Options trading, a dynamic financial realm, involves intricate concepts and market dynamics. One pivotal aspect that governs the fluidity and liquidity of options markets is turnover. Understanding turnover in options trading is crucial for investors seeking to optimize their trading strategies and grasp the market’s intricacies.

Image: www.aihr.com

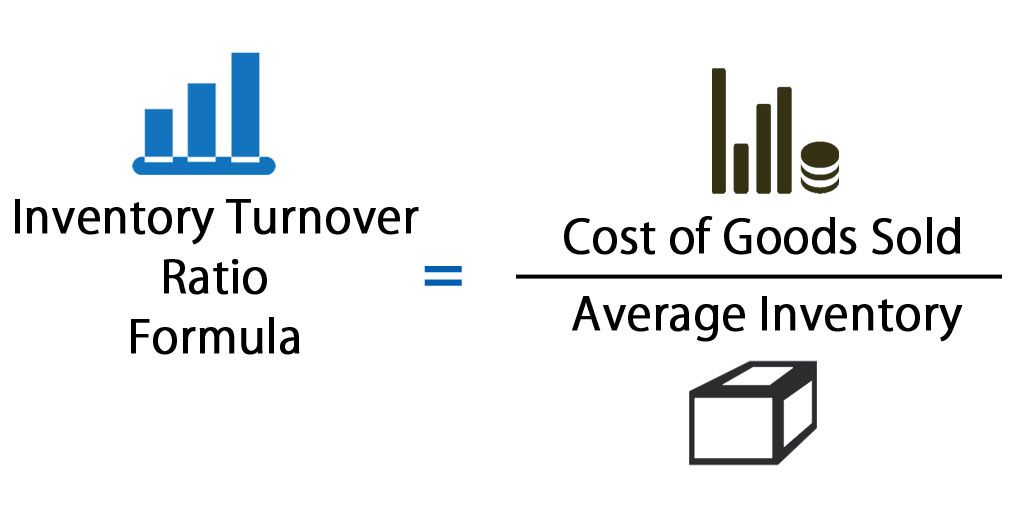

Turnover refers to the total volume of options contracts traded during a specific period, typically a trading day or month. It measures the velocity at which options are exchanged between buyers and sellers, reflecting market activity and interest levels. In simpler terms, it represents how frequently options change hands within the trading landscape.

Importance of Turnover in Options Trading

Turnover plays a significant role in options trading for several reasons. First and foremost, it indicates the liquidity of the options market. High turnover suggests a market with numerous buyers and sellers, facilitating seamless execution of trades and minimizing transaction costs. Conversely, low turnover can result in illiquid markets, where finding counterparties and executing trades becomes challenging.

Another aspect to consider is the impact of turnover on option premiums. In highly traded markets with robust turnover, premiums tend to align more closely with theoretical values derived from pricing models. This is because numerous market participants continuously evaluate and adjust prices based on supply and demand dynamics. On the other hand, options with low turnover may exhibit significant deviations from theoretical values, making pricing less efficient.

Turnover also influences the volatility of options. High turnover markets tend to display lower volatility as a greater number of market participants continuously absorb and mitigate price fluctuations. Conversely, low turnover markets can often experience higher volatility due to the limited number of participants actively trading the options.

Factors Affecting Options Turnover

Numerous factors can influence turnover in options trading. One key factor is the underlying asset. Options on popular and widely traded assets, such as major stock indices and currencies, typically exhibit higher turnover compared to options on less liquid underlying assets. The popularity of the underlying asset attracts more market participants, leading to increased trading activity.

Another factor affecting turnover is the option’s strike price and expiration date. At-the-money (ATM) options, which have a strike price close to the underlying asset’s current price, generally have higher turnover than out-of-the-money (OTM) options with strike prices significantly away from the current price. Additionally, options with near-term expiration dates tend to have higher turnover as traders actively seek to adjust their positions or close out trades.

Institutional participation also plays a role in options turnover. Market makers, hedge funds, and other institutional players often engage in high-volume options trading, contributing significantly to overall turnover. The strategies and risk management practices of these institutions can influence the demand and supply dynamics for options, thus impacting turnover.

Strategies for Optimizing Turnover

Traders can employ various strategies to increase the turnover of their options trades. One approach is to focus on trading options with high liquidity, such as those on popular underlying assets or with ATM strike prices. By participating in more liquid markets, traders can minimize transaction costs and enhance the execution efficiency of their trades.

Another strategy is to consider the bid-ask spread, which represents the difference between the highest bid and the lowest ask price offered in the market. By carefully studying the order book and identifying options with narrow bid-ask spreads, traders can increase the chances of executing their trades at desired prices and limit potential slippage.

Image: scienceforwork.com

Turnover In Options Trading

Image: www.getdor.com

Key Takeaways

Turnover is a vital metric that reflects the liquidity, efficiency, volatility, and overall health of options markets. By comprehending the factors influencing turnover and employing strategic approaches, traders can optimize their trading activities. High turnover markets offer the advantages of enhanced liquidity, efficient pricing, and reduced volatility, making them preferred trading environments.