As an option trading pro, understanding how to accurately measure return and calculate margin requirements is crucial for making informed decisions and managing risk effectively. Let’s delve into the strategies employed by professionals to quantify these key aspects of option trading.

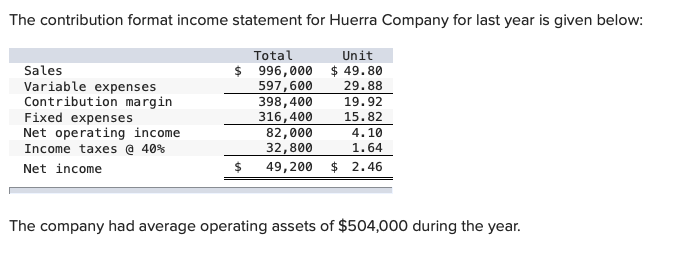

Image: www.chegg.com

Measuring Return: ROI and Profit Potential

1. Return on Investment (ROI): ROI is a simple but powerful metric that measures the profit or loss gained relative to the initial investment. It is calculated by dividing the net profit by the investment amount and multiplying by 100 to express it as a percentage.

2. Profit Potential: Profit potential represents the maximum possible profit that can be generated from an option trade. It is influenced by factors such as the underlying asset’s price movement, time decay, and the option’s strike price and expiration date.

Calculating Margin Requirement

Margin requirement refers to the minimum amount of capital that must be maintained in a trading account to cover potential losses. For options, margin is calculated based on the option’s premium and other factors.

1. Premium: The premium is the price paid to acquire an option contract. A higher premium generally implies a higher margin requirement.

2. Delta: Delta measures the sensitivity of an option’s price to changes in the underlying asset’s price. Higher delta values result in higher margin requirements.

3. Vega: Vega measures the sensitivity of an option’s price to changes in implied volatility. Higher vega values lead to higher margin requirements, especially for long-volatility strategies.

Tips for Maximizing Return and Minimizing Margin Requirement

**1. Option Selection:** Carefully select options with favorable risk-to-reward ratios and consider factors such as premium cost, time decay, and volatility.

**2. Leverage Management:** Use leverage wisely to enhance potential returns, but be aware of the increased risk and margin requirements associated with it.

**3. Margin Optimization:** Regularly monitor your margin requirement and optimize it by adjusting trade sizes, reducing premium costs, or increasing account equity.

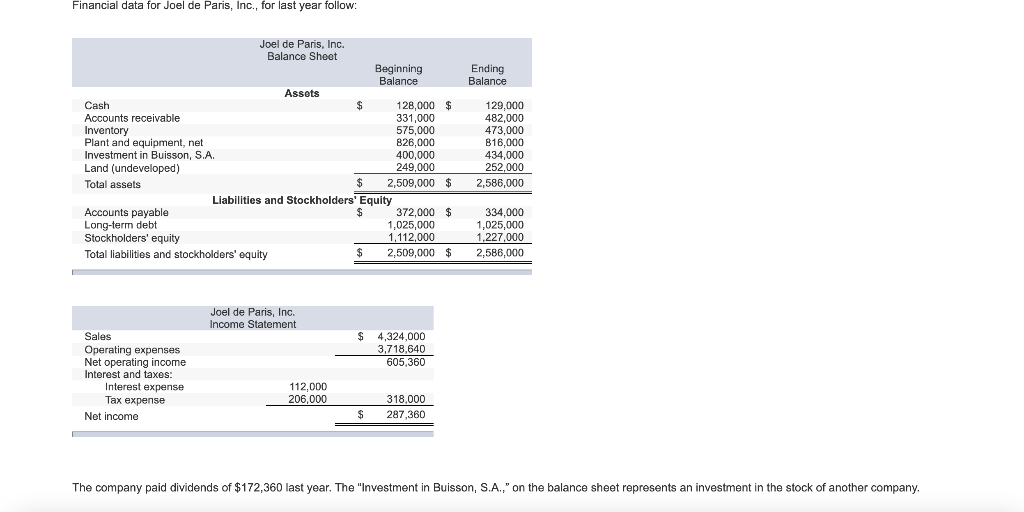

Image: www.chegg.com

FAQs:

**Q: Why is it important to measure return accurately?**

**A:** Accurately measuring return allows traders to assess the profitability of their trades, identify areas for improvement, and manage risk more effectively.

**Q: What factors can minimize margin requirements?**

**A:** Lower premiums, selecting options with favorable deltas and vegas, and maintaining sufficient account equity can help minimize margin requirements.

How Do Option Trading Pros Measure Return And Margin Requirement

Image: slideplayer.com

Conclusion

Understanding how to measure return and calculate margin requirements is essential for successful option trading. By employing the strategies outlined in this article, traders can effectively assess their profitability, manage risk, and enhance their trading outcomes. Are you ready to delve deeper into the world of option trading metrics and optimize your trading performance?