Imagine you’re an options trader, navigating the dynamic markets with the potential for lucrative returns. Understanding turnover, a vital metric in options trading, is key to your success. This guide will provide a comprehensive overview of how to calculate turnover, empowering you to make informed trading decisions.

Image: tradesmartonline.in

Turnover represents the total value of options contracts traded over a specific period. It serves as a significant indicator of market activity and option liquidity. A high turnover rate indicates a liquid market, facilitating timely trade execution and reducing the risk of price slippage. Conversely, a low turnover rate suggests a less active market with potentially increased execution costs and bid-ask spreads.

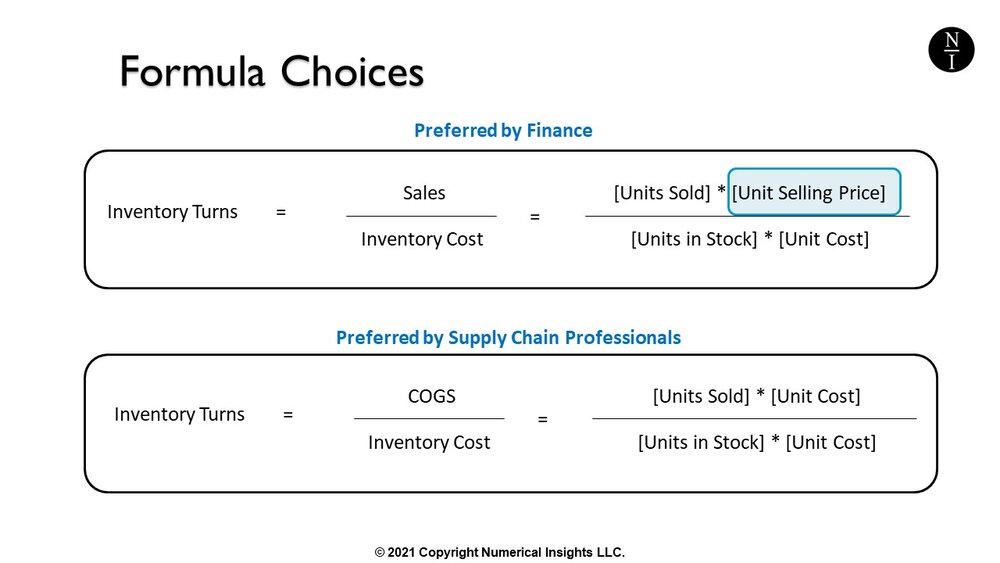

Calculating Turnover: Understanding the Formula

To calculate turnover accurately, you’ll need to consider the following formula: Turnover = Volume Traded * Contract Size * Underlying Price

1. Volume Traded: This refers to the total number of options contracts traded during the specified period. It includes both buy and sell transactions.

2. Contract Size: Each option contract typically represents 100 shares of the underlying asset. Note that specific index options may have different contract sizes.

3. Underlying Price: This is the current market price of the underlying asset, which the option contract references. It directly impacts the value of each contract.

Factors Influencing Turnover

Recognition of factors that drive turnover is essential. Many aspects contribute to determining a market’s turnover rate. Some of the key factors include:

- Market Volatility: Higher volatility in the underlying asset leads to increased option trading activity, resulting in a higher turnover rate.

- Overall Market Sentiment: Bullish or bearish market sentiment can substantially influence option trading volumes and, subsequently, turnover.

- Expiration Date Proximity: As options approach their expiration dates, trading activity tends to intensify, particularly for near-the-money contracts.

Significant Trends and Developments

To stay competitive, staying informed about recent shifts and advancements in option trading is imperative. Jump onto popular online forums and tap into social media discussions, besides keeping a close watch on reputable financial news outlets.

Image: coremymages.blogspot.com

Tips from the Experts

- Monitor Liquidity: Continuously evaluate an option’s liquidity by examining its turnover rate. Higher turnover ensures smoother trade execution.

- Time Your Trades: Consider market trends and volatility when planning option trades. Adjusting them based on these factors can enhance your chances.

Frequently Asked Questions (FAQs)

- Monitor Liquidity: Continuously evaluate an option’s liquidity by examining its turnover rate. Higher turnover ensures smoother trade execution.

- Time Your Trades: Consider market trends and volatility when planning option trades. Adjusting them based on these factors can enhance your chances.

Frequently Asked Questions (FAQs)

Q: How does turnover differ from trading volume?

A: While related, turnover represents the total value traded, incorporating contract size and underlying price, whereas trading volume solely reflects the number of contracts traded.

Q: Can turnover predict future market movements?

A: Turnover alone cannot forecast future price changes, but it can provide insights into market sentiment and potential volatility.

How To Calculate Turnover In Option Trading

Conclusion

Calculating and comprehending turnover in options trading is a cornerstone for successful navigation of the market. By implementing these tactics, you can gain an advantage. Identify suitable trading opportunities, think about incorporating these expert tidbits into your approach. Embark on a proactive journey by researching industry forums, keeping tabs on financial news, and incorporating expert advice. Are you ready to venture into the world of option trading? Embrace the strategies, ask further questions, and engage with us to elevate your trading prowess!