option contract you are trading can influence the fees charged. Exotic options or large contracts typically have higher premiums and fees.

How to Find the Lowest Option Trading Charges

-

Compare Brokerage Fees:

Use online tools or consult industry reports to compare fees from different brokers. Be sure to pay attention to both commissions and exchange fees.

-

Negotiate with Your Broker:

If you are a high-volume trader, don’t hesitate to negotiate with your broker for discounted rates.

-

Consider Electronic Trading Platforms:

Electronic trading platforms typically have lower fees than traditional floor trading.

-

Look for Fee Bundles:

Some brokers offer fee bundles that include discounted rates for multiple services, such as trading, data, and research tools.

Tips and Expert Advice

-

Choose a reputable broker:

This is paramount to ensure fair and transparent fee structures.

-

Calculate your potential trade costs:

Factor in all potential fees, including commissions, exchange fees, and option premiums.

-

Use a cost basis calculator:

This can help you determine the actual cost of the trade considering both fees and the option premium.

-

Monitor your trading activity:

Regularly review your trade confirmations to ensure that you are not overpaying fees.

Frequently Asked Questions

-

What are standard option trading fees?

It varies depending on the broker and contract type, but commissions typically range from $0.50 to $1.50 per contract, and exchange fees are usually around $0.10 to $0.30 per contract.

-

How can I avoid excessive option trading charges?

Negotiate with your broker, compare fees, and opt for electronic trading platforms and fee bundles.

-

Is it worth paying higher fees for more services?

It depends on your trading volume and needs. If you require advanced trading tools or real-time data, it may be worth considering, but evaluate the benefits against the additional costs.

Lowest Option Trading Charges

Conclusion

Navigating the world of option trading charges can be a complex task, but by understanding the different fees involved and considering the factors that can affect them, you can minimize your costs and maximize your profitability. Remember to do thorough research, compare fees, and seek professional advice if needed. With the right knowledge and strategy, you can find the lowest option trading charges and enhance your financial success in this exciting market.

Are you ready to delve deeper into the world of option trading charges and unlock new opportunities? Your next step is to consult with a reputable broker, compare fee structures, and fine-tune your trading strategy. Embrace this journey of financial empowerment and reap the rewards of informed decision-making.