The world of options trading can be a captivating realm for investors seeking to harness the potential for lucrative returns. However, understanding the intricacies of this financial instrument is crucial to navigating its complexities and maximizing its benefits. One fundamental aspect that every trader must grasp is the average return in options trading. In this comprehensive guide, we delve into the nuances of average returns, exploring its significance, calculation methods, and strategies for enhancing your investment outcomes. Join us on this enriching journey as we demystify the average returns in options trading and empower you with the knowledge to make informed investment decisions.

Image: finance.yahoo.com

Unveiling the Significance of Average Returns in Options Trading

Average return, often referred to as “expected return,” represents the anticipated profit or loss an investor can reasonably expect from an options trading strategy over a specific period. By comprehending the concept of average returns, traders can make informed decisions, set realistic expectations, and strategize effectively to boost their chances of success.

Calculating the Average Return: A Step-by-Step Guide

Determining the average return involves analyzing the potential outcomes of an options trading strategy and their corresponding probabilities. The formula for calculating the average return is:

Expected Return = (Profit Probability of Profit) + (Loss Probability of Loss)

A practical approach to calculating the average return is to construct a probability distribution table that outlines all possible outcomes and their associated probabilities. Multiplying each outcome by its probability and summing the products yields the average return.

Enhancing Your Average Returns: Proven Strategies

Maximizing the average return in options trading entails adopting strategic approaches that increase the probability of profit and mitigate potential losses. Some proven strategies include:

-

Choosing Options with High Probability: Selecting options with a higher probability of success reduces the risk of losses and enhances the chances of profitable outcomes. Conduct thorough research to identify options with favorable price movements and market trends.

-

Hedging Your Positions: Diversify your portfolio by implementing hedging strategies to minimize the impact of market fluctuations. Balancing long and short options positions, for instance, can help cushion against significant losses while preserving the potential for收益.

-

Trading Options with High Volatility: Higher volatility typically translates to increased potential rewards but also comes with elevated risks. By understanding and leveraging volatility, traders can capture significant returns if the option moves in a favorable direction.

Image: en.rattibha.com

Factors Influencing Average Returns in Options Trading

Several key factors influence the average return in options trading, including:

-

Market Conditions: The overall market environment, including economic indicators, political events, and natural disasters, can significantly sway options prices and impact average returns.

-

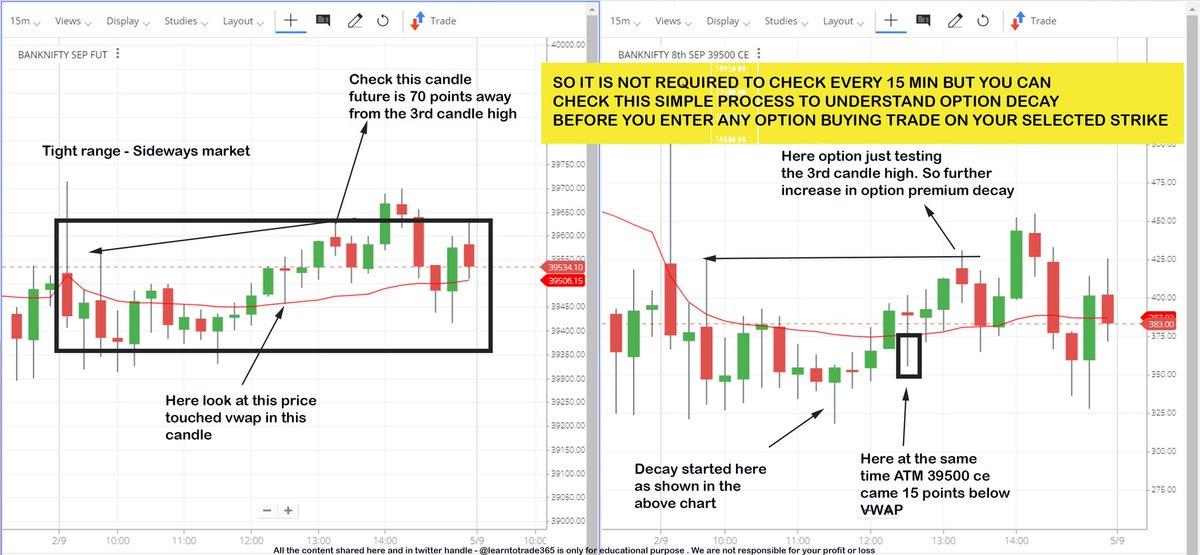

Option Expiration: Time plays a crucial role in options trading. As an option approaches its expiration date, its value decays, affecting average returns. Traders must consider the time value of options when evaluating potential returns.

-

Volatility: Volatility measures the amplitude of price fluctuations in the underlying asset. High volatility can lead to substantial gains but also increases the risk of significant losses.

Average Return Trading Options

Leveraging Average Returns for Informed Investment Decisions

Understanding average returns empowers investors to:

-

Quantify Risk: Assess the potential risk and return involved in an options trading strategy and make calculated decisions.

-

Compare Strategies: Evaluate different options trading strategies and determine which ones align best with their risk tolerance and financial goals.

-

Monitor Performance: Track the average return of their options trading strategies over time and make adjustments as needed to optimize performance.

Embracing the power of average returns, investors can elevate their options trading prowess, navigate market complexities with confidence, and position themselves for enhanced financial success. Continuously educating oneself, seeking guidance from reputable sources, and exercising prudent decision-making will pave the way toward maximizing average returns in the dynamic world of options trading.