Comprehending the Basics of Discount Broker Trading

Discount broker trading commodity options has emerged as a popular investment strategy for seasoned investors seeking exposure to the dynamic and often volatile commodities market. Commodity options, which grant the holder the right to buy or sell an underlying commodity at a predefined price on or before a specific date, offer a unique blend of risk and reward. Understanding the ins and outs of discount broker trading in this realm is paramount for optimizing returns and navigating the complexities involved.

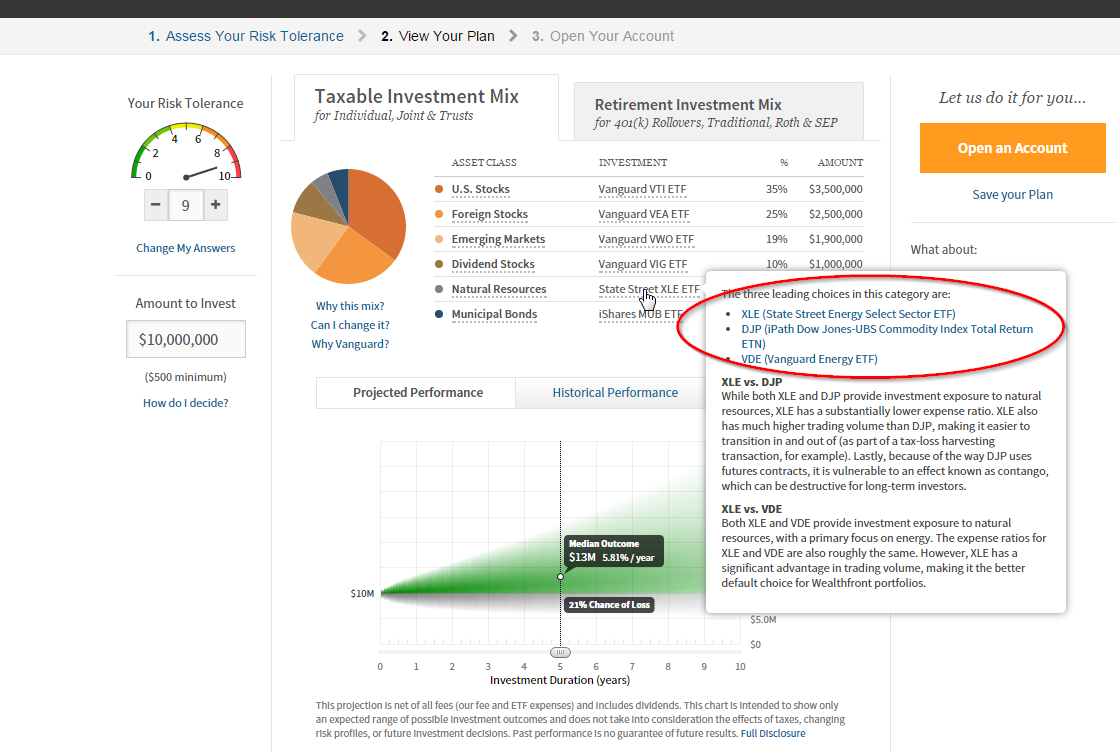

Image: alphaarchitect.com

Discount brokers, unlike traditional full-service brokers, provide a stripped-down yet cost-effective trading platform catering to self-directed investors. Their low-cost commissions and account fees, combined with advanced trading tools, empower individuals to execute trades swiftly and efficiently. When delving into commodity options trading, discount brokers offer a compelling alternative to their full-service counterparts, allowing traders to capitalize on price movements in underlying commodities while minimizing transaction costs.

Specialized Knowledge and Enhanced Expertise

Discount broker trading, particularly in the realm of commodity options, demands specialized knowledge and a comprehensive grasp of market dynamics. Commodity options involve unique characteristics and risks, making it imperative for traders to approach this domain with the necessary expertise. To fully harness the nuances of commodity options, traders must equip themselves with an in-depth understanding of factors that influence commodity prices, such as supply and demand fundamentals, geopolitical events, and global economic conditions.

Proficiency in technical analysis, the study of price patterns and trends, plays a vital role in identifying potential trading opportunities and formulating sound investment decisions. Developing a clear understanding of option Greeks, a set of metrics that measure the sensitivity of an option’s price to underlying variables, is also essential for gauging risk and return dynamics. Arming oneself with this specialized knowledge empowers traders to navigate the complexities of commodity options trading with greater confidence and precision.

Unlocking the Benefits of Discount Broker Trading

Discount broker trading offers a myriad of compelling benefits for commodity options traders, including:

- Cost-effective: Discount brokers provide significantly lower commissions and account fees compared to full-service brokers, enabling traders to retain a larger portion of their profits.

- Control and Autonomy: Self-directed trading platforms empower traders with complete control over their investment decisions, offering the freedom to implement their own trading strategies and execute trades at their own discretion.

- Advanced Trading Tools: Many discount brokers offer sophisticated trading tools, including real-time charting, market scanners, and options analysis tools, to enhance traders’ decision-making process.

- Flexibility: Discount broker trading provides the flexibility to trade from any location at any time, allowing traders to adapt to the dynamic and fast-paced nature of the commodities market.

Embracing a Prudent and Informed Approach

While discount broker trading offers numerous benefits, traders must recognize the importance of adopting a prudent and informed approach to mitigate risks and maximize returns. To achieve this, consider the following:

- Diligent Research: Conduct thorough research and due diligence on underlying commodities, industry dynamics, and market conditions before initiating any trades.

- Realistic Expectations: Commodity options trading involves significant risk, and traders should approach it with realistic profit and loss expectations.

- Risk Management: Implement a comprehensive risk management strategy that includes position sizing, stop-loss orders, and hedging techniques to mitigate potential losses.

- Emotional Discipline: Maintain emotional discipline and avoid impulsive or speculative trading decisions. Treat trading as a business, not a gamble.

Image: zhuanlan.zhihu.com

Discount Broker Trading Commodity Options

Image: carleygarnertrading.com

Closing Remarks: Embarking on the Journey with Awareness

Discount broker trading in commodity options offers a potent avenue for savvy investors seeking exposure to the commodities market. By understanding the intricacies of commodity options, leveraging the benefits of discount brokers, and adopting a prudent and informed approach, traders can harness the potential of this dynamic asset class while effectively managing risks. Embark on the journey with awareness, empowering yourself with the necessary knowledge and strategies to navigate this exciting and potentially rewarding realm. Are you ready to delve into the world of discount broker trading commodity options?