Introduction

Image: www.pinterest.com

In the realm of investing, options offer a versatile tool to manage risk and potentially amplify returns. Among the various options strategies, option spreads have emerged as a powerful approach that can adapt to diverse market conditions. This comprehensive guide delves into the intricate world of option spread trading, empowering readers with the knowledge and insights to navigate this multifaceted strategy.

Understanding Option Spread Trading

An option spread involves buying one option and simultaneously selling another option with different strike prices or expiration dates. This creates a defined spread or difference in value between the options. The primary advantage of option spread trading lies in its ability to tailor risk and reward levels by adjusting the strike prices and expiration dates of the options included in the spread.

Strategies and Tactics

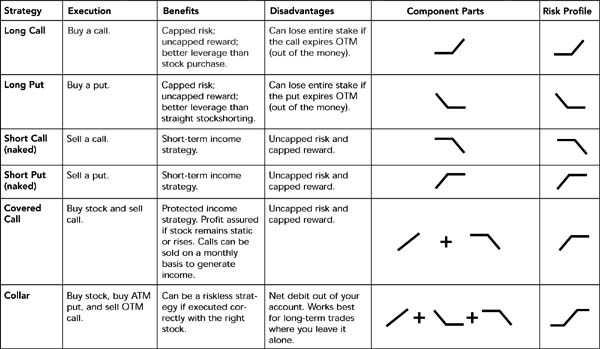

The world of option spread trading encompasses a vast array of strategies, each with its unique risk-reward profile. Some of the most popular strategies include:

- Bull Call Spread: A bullish strategy designed to profit from an increase in the underlying asset’s price.

- Bear Put Spread: A bearish strategy that benefits from a decrease in the underlying asset’s value.

- Iron Condor Spread: A neutral strategy combining both bullish and bearish components, aiming to profit from a limited range of price movements.

Key Elements of Option Spread Trading

To successfully implement option spread trading, it’s essential to grasp the fundamental elements:

- Strike Price: The price at which the option can be exercised.

- Expiration Date: The date on which the option expires.

- Spread Width: The difference between the strike prices of the options.

- Option Premium: The price paid or received for the options involved in the spread.

Expert Insights and Actionable Tips

Seasoned experts recommend utilizing option spread trading within a broader investment strategy. Prudent risk management, thorough research, and continuous monitoring are vital for success. Here are some tips from the professionals:

- Diversify your spread portfolio across different assets and strategies.

- Set clear profit and loss targets before implementing a trade.

- Monitor market news and analyze technical indicators to make informed decisions.

Conclusion

Option spread trading offers investors a flexible and versatile approach to manage risk and enhance returns. By understanding the strategies and tactics involved, along with the key elements of the spreads, traders can leverage this powerful tool to optimize their investment portfolios. Remember, due diligence, prudent risk management, and a disciplined approach are essential for successful option spread trading.

Image: www.oreilly.com

Option Spread Trading A Comprehensive Guide To Strategies And Tactics