Introduction

Image: en.rattibha.com

In the dynamic world of financial trading, the concept of trading turnover plays a pivotal role, offering invaluable insights into market activity. Pocket Option, a renowned binary options trading platform, offers traders access to this crucial metric, empowering them to make informed decisions and optimize their trading strategies. This comprehensive guide will delve into the intricacies of trading turnover, exploring its definition, significance, applications, and practical implications for Pocket Option traders.

Understanding Trading Turnover

Trading turnover, also known as trading volume, represents the aggregate number of transactions executed within a specific period in a given market. It measures the total number of trades, irrespective of their direction or profitability. By summarizing the market’s overall activity level, trading turnover serves as a potent indicator of market liquidity, volatility, and overall health.

Significance for Pocket Option Traders

For Pocket Option traders, understanding trading turnover is essential for several reasons:

-

Liquidity Assessment: High trading turnover indicates a liquid market with numerous active participants. This ensures smooth trade execution, minimal slippage, and competitive bid-ask spreads, enhancing the trader’s ability to enter and exit positions promptly.

-

Market Volatility Indicator: Sharp fluctuations in trading turnover can suggest volatile market conditions. Abrupt increases often signal increased speculation and price swings, while sudden drops may indicate market stabilization or waning interest. Traders can adjust their strategies accordingly, managing risk and positioning themselves to capitalize on market movements.

-

Trading Strategy Refinement: Analyzing historical trading turnover patterns can provide insights into market behavior under different conditions. Traders can identify periods of high or low turnover and align their trading strategies to exploit market trends and fluctuations.

Applications in Pocket Option Trading

Practical applications of trading turnover for Pocket Option traders include:

-

Trend Identification: Rising trading turnover often accompanies market trends. Traders can monitor turnover alongside price action to gauge trend strength and identify potential breakout opportunities.

-

Contrarian Trading: Deviations between trading turnover and price movements can signal potential contrarian trading opportunities. When turnover diverges from price, traders can consider betting against the prevailing trend for potential profits.

-

Risk Management: Understanding trading turnover can inform risk management strategies. High turnover may warrant reduced position sizes or protective measures, while low turnover suggests a more conservative approach.

-

Scalping Opportunities: Scalpers rely on high trading turnover to execute multiple short-term trades quickly. Identifying periods of heightened turnover can provide scalpers with ample opportunities for profitable entries and exits.

Real-World Examples

To illustrate the practical implications of trading turnover, consider the following examples:

-

Example A:

- High trading turnover during an uptrend suggests strong buying pressure. Traders may consider entering long positions, assuming the uptrend continues.

-

Example B:

- Low trading turnover in a sideways market indicates a lack of clear direction. Traders may exercise caution and avoid aggressive positions until turnover increases.

-

Example C:

- A sudden surge in trading turnover followed by a swift decline may indicate a market reversal. Traders can consider shorting the asset if the turnover spike precedes a price drop.

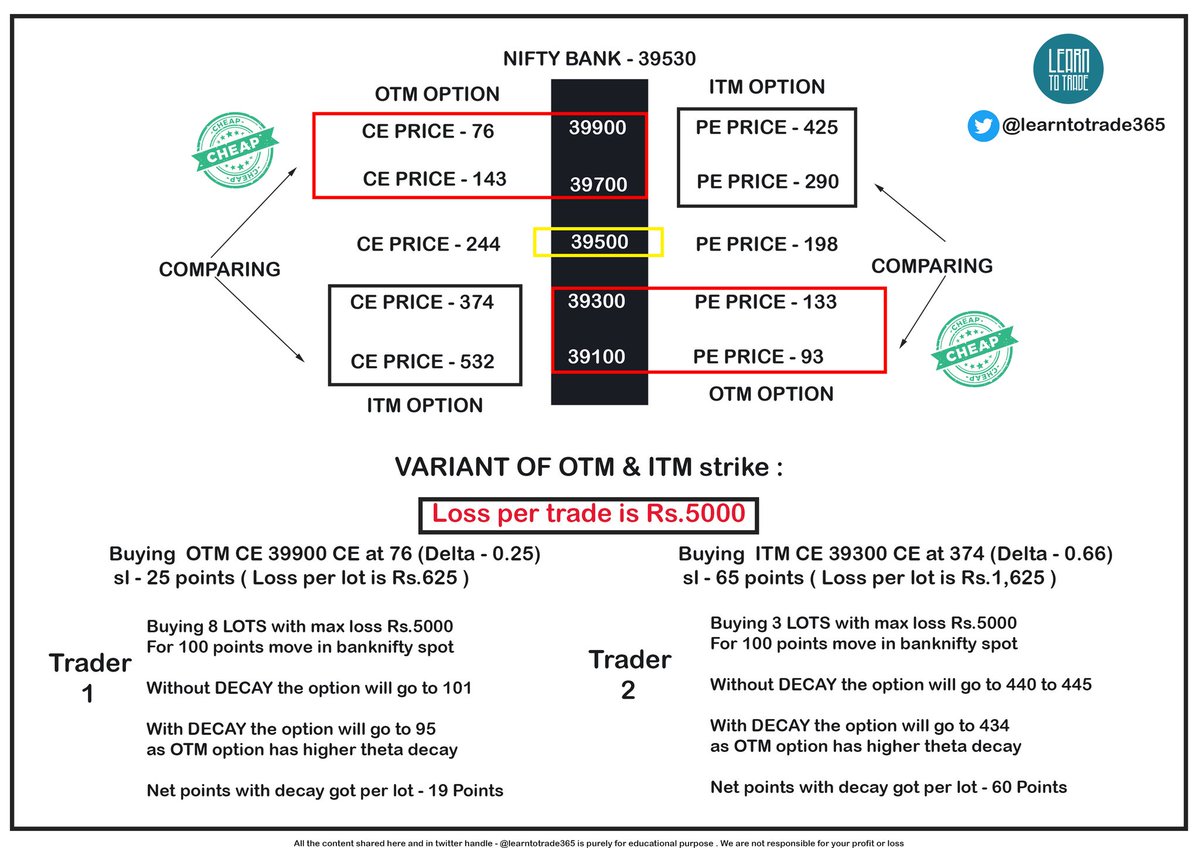

Image: tradingqna.com

What Is Trading Turnover In Pocket Option

Image: en.rattibha.com

Conclusion

Trading turnover is an essential metric for Pocket Option traders, providing valuable insights into market activity, liquidity, volatility, and trend dynamics. By understanding and applying the principles outlined in this guide, traders can enhance their decision-making, refine their strategies, and maximize their potential profits. Whether navigating choppy waters or riding the waves of market fluctuations, comprehending trading turnover empowers Pocket Option traders to excel in the ever-evolving world of financial instruments.