Unlocking the Power of Option Trading

In the labyrinthine world of financial markets, option trading offers a labyrinth of possibilities. Among the various strategies, the vertical spread option emerges as a versatile tool for both seasoned traders and those seeking calculated risk. Embark on this journey as we delve into the intricacies of vertical spread option trading, unraveling its nuances and empowering you with insights and proven strategies.

Image: dessinezen.com

Decoding Vertical Spread Option Trading

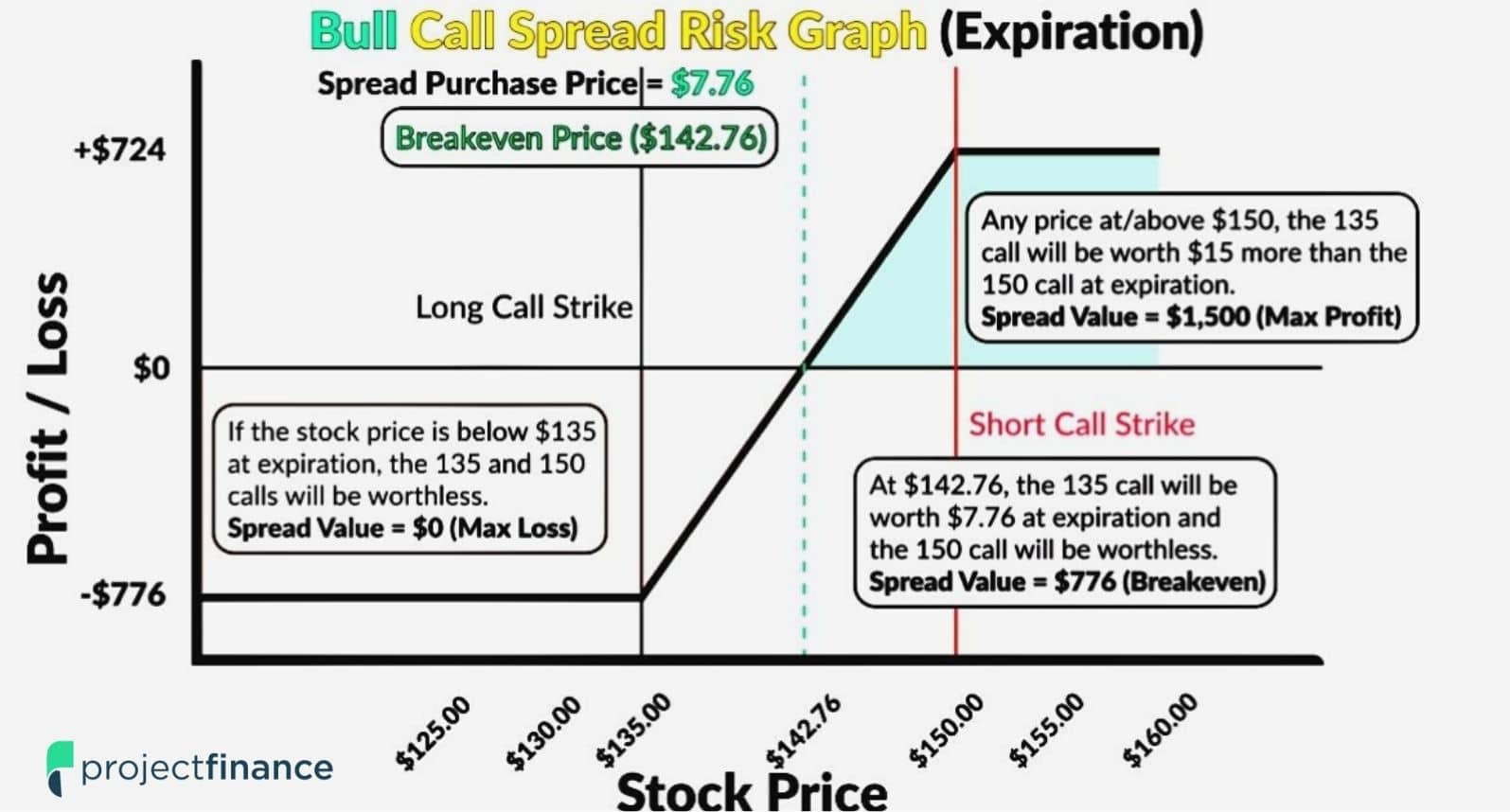

A vertical spread option trading strategy involves the simultaneous purchase and sale of two options with the same expiration date but different strike prices. The spread between the strike prices creates a predefined risk and reward profile. By combining these options, traders aim to capitalize on the difference in their value, known as the spread premium.

There are two main types of vertical spread option trading strategies: call spreads and put spreads. In a call spread, a trader buys a higher strike call and sells a lower strike call. In contrast, a put spread entails purchasing a higher strike put and selling a lower strike put. The choice between call and put spreads depends on the trader’s market outlook and risk tolerance.

Empowering Traders with Expert Insights

Seasoned traders have honed their skills through experience and unwavering dedication to the craft. They generously share their invaluable insights, providing a lifeline for aspiring traders.

-

Embrace Volatility: Vertical spread option trading thrives on market volatility. By identifying periods of heightened market activity, traders can capitalize on the price fluctuations.

-

Manage Risk Wisely: Risk management is paramount in vertical spread option trading. Understanding the potential profit and loss scenarios is crucial for informed decisions.

-

Customize the Strategy: Adapt the vertical spread option trading strategy to align with your risk tolerance and market outlook. Tailoring the spread width and strike prices allows for personalized risk and reward profiles.

Illuminating Trends and Developments

The world of vertical spread option trading is constantly evolving, driven by market dynamics and technological advancements. Staying abreast of these trends is crucial for successful trading.

-

Rise of Automated Trading: Artificial intelligence and algorithmic trading are revolutionizing the industry, offering enhanced execution capabilities and real-time market monitoring.

-

Increased Volatility: Recent market events have showcased heightened volatility, which has propelled the popularity of vertical spread option trading as a hedging strategy.

-

Growth of Online Trading Platforms: The advent of user-friendly online trading platforms has democratized access to vertical spread option trading, empowering individual investors.

Image: www.randomwalktrading.com

Frequently Asked Questions: Embracing Clarity

Q: What are the key advantages of vertical spread option trading?

A: Vertical spread option trading offers defined risk and reward profiles, allowing traders to navigate market volatility while maximizing potential profits.

Q: How do I select the right strike prices and spread width?

A: Consider your market outlook, risk tolerance, and the cost of the options premiums when choosing strike prices and spread width.

Q: What is the impact of volatility on vertical spread option trading?

A: Higher volatility tends to increase the value of the vertical spread, while lower volatility can decrease its value.

Vertical Spread Option Trading Strategy

Image: www.youtube.com

Conclusion: Embracing Calculated Risk

Vertical spread option trading unveils a world of opportunities for traders seeking both income generation and risk management. By leveraging the strategies and insights outlined in this article, you can enhance your trading acumen and navigate the complexities of option markets.

Are you ready to unlock the power of vertical spread option trading and embark on a journey of knowledge, calculated risk, and potential rewards?