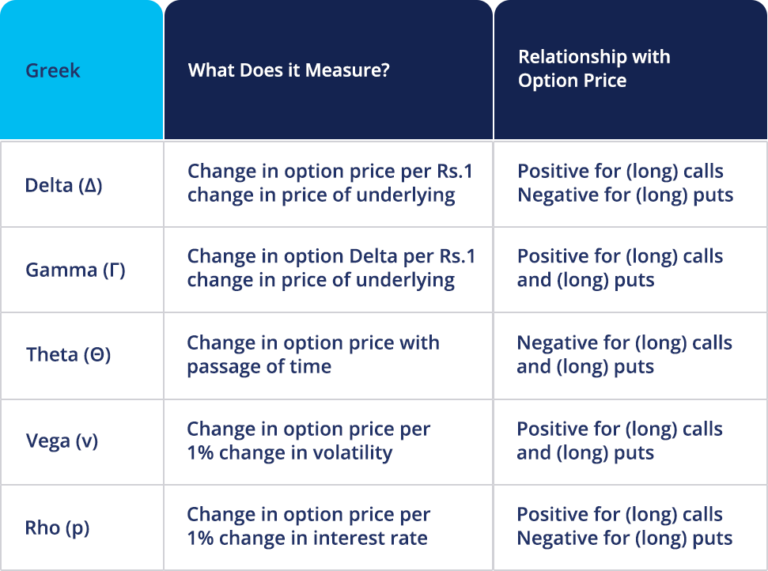

In the vibrant world of options trading, mastering the intricate concepts of greeks is paramount to deciphering market movements and maximizing profits. Greeks, a set of variables, quantify an option’s sensitivity to underlying factors, enabling traders to make informed and calculated decisions. This comprehensive guide delves into the intricacies of greeks, empowering you with the tools to harness their power and elevate your trading strategies.

Image: positron-investments.com

Delta: The Measure of Sensitivity to Underlying Movement

Delta, the quintessential greek, serves as a cornerstone for understanding option pricing. It measures the rate of change in an option’s value relative to the price of the underlying asset. A positive delta indicates that the option will gain value as the underlying asset rises, while a negative delta implies a decline in option value with a falling asset price. This pivotal metric allows traders to assess the direct impact of asset fluctuations on option positions.

Gamma: Unveiling the Delta’s Sensitivity to Underlying Volatility

Gamma, the second derivative of an option’s price, captures the dynamic relationship between delta and underlying volatility. It quantifies the rate of change in delta for every unit change in volatility. High gamma denotes a significant delta shift with volatility fluctuations, making options more sensitive to market swings. Understanding gamma is crucial for traders aiming to manage volatility risk and optimize option strategies.

Theta: Time’s Unremitting Decay on Option Value

Time plays a pivotal role in options trading, and theta, the measure of an option’s value decay as it approaches expiration, is a crucial factor to consider. As time passes, theta exerts a negative impact on an option’s premium, eroding its value consistently. This time-sensitive metric enables traders to gauge the urgency of option execution and make informed decisions based on market timetables.

Image: www.paytmmoney.com

Vega: Volatility’s Influence on Option Value

Vega captures the sensitivity of an option’s value to changes in implied volatility. Implied volatility, a gauge of market expectations for future price fluctuations, influences option pricing significantly. A high vega indicates that the option’s value will respond markedly to volatility changes, making it a valuable tool for traders seeking to leverage market dynamics.

Rho: Interest Rate’s Sway on Option Value

Rho measures the impact of interest rate variations on option values. As interest rates rise, the value of call options (generally) increases, while put options (generally) decline. Understanding rho empowers traders to adapt their strategies based on interest rate forecasts and market conditions.

How To Determine Greeks In Option Trading

Image: www.youtube.com

Conclusion: Greeks as Trade Optimization Catalysts

Mastering the complexities of greeks unlocks a treasure trove of insights for options traders. By leveraging these dynamic variables, traders can decipher market movements, fine-tune hedging strategies, and make informed decisions that enhance their trading performance. Whether you’re a seasoned veteran or a budding options enthusiast, embracing the power of greeks is a transformative step towards navigating the dynamic world of options trading with precision and confidence.