**Embarking on the Options Trading Odyssey**

In the realm of financial markets, options have emerged as a powerful tool for investors seeking to navigate the complexities of trading. Like a seasoned captain charting a course through treacherous seas, a well-crafted options trading strategy can guide traders towards their desired investment destinations. In this comprehensive guide, we will unravel the intricacies of options trading, providing you with the knowledge and strategies needed to conquer the financial waters like a master strategist.

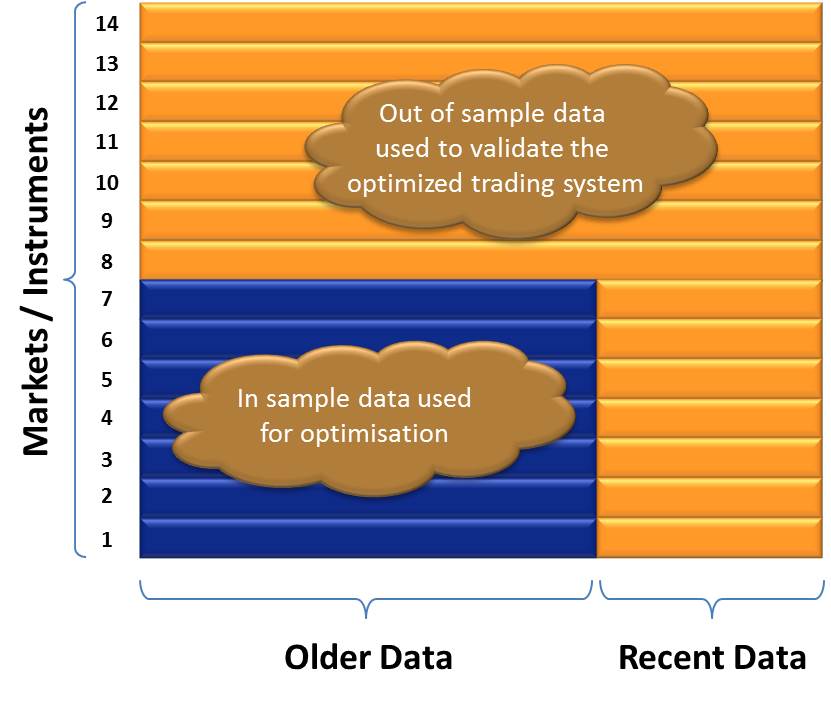

Image: www.tradingsystemlife.com

**Understanding the Options Trading Arena**

Options are essentially financial contracts that confer upon their holders the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (the strike price) on or before a designated date (the expiration date). This unique duality—the optionality—is what distinguishes options from other financial instruments and opens up a realm of trading possibilities.

**Delving into Options Trading Strategies**

The world of options trading strategies is a vast and dynamic landscape, teeming with a myriad of approaches tailored to different market conditions and investor risk appetites. Some of the most popular strategies include:

- Covered Calls: A strategy involving selling a call option against a stock that the trader already owns. This strategy generates additional income while limiting downside risk by capping potential profits.

- Protective Puts: Purchasing a put option to protect an underlying position from potential losses. This strategy acts as a safety net, minimizing the risk associated with holding an underlying asset.

- Iron Condors: A combination strategy that involves selling both a call option and a put option with different strike prices and the same expiration date. The trader generates income from selling the options and profits from the potential convergence of the underlying asset’s price towards the strike prices.

- Bull Call Spreads: A strategy that involves buying a call option and simultaneously selling another call option with a higher strike price. This strategy benefits from a moderate rise in the underlying asset’s price.

**Mastering the Art of Options Trading**

Navigating the options trading landscape requires not only a thorough understanding of the strategies themselves but also a deep-seated knowledge of the underlying assets, market trends, and various trading techniques. To emerge victorious, traders should consider incorporating the following expert advice:

- Conduct Thorough Research: Meticulous research into the underlying asset, including historical performance, market dynamics, and industry news, is paramount. This knowledge forms the foundation for informed trading decisions.

- Manage Risk with Discipline: Risk management is the cornerstone of successful trading. Establish clear risk parameters, utilize stop-loss orders, and monitor positions closely to mitigate potential losses.

- Stay Informed with Market Trends: Keep abreast of the latest market developments, economic indicators, and news that may impact the underlying asset’s price. Real-time market monitoring allows traders to adjust strategies accordingly.

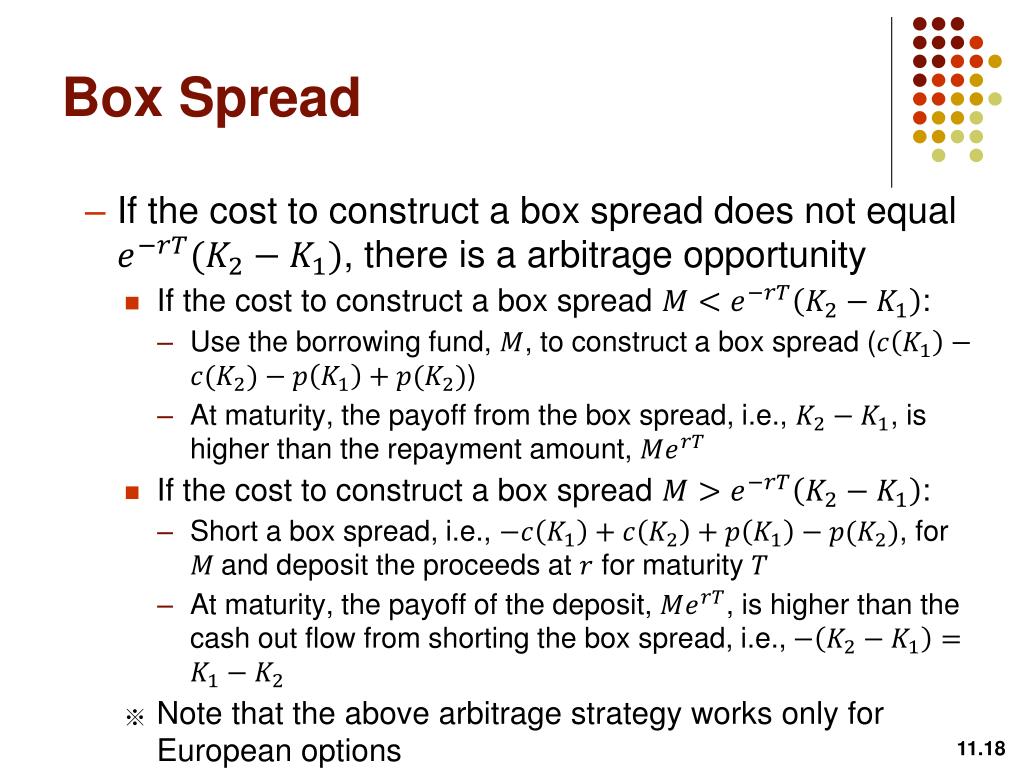

Image: www.slideserve.com

**Frequently Asked Questions (FAQs) about Options Trading**

Q: What are the benefits of options trading?

A: Options trading offers several benefits, including the potential for increased returns, hedging against risk, and the ability to execute complex trading strategies.

Q: What are the risks associated with options trading?

A: Options trading carries inherent risks, such as the potential for losses exceeding the initial investment and the possibility of time decay eroding the option’s value if the asset’s price remains stagnant.

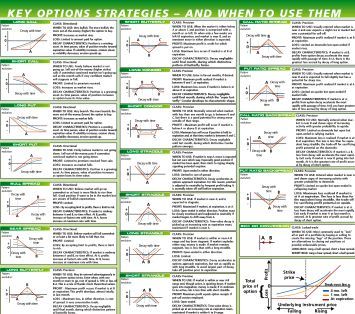

Trading Strategy Involving Options

Image: kumeyuroj.web.fc2.com

**Conclusion: Steering Towards Success**

Embracing the world of options trading can empower investors with a potent tool for navigat