SEO Title: How Do Option Trading Professionals Calculate Return and Margin Requirements?

Option trading, an intricate realm of the financial markets, has the potential to yield substantial profits. However, understanding how professionals measure return and margin requirements is pivotal for success in this arena. Delve into this comprehensive guide to unravel the intricacies of option trading and elevate your investing prowess.

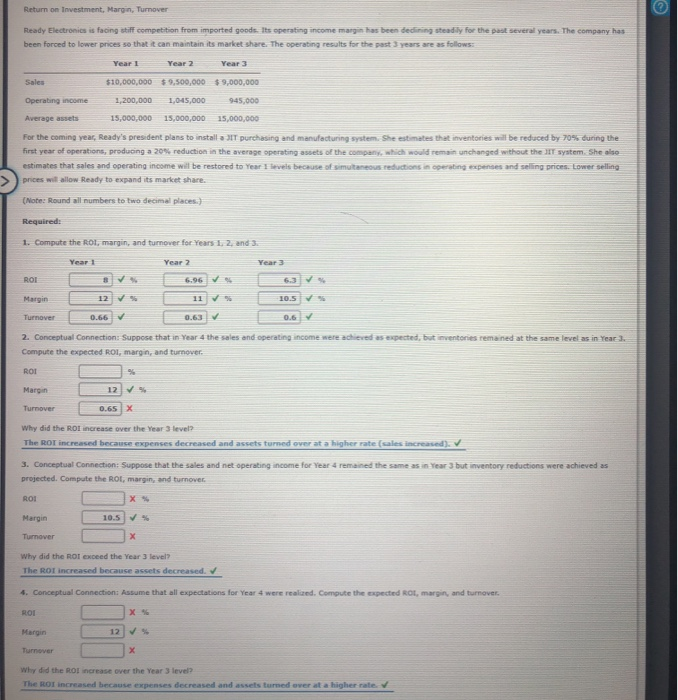

Image: www.chegg.com

Introduction to Option Trading

An option contract conveys the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset (e.g., stock, bond) at a predetermined price (strike price) on or before a specific date (expiration date). Option premiums, the purchase prices of these contracts, fluctuate based on market conditions and the characteristics of the underlying asset.

Metrics for Measuring Returns

One crucial metric in options trading is annualized return on investment (ROI). This figure reflects the percentage gain or loss an option generates over a one-year holding period. It is computed by dividing the profit (or loss) from the trade by the initial investment and annualizing the result.

Another essential metric is delta, a measure of how much an option’s price changes in relation to movements in the underlying asset’s price. A higher delta indicates a closer relationship between the two prices, while a lower delta suggests a weaker correlation.

Managing Margin Requirements

Margin requirements in option trading impose a minimum amount of collateral necessary to initiate and maintain a position. These requirements vary between exchanges and brokers, typically expressed as a percentage of the option’s notional value.

Monitoring margin utilization, calculated by considering the value of all open option positions relative to the account’s equity, is vital for traders. Exceeding the margin requirement limit can trigger a margin call, compelling the trader to deposit additional funds or liquidate positions to satisfy the requirement.

Image: decoqiw.web.fc2.com

Options Trading Strategies

Seasoned option traders employ diverse strategies to capitalize on market opportunities. Some common strategies include covered calls (selling call options against underlying shares owned), protective puts (purchasing put options to hedge against potential losses), and straddles (simultaneously buying a call and a put option at the same strike price).

Advanced Option Trading Concepts

Theta represents the time decay of an option’s value as its expiration date approaches. Volatility measures the degree of price fluctuations in the underlying asset and significantly influences option premiums. Implied volatility gauges market expectations regarding future price volatility of the underlying asset.

How Does Option Trading Pros Measure Return And Margin Requirement

Image: www.chegg.com

Conclusion

Mastering the intricacies of option trading return measurement and margin requirements is indispensable for thriving in this dynamic market. Annualized ROI, delta, margin utilization, and a thorough understanding of options strategies and advanced concepts empower traders to navigate market complexities effectively. By embracing these principles, you can enhance your ability to reap the potential rewards of option trading while managing risks prudently.