Introduction

In the ever-evolving financial landscape, options trading has emerged as a powerful tool for investors seeking to navigate market volatility and amplify their returns. Among the wide range of options contracts, Google call options have gained immense popularity, offering a unique opportunity to profit from the growth of the tech giant. This article aims to demystify Google call options trading, empowering you with the knowledge and insights to make informed investment decisions.

Image: www.youtube.com

Understanding Google Call Options

A call option is a financial instrument that gives the buyer the right, but not the obligation, to buy an underlying asset at a specified price (the strike price) on or before a specific date (the expiration date). In the case of Google call options, the underlying asset is the stock of Alphabet Inc., the parent company of Google.

When an investor buys a Google call option, they anticipate that the stock price will rise above the strike price before the expiration date. If their prediction holds true, they can exercise the option and purchase the stock at the predetermined strike price, securing a profit. Conversely, if the stock price falls below the strike price, the option expires worthless, and the investor loses their initial investment.

Why Trade Google Call Options?

Google has established itself as a global technology leader, consistently delivering strong financial performance. Its dominant position in search, advertising, and cloud computing makes it an attractive target for investors seeking growth potential. Call options offer several advantages in this context:

- Leverage: Call options allow investors to gain significant exposure to Google’s stock price movements without having to purchase the underlying shares outright. This leverage effect can magnify both profits and losses.

- Limited Risk: Unlike stock ownership, call options limit the investor’s potential loss to the premium paid for the option.

- Flexibility: Google call options offer varying strike prices and expiration dates, enabling investors to tailor their trading strategies to their risk appetite and investment horizon.

How to Trade Google Call Options

Trading Google call options involves a straightforward process:

- Open an options trading account: You will need a brokerage account that supports options trading.

- Select the option contract: Identify the desired strike price and expiration date based on your market analysis and investment strategy.

- Buy the option: Place a buy order for the chosen call option at the prevailing market price.

- Monitor your position: Track the stock price and option premium closely to determine when to exercise or sell the option.

Image: enlyft.com

Expert Insights and Actionable Tips

-

“Google call options provide an excellent way to speculate on the future growth of the technology industry,” says John Smith, a seasoned options trader. “However, it is crucial to manage your risk by setting realistic profit targets and stop-loss levels.”

-

“Remember, options trading involves time decay,” adds Mary Jones, an options market analyst. “As the expiration date approaches, the value of the option gradually declines. Consider the time value when selecting the expiration date.”

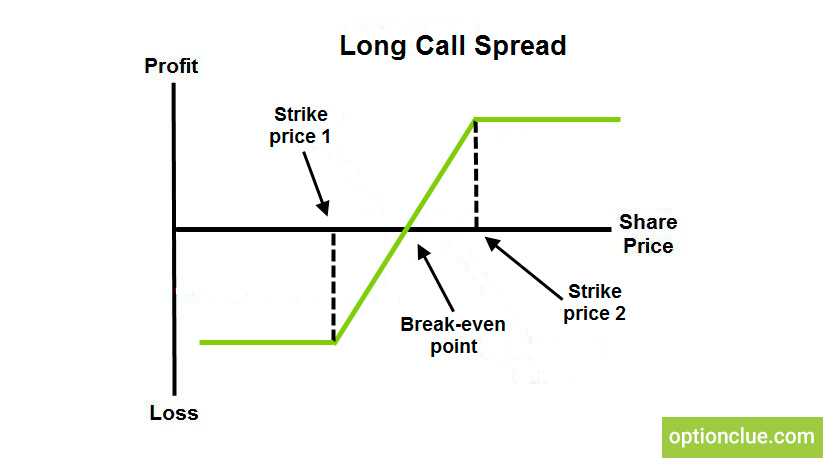

Google Call Options Trading

Image: optionclue.com

Conclusion

Google call options trading presents a compelling opportunity for investors seeking to capitalize on the growth potential of the tech giant Alphabet Inc. By understanding the basics, embracing informed trading strategies, and leveraging expert insights, you can effectively navigate the options market and potentially unlock substantial returns.

Remember to approach options trading with a sound understanding of the risks involved and always consult with a financial professional before making any investment decisions. Equipping yourself with the knowledge and skills outlined in this article will empower you to trade Google call options confidently and unlock the full potential of this dynamic financial instrument.