Imagine a scenario where you have the ability to tap into the potential of stock market movements without directly buying or selling the underlying assets. This is where options trading comes into play, offering a unique medium for investors. In this article, we delve into the world of options trading, exploring its fundamentals, latest trends, and expert advice to empower you with a comprehensive understanding.

Image: www.warriortrading.com

Introduction to Options Trading

Options trading involves contracts that grant you the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specific price on or before a designated date. These contracts are versatile tools that allow you to gain exposure to market movements while managing risk strategically.

Understanding the Key Concepts

The foundation of options trading rests on three crucial concepts: option type (call or put), strike price (the price at which you can exercise the option), and expiration date (the deadline by which the option can be exercised). Call options allow you to profit when the market price of the underlying asset rises, while put options provide gains when the market price falls.

When purchasing an option, you pay a premium, which represents the cost of acquiring the contract. If the option expires unexercised, the premium is lost. However, if the market moves favorably, you can exercise the option to buy or sell the underlying asset at the specified price, potentially generating significant profits.

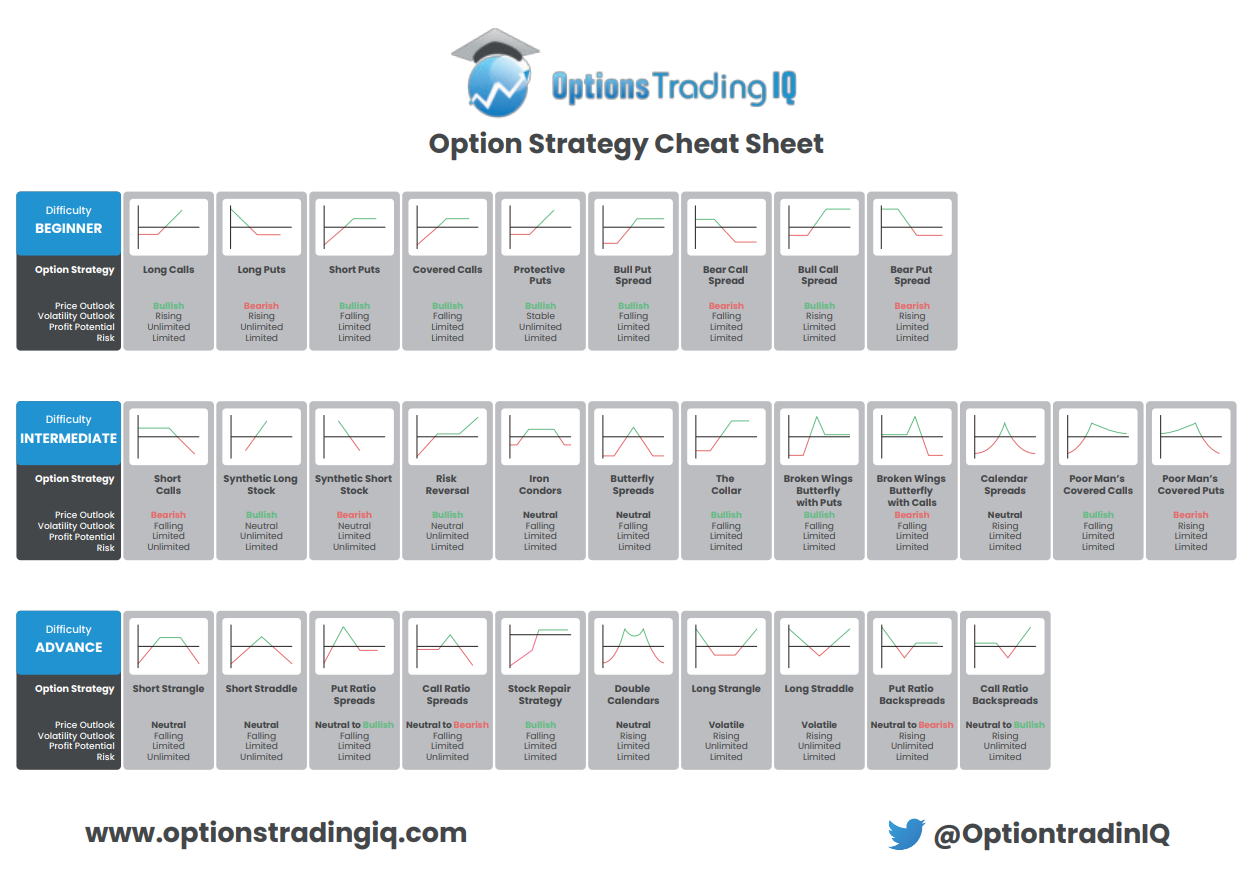

Options Trading Strategies

Options trading strategies are meticulously crafted plans that deploy different combinations of options to maximize potential returns while managing risk. Call options can be employed for bullish positions, allowing you to benefit from market rallies. Conversely, put options can be used for bearish positions, offering protection against market downturns. More advanced strategies, such as spreads and straddles, provide even more flexibility to adapt to various market conditions.

However, it’s imperative to approach options trading with a measured and cautious mindset. While the potential for high rewards exists, the inherent risks cannot be overlooked. The value of options can fluctuate rapidly, and substantial losses can occur if trades are not executed wisely.

Image: www.walmart.com

Latest Trends and Developments

The options trading landscape is constantly evolving, influenced by market dynamics, regulatory changes, and technological advancements. One emerging trend is the increasing popularity of options trading platforms, which provide a user-friendly interface and sophisticated tools to streamline the trading process.

Additionally, the rise of mobile trading has made it easier for investors to monitor and execute trades from anywhere. Social media platforms have also become influential, with many traders sharing insights, strategies, and market updates, fostering a vibrant community around options trading.

Tips and Expert Advice for Options Trading

To achieve potential success in options trading, it is essential to seek guidance from experienced traders and stay abreast of market developments. Here are some proven tips from seasoned professionals:

- Understand the risks: Options trading carries inherent risks, so it’s critical to fully comprehend the potential for losses before engaging in this activity.

- Educate yourself: Continuously expand your knowledge base by reading books, attending webinars, and utilizing educational resources to enhance your trading strategies.

- Use technical analysis: Study charts and technical indicators to identify market trends and potential entry and exit points for your options trades.

- Manage your emotions: Discipline is paramount in options trading. Avoid making impulsive decisions based on emotions and stick to your predetermined trading plan.

- Protect your capital: Utilize stop-loss orders to limit potential losses and preserve your trading capital.

Frequently Asked Questions (FAQs)

To clarify common questions and provide further insights, here is a brief FAQ section on options trading:

- Q: What is the difference between a call and a put option?

A: Call options give you the right to buy, while put options give you the right to sell an underlying asset at a specific price. - Q: What factors affect the value of an option?

A: The value of an option is influenced by the underlying asset price, time remaining until expiration, volatility, and interest rates. - Q: How can I get started with options trading?

A: Open an account with an options broker, ensure that you meet the necessary eligibility requirements, and educate yourself thoroughly before placing any trades. - Q: Is options trading suitable for beginners?

A: Options trading can be complex, and beginners should proceed with caution. It’s advisable to gain foundational knowledge and experience before venturing into options trading. - Q: How can I minimize risks in options trading?

A: Thoroughly understand the risks involved, use stop-loss orders, and implement a comprehensive risk management strategy to mitigate potential losses.

Options Trading Medium

Image: www.newtraderu.com

Conclusion

Options trading provides a powerful medium for investors to tap into the potential of financial markets. However, it’s imperative to approach this endeavor with a thorough understanding of the concepts, strategies, risks, and ongoing market trends. By following expert advice and adopting a disciplined approach, you can navigate the intricacies of options trading and potentially harness its power to achieve financial goals.

Are you intrigued by the prospect of options trading? Share your thoughts and questions in the comments section below, and let’s embark on a discussion to explore this fascinating financial instrument further.