Introduction

In the realm of finance, measuring the return on your investments is paramount. For options traders, understanding the return on investment (ROI) is crucial to assess the success of their strategies and make informed decisions. This comprehensive guide will delve into calculating ROI in options trading, empowering you with the knowledge to evaluate your performance and navigate the markets effectively.

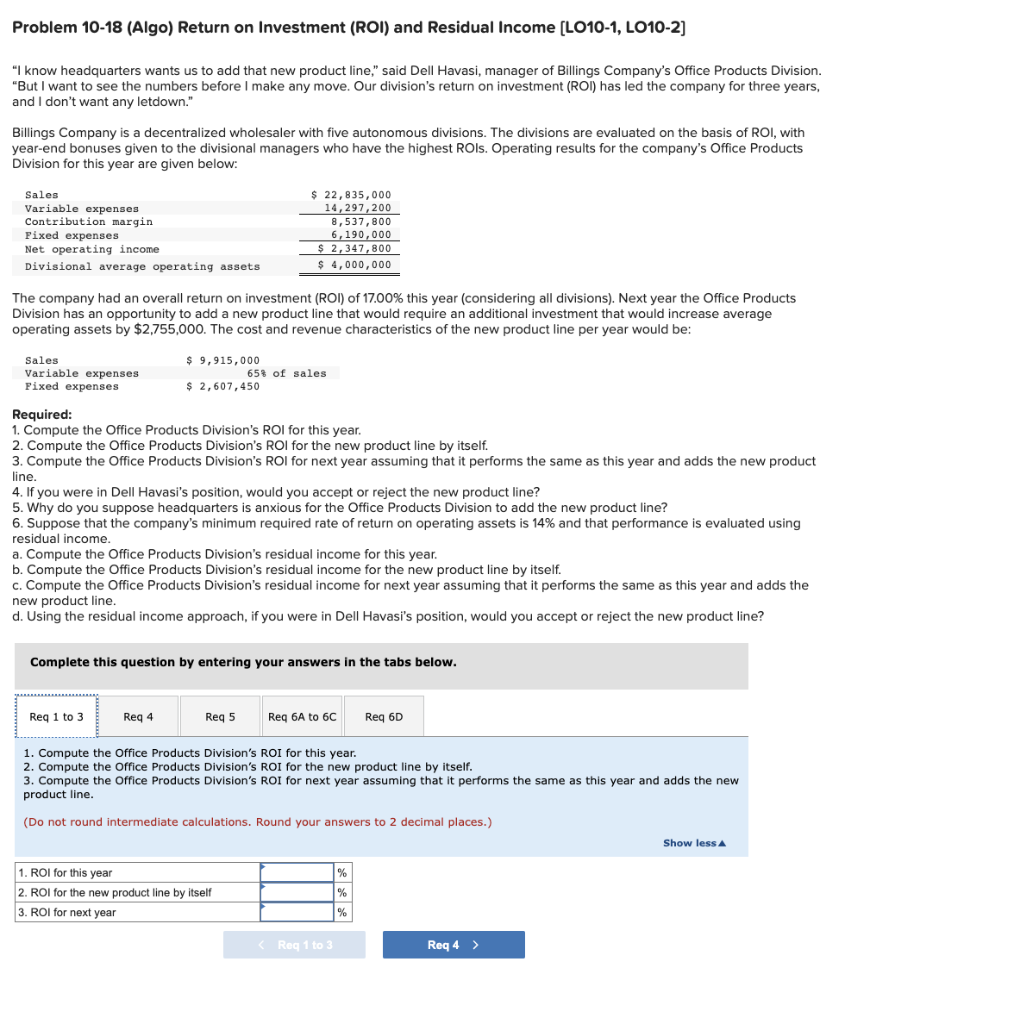

Image: www.chegg.com

Understanding Options Trading

Before delving into ROI calculations, it’s essential to grasp the fundamentals of options trading. Options are contracts that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price (strike price) on or before a predetermined date (expiration date). Traders engage in options trading with various strategies, aiming to capitalize on market movements and generate profits.

Calculating ROI in Options Trading

Calculating ROI in options trading involves determining the difference between the proceeds or loss from a trade and the initial investment. Here’s a step-by-step guide:

-

Determine Your Proceeds or Loss: This involves calculating the difference between the sale price and purchase price of the option contract or the intrinsic value and original premium paid, whichever is applicable.

-

Subtract Initial Investment: Once you have determined your proceeds or loss, subtract the initial investment amount, which represents the cost of acquiring the option contract.

-

Calculate ROI as a Percentage: Divide the resulting value by your initial investment and multiply by 100 to express your ROI as a percentage.

Factors Influencing ROI in Options Trading

Several factors can influence the ROI of your options trades, including:

-

Market Conditions: The overall market trend and volatility can impact option prices significantly.

-

Expiration Date: The time value of an option decays as the expiration date approaches, affecting its potential ROI.

-

Strike Price: The relationship between the strike price and the underlying asset’s price influences the option’s value.

-

Options Strategy: The type of options strategy you employ (e.g., calls, puts, spreads) can affect your ROI.

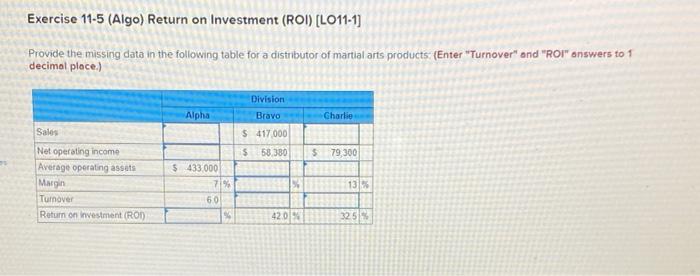

Image: www.chegg.com

Expert Insights and Tips

To enhance your options trading ROI, consider these valuable insights from experts in the field:

-

Choose Options with a High Probability of Profit: Analyze market data, conduct technical analysis, and use option chains to identify options with a positive expected value.

-

Manage Risk Prudently: Calculate potential losses before entering a trade and employ risk management strategies, such as stop-loss orders.

-

Trade with Discipline and a Plan: Stick to your trading strategy, set clear objectives, and avoid emotional decision-making.

Https Steadyoptions.Com Articles Calculating-Roi-In-Options-Trading-R97

Image: forex-station.com

Conclusion

Calculating ROI in options trading provides invaluable information for traders to assess their performance and adjust their strategies accordingly. By understanding the factors influencing ROI, leveraging expert insights, and incorporating these tips into your trading approach, you can increase your chances of generating successful returns in the options market. Remember, investing involves both risks and potential rewards, and thorough research and informed decision-making are key to maximizing your ROI and achieving your financial goals.